Cadre Holdings IPO Presentation Deck

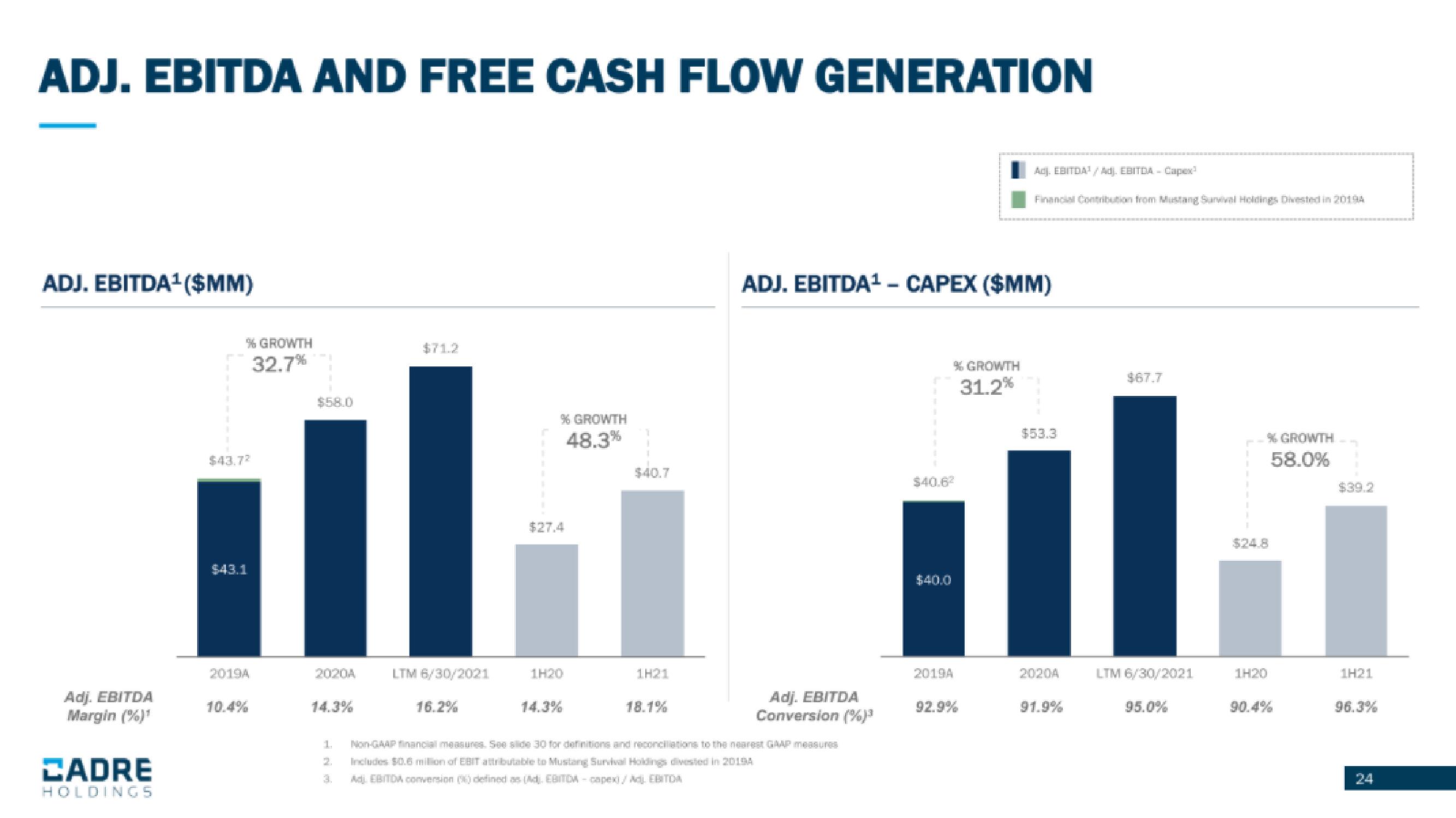

ADJ. EBITDA AND FREE CASH FLOW GENERATION

ADJ. EBITDA¹($MM)

Adj. EBITDA

Margin (%)*

CADRE

HOLDINGS

% GROWTH

32.7%

$43.72

$43.1

2019A

10.4%

$58.0

2020A

LTM 6/30/2021

16.2%

% GROWTH

48.3%

$27.4

1H20

$40.7

1H21

18.1%

ADJ. EBITDA¹ - CAPEX ($MM)

Adj. EBITDA

Conversion (%) ³

1. Non-GAAP financial measures. See siide 30 for definitions and reconciliations to the nearest GAAP measung

Includes $0.6 milion of EBIT attributable to Mustang Survival Holdings divested in 20194

2.

3.

Adj. EBITDA conversion (9) defined as (Ad). EBITDA - Gapex) / Adj. EBITDA

% GROWTH

31.2%

$40.6²

$40.0

Adj. EBITDA¹/Adj. EBITDA - Capex

Financial Contribution from Mustang Survéval Holdings Divested in 20194

2019A

$53.3

20204

91.9%

$67.7

LTM 6/30/2021

95.0%

1H20

% GROWTH

58.0%

90.4%

$39.2

1H21

96.3%View entire presentation