Better SPAC Presentation Deck

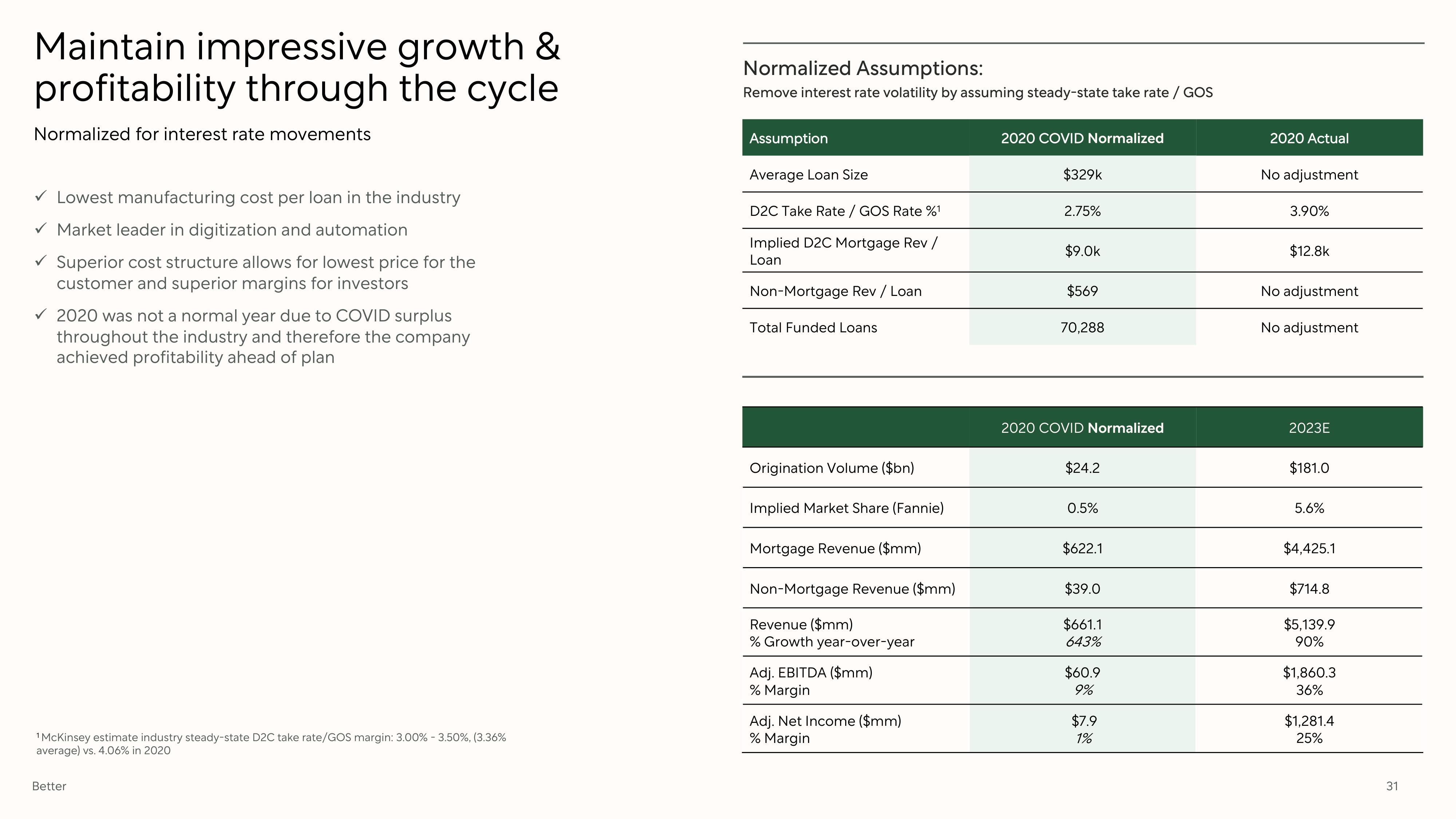

Maintain impressive growth &

profitability through the cycle

Normalized for interest rate movements

✓ Lowest manufacturing cost per loan in the industry

✓ Market leader in digitization and automation

✓ Superior cost structure allows for lowest price for the

customer and superior margins for investors

✓2020 was not a normal year due to COVID surplus

throughout the industry and therefore company

achieved profitability ahead of plan

¹McKinsey estimate industry steady-state D2C take rate/GOS margin: 3.00 % - 3.50%, (3.36%

average) vs. 4.06% in 2020

Better

Normalized Assumptions:

Remove interest rate volatility by assuming steady-state take rate / GOS

Assumption

Average Loan Size

D2C Take Rate / GOS Rate %¹

Implied D2C Mortgage Rev /

Loan

Non-Mortgage Rev / Loan

Total Funded Loans

Origination Volume ($bn)

Implied Market Share (Fannie)

Mortgage Revenue ($mm)

Non-Mortgage Revenue ($mm)

Revenue ($mm)

% Growth year-over-year

Adj. EBITDA ($mm)

% Margin

Adj. Net Income ($mm)

% Margin

2020 COVID Normalized

$329k

2.75%

$9.0k

$569

70,288

2020 COVID Normalized

$24.2

0.5%

$622.1

$39.0

$661.1

643%

$60.9

9%

$7.9

1%

2020 Actual

No adjustment

3.90%

$12.8k

No adjustment

No adjustment

2023E

$181.0

5.6%

$4,425.1

$714.8

$5,139.9

90%

$1,860.3

36%

$1,281.4

25%

31View entire presentation