AT&T Mergers and Acquisitions Presentation Deck

Transaction Summary

5

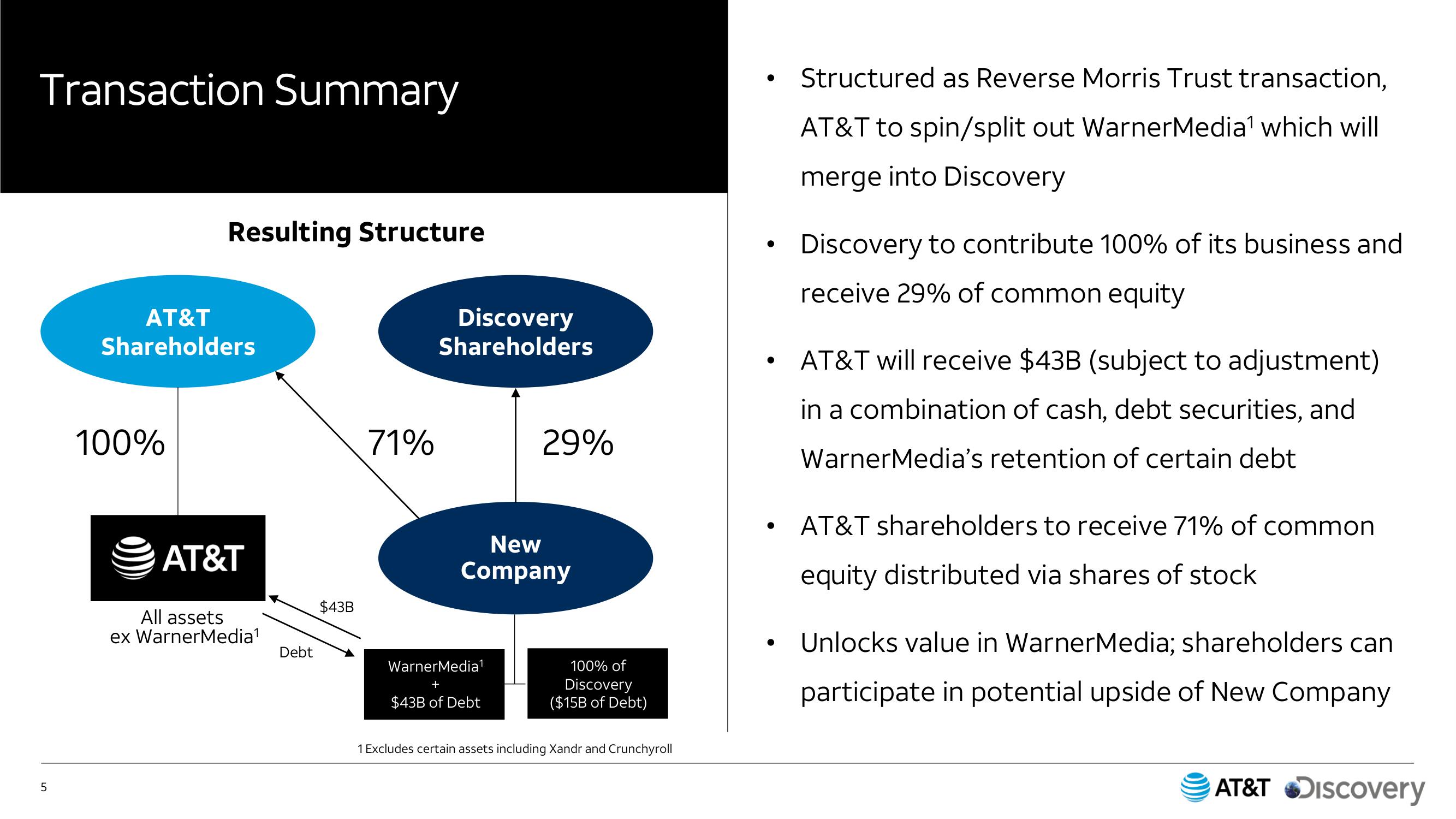

Resulting Structure

AT&T

Shareholders

100%

AT&T

All assets

ex WarnerMedia¹

Debt

$43B

71%

Discovery

Shareholders

29%

New

Company

WarnerMedia¹

+

43B of Debt

100% of

Discovery

($15B of Debt)

1 Excludes certain assets including Xandr and Crunchyroll

●

●

●

●

Structured as Reverse Morris Trust transaction,

AT&T to spin/split out WarnerMedia¹ which will

merge into Discovery

Discovery to contribute 100% of its business and

receive 29% of common equity

AT&T will receive $43B (subject to adjustment)

in a combination of cash, debt securities, and

WarnerMedia's retention of certain debt

AT&T shareholders to receive 71% of common

equity distributed via shares of stock

Unlocks value in WarnerMedia; shareholders can

participate in potential upside of New Company

AT&T DiscoveryView entire presentation