BAT Investor Conference Presentation Deck

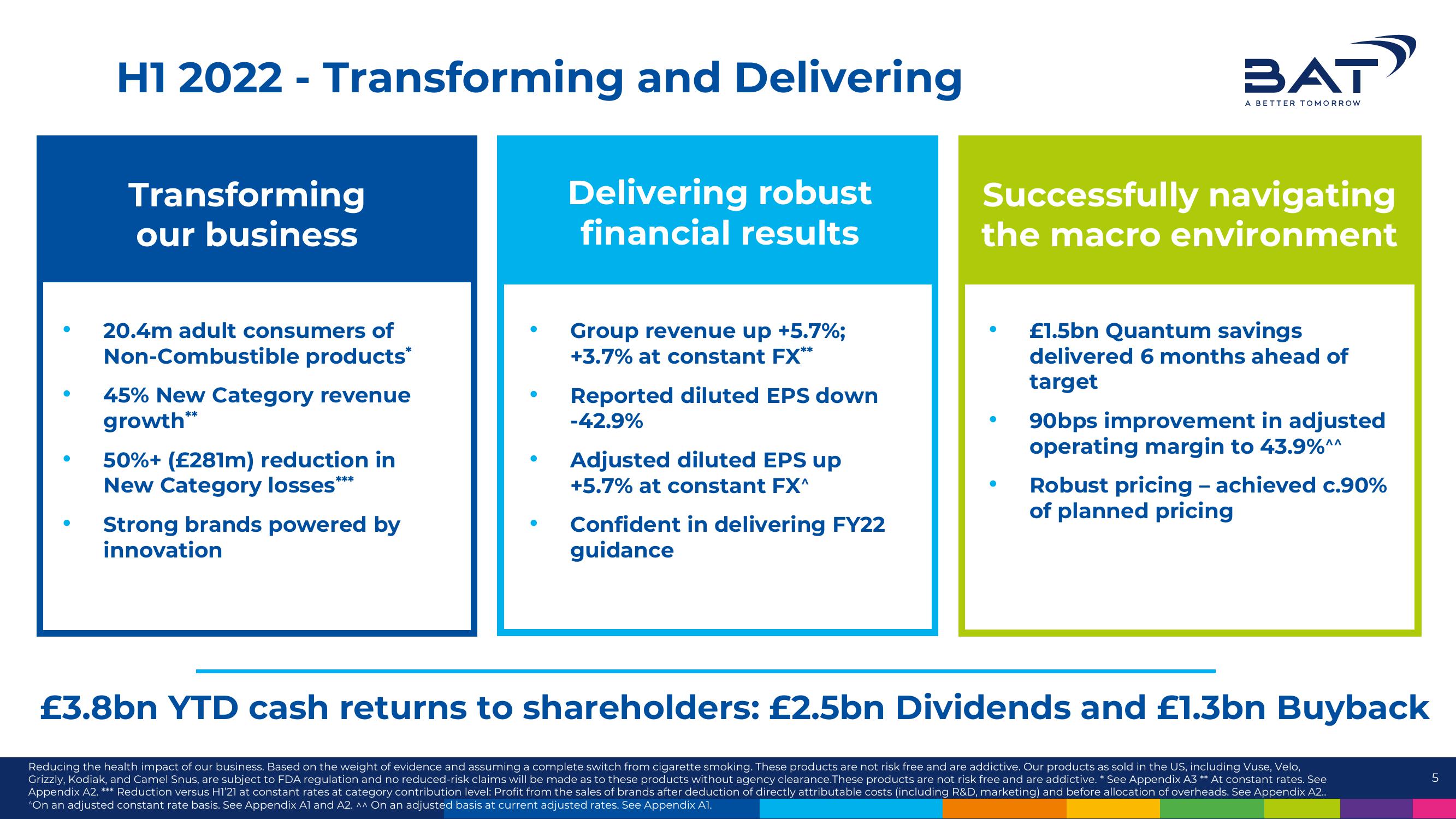

H1 2022 - Transforming and Delivering

Delivering robust

financial results

Transforming

our business

20.4m adult consumers of

Non-Combustible products

45% New Category revenue

growth**

50%+ (£281m) reduction in

New Category losses****

Strong brands powered by

innovation

Group revenue up +5.7%;

+3.7% at constant FX**

Reported diluted EPS down

-42.9%

Adjusted diluted EPS up

+5.7% at constant FX^

Confident in delivering FY22

guidance

●

BAT

Successfully navigating

the macro environment

●

A BETTER TOMORROW

£1.5bn Quantum savings

delivered 6 months ahead of

target

90bps improvement in adjusted

operating margin to 43.9%^^

Robust pricing - achieved c.90%

of planned pricing

£3.8bn YTD cash returns to shareholders: £2.5bn Dividends and £1.3bn Buyback

Reducing the health impact of our business. Based on the weight of evidence and assuming a complete switch from cigarette smoking. These products are not risk free and are addictive. Our products as sold in the US, including Vuse, Velo,

Grizzly, Kodiak, and Camel Snus, are subject to FDA regulation and no reduced-risk claims will be made as to these products without agency clearance. These products are not risk free and are addictive. * See Appendix A3 ** At constant rates. See

Appendix A2. *** Reduction versus H1'21 at constant rates at category contribution level: Profit from the sales of brands after deduction of directly attributable costs (including R&D, marketing) and before allocation of overheads. See Appendix A2..

^On an adjusted constant rate basis. See Appendix A1 and A2. ^^ On an adjusted basis at current adjusted rates. See Appendix A1.

5View entire presentation