Waldencast SPAC

OBAGI

Milk

MAKEUP

transaction summary

■

+

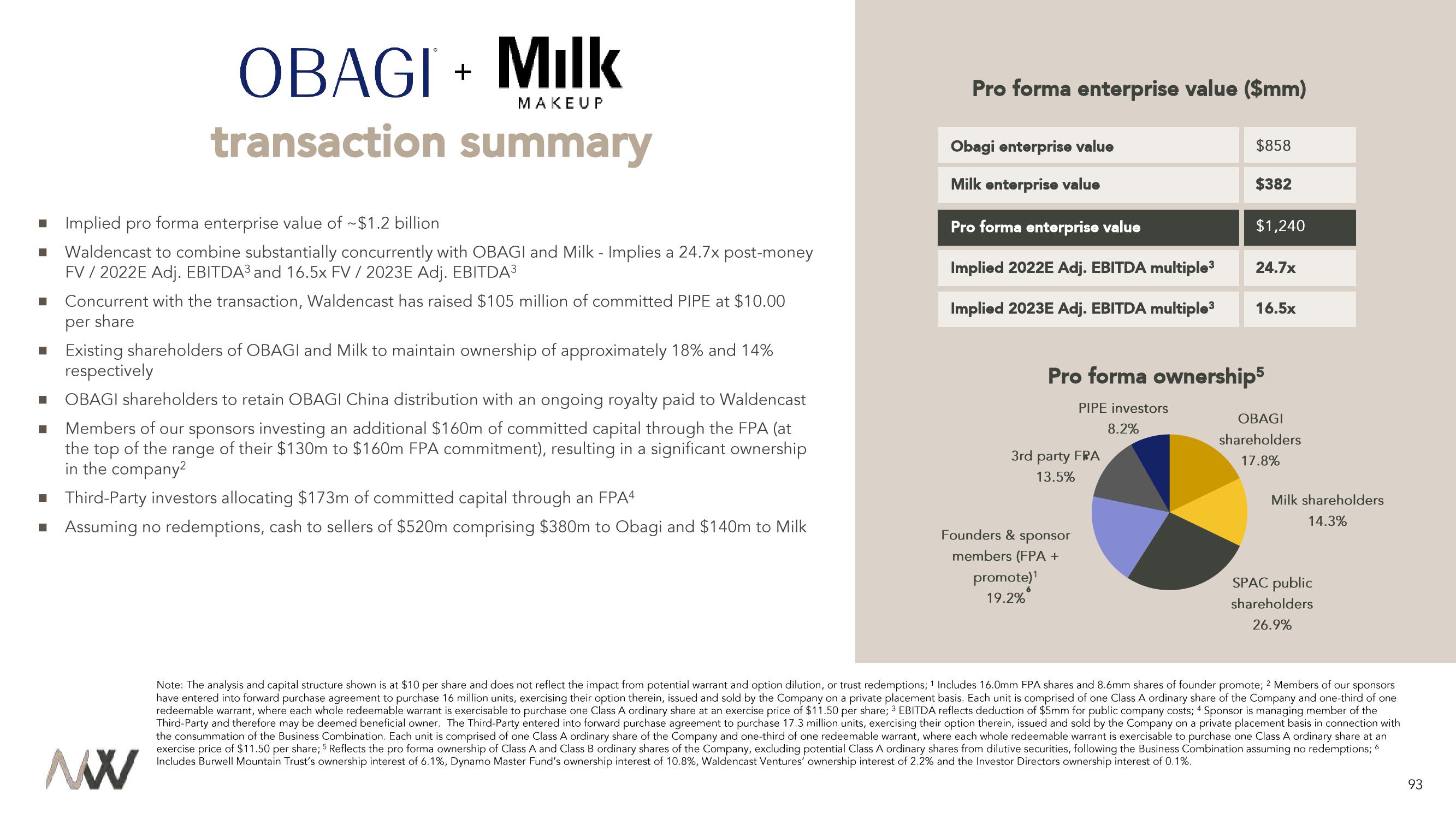

■ Implied pro forma enterprise value of ~$1.2 billion

■

Waldencast to combine substantially concurrently with OBAGI and Milk - Implies a 24.7x post-money

FV / 2022E Adj. EBITDA³ and 16.5x FV / 2023E Adj. EBITDA³

Concurrent with the transaction, Waldencast has raised $105 million of committed PIPE at $10.00

per share

Existing shareholders of OBAGI and Milk to maintain ownership of approximately 18% and 14%

respectively

OBAGI shareholders to retain OBAGI China distribution with an ongoing royalty paid to Waldencast

Members of our sponsors investing an additional $160m of committed capital through the FPA (at

the top of the range of their $130m to $160m FPA commitment), resulting in a significant ownership

in the company²

■ Third-Party investors allocating $173m of committed capital through an FPA4

■ Assuming no redemptions, cash to sellers of $520m comprising $380m to Obagi and $140m to Milk

Pro forma enterprise value ($mm)

Obagi enterprise value

Milk enterprise value

Pro forma enterprise value

Implied 2022E Adj. EBITDA multiple³

Implied 2023E Adj. EBITDA multiple³

3rd party FRA

13.5%

Founders & sponsor

members (FPA +

promote)¹

19.2%

6

PIPE investors

8.2%

$858

$382

$1,240

Pro forma ownership5

24.7x

16.5x

OBAGI

shareholders

17.8%

Milk shareholders

14.3%

SPAC public

shareholders

26.9%

Note: The analysis and capital structure shown is at $10 per share and does not reflect the impact from potential warrant and option dilution, or trust redemptions; 1 Includes 16.0mm FPA shares and 8.6mm shares of founder promote; 2 Members of our sponsors

have entered into forward purchase agreement to purchase 16 million units, exercising their option therein, issued and sold by the Company on a private placement basis. Each unit is comprised of one Class A ordinary share of the Company and one-third of one

redeemable warrant, where each whole redeemable warrant is exercisable to purchase one Class A ordinary share at an exercise price of $11.50 per share; 3 EBITDA reflects deduction of $5mm for public company costs; 4 Sponsor is managing member of the

Third-Party and therefore may be deemed beneficial owner. The Third-Party entered into forward purchase agreement to purchase 17.3 million units, exercising their option therein, issued and sold by the Company on a private placement basis in connection with

the consummation of the Business Combination. Each unit is comprised of one Class A ordinary share of the Company and one-third of one redeemable warrant, where each whole redeemable warrant is exercisable to purchase one Class A ordinary share at an

exercise price of $11.50 per share; 5 Reflects the pro forma ownership of Class A and Class B ordinary shares of the Company, excluding potential Class A ordinary shares from dilutive securities, following the Business Combination assuming no redemptions; 6.

Includes Burwell Mountain Trust's ownership interest of 6.1%, Dynamo Master Fund's ownership interest of 10.8%, Waldencast Ventures' ownership interest of 2.2% and the Investor Directors ownership interest of 0.1%.

MX

93View entire presentation