RELX Investor Day Presentation Deck

Case study: Supporting financial inclusion globally

Key customer issues:

A total of 1.7 billion adults¹ are excluded

access to credit globally

●

●

●

The financial inclusion challenge is often

magnified in low-income countries, given a

significant knowledge gap

Key challenges impacting low-income

countries include:

Lack of a traditional reporting

infrastructure

Limited credit bureau presence

Absence of analytics technology to

support credit underwriting/scoring

Insufficient credit performance

documentation or recording

High degree of fraud

Solutions:

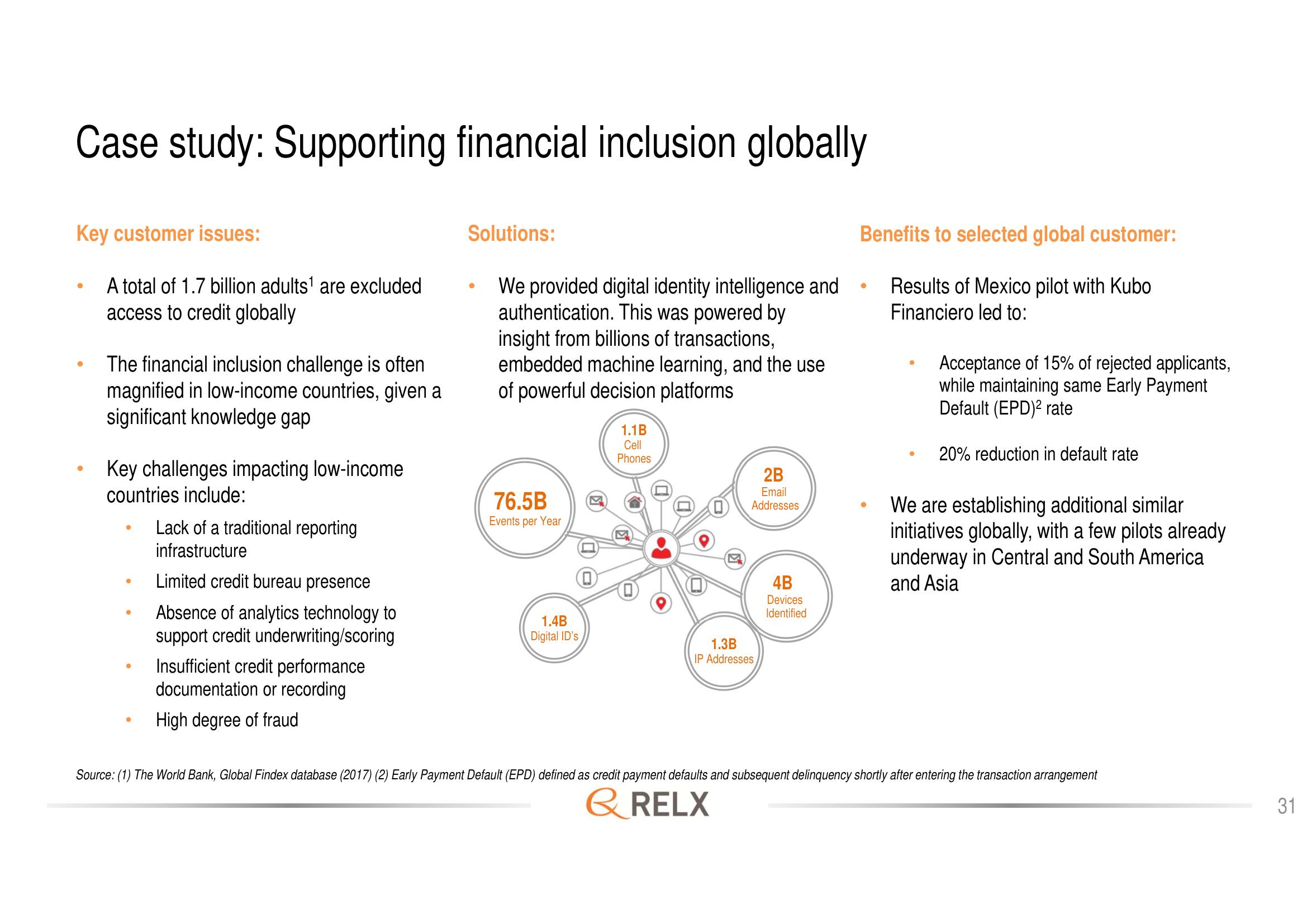

We provided digital identity intelligence and

authentication. This was powered by

insight from billions of transactions,

embedded machine learning, and the use

of powerful decision platforms

76.5B

Events per Year

1.4B

Digital ID's

1.1B

Cell

Phones

2B

Email

Addresses

1.3B

IP Addresses

4B

Devices

Identified

Benefits to selected global customer:

Results of Mexico pilot with Kubo

Financiero led to:

●

Acceptance of 15% of rejected applicants,

while maintaining same Early Payment

Default (EPD)² rate

20% reduction in default rate

We are establishing additional similar

initiatives globally, with a few pilots already

underway in Central and South America

and Asia

Source: (1) The World Bank, Global Findex database (2017) (2) Early Payment Default (EPD) defined as credit payment defaults and subsequent delinquency shortly after entering the transaction arrangement

& RELX

31View entire presentation