Barclays Investment Banking Pitch Book

TransCanada / Columbia Pipeline Transaction Overview

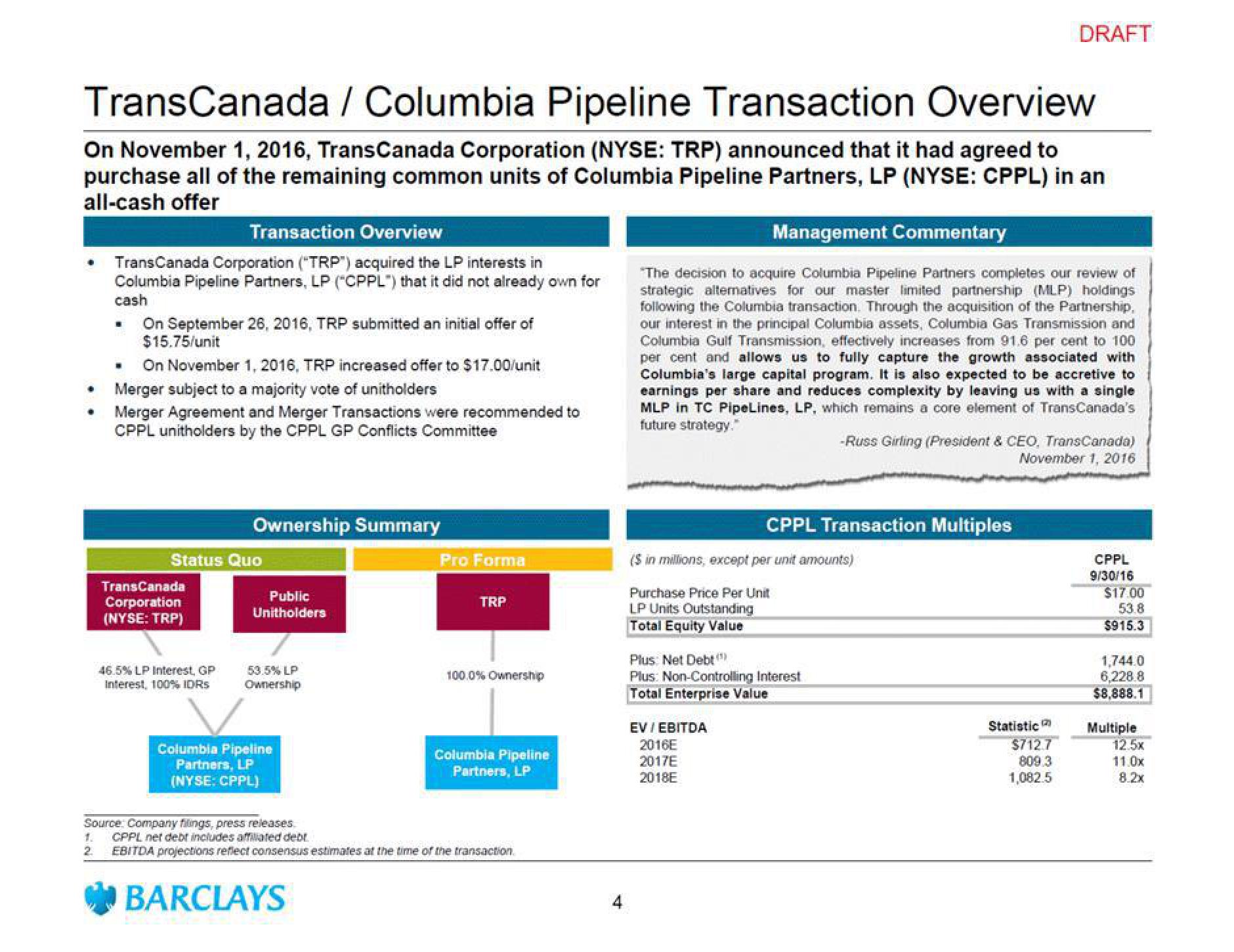

On November 1, 2016, TransCanada Corporation (NYSE: TRP) announced that it had agreed to

purchase all of the remaining common units of Columbia Pipeline Partners, LP (NYSE: CPPL) in an

all-cash offer

Transaction Overview

TransCanada Corporation ("TRP") acquired the LP interests in

Columbia Pipeline Partners, LP ("CPPL") that it did not already own for

cash

■

On September 26, 2016, TRP submitted an initial offer of

$15.75/unit

On November 1, 2016, TRP increased offer to $17.00/unit

Merger subject to a majority vote of unitholders

Merger Agreement and Merger Transactions were recommended to

CPPL unitholders by the CPPL GP Conflicts Committee

Status Quo

TransCanada

Corporation

(NYSE: TRP)

Ownership Summary

46.5% LP Interest, GP

Interest, 100% IDRS

Public

Unitholders

53.5% LP

Ownership

Columbia Pipeline

Partners, LP

(NYSE: CPPL)

Pro Forma

BARCLAYS

TRP

100.0% Ownership

Columbia Pipeline

Partners, LP

Source: Company filings, press releases

1. CPPL net debt includes affiliated debt

2 EBITDA projections reflect consensus estimates at the time of the transaction.

Management Commentary

"The decision to acquire Columbia Pipeline Partners completes our review of

strategic alternatives for our master limited partnership (MLP) holdings

following the Columbia transaction. Through the acquisition of the Partnership,

our interest in the principal Columbia assets, Columbia Gas Transmission and

Columbia Gulf Transmission, effectively increases from 91.6 per cent to 100

per cent and allows us to fully capture the growth associated with

Columbia's large capital program. It is also expected to be accretive to

earnings per share and reduces complexity by leaving us with a single

MLP in TC PipeLines, LP, which remains a core element of TransCanada's

future strategy."

CPPL Transaction Multiples

($ in millions, except per unit amounts)

Purchase Price Per Unit

LP Units Outstanding

Total Equity Value

Plus: Net Debt()

Plus: Non-Controlling Interest

Total Enterprise Value

EV / EBITDA

2016E

2017E

2018E

-Russ Girling (President & CEO, TransCanada)

November 1, 2016

DRAFT

Statistic

$712.7

809.3

1,082.5

CPPL

9/30/16

$17.00

53.8

$915.3

1,744.0

6,228.8

$8,888.1

Multiple

125

11.0x

8.2xView entire presentation