Liberty Global Results Presentation Deck

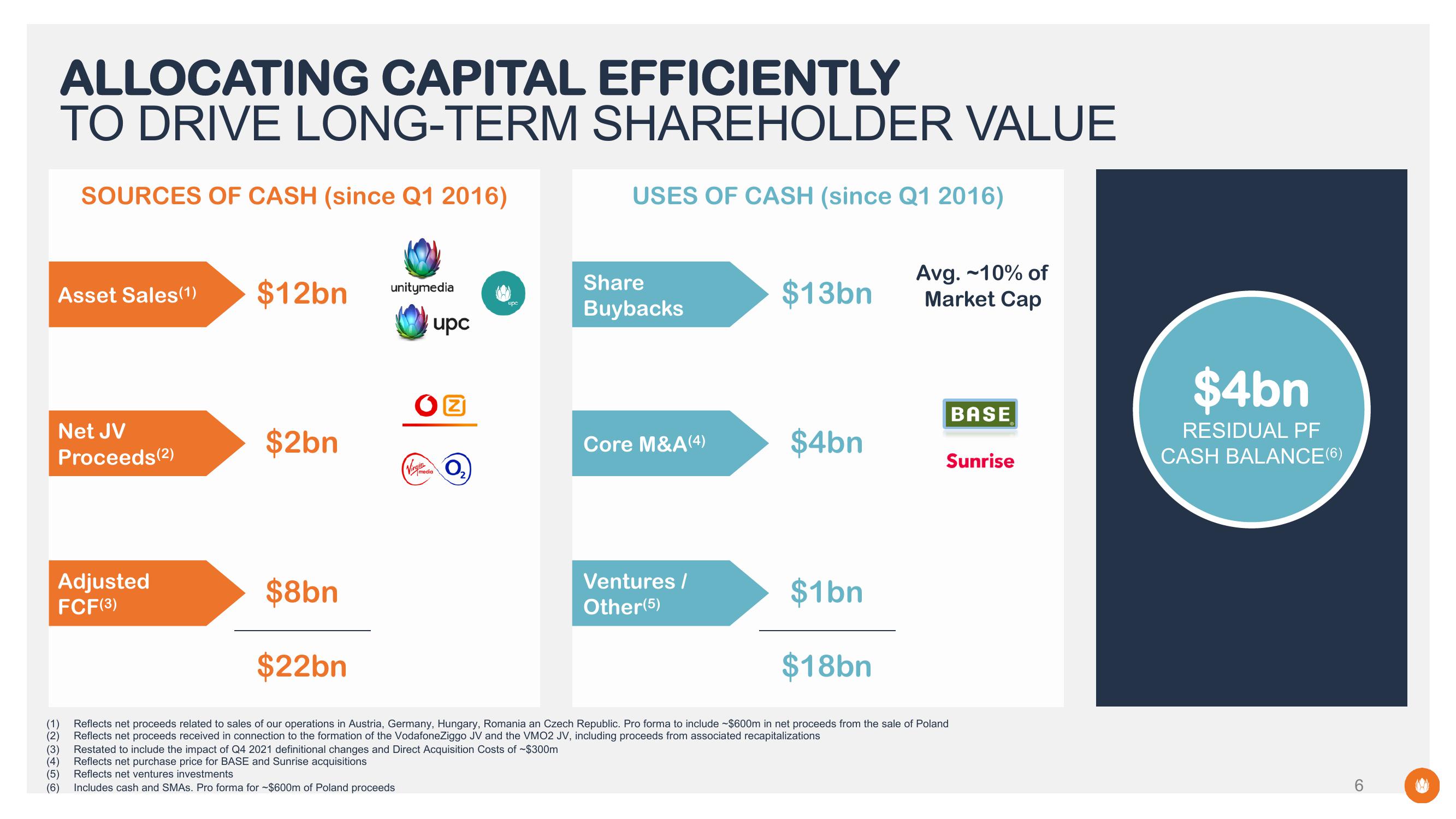

ALLOCATING CAPITAL EFFICIENTLY

TO DRIVE LONG-TERM SHAREHOLDER VALUE

SOURCES OF CASH (since Q1 2016)

USES OF CASH (since Q1 2016)

Asset Sales(1)

Net JV

Proceeds (2)

Adjusted

FCF(3)

$12bn

$2bn

$8bn

$22bn

unitymedia

upc

Z

Virginia O₂

media

Share

Buybacks

(3)

Restated to include the impact of Q4 2021 definitional changes and Direct Acquisition Costs of $300m

(4)

Reflects net purchase price for BASE and Sunrise acquisitions

(5)

Reflects net ventures investments

(6) Includes cash and SMAS. Pro forma for $600m of Poland proceeds

Core M&A (4)

Ventures /

Other (5)

$13bn

$4bn

$1bn

$18bn

Avg. ~10% of

Market Cap

(1) Reflects net proceeds related to sales of our operations in Austria, Germany, Hungary, Romania an Czech Republic. Pro forma to include ~$600m in net proceeds from the sale of Poland

(2) Reflects net proceeds received in connection to the formation of the VodafoneZiggo JV and the VMO2 JV, including proceeds from associated recapitalizations

BASE

Sunrise

$4bn

RESIDUAL PF

CASH BALANCE (6)

6View entire presentation