Maersk Investor Presentation Deck

Ocean highlights Q1 2020

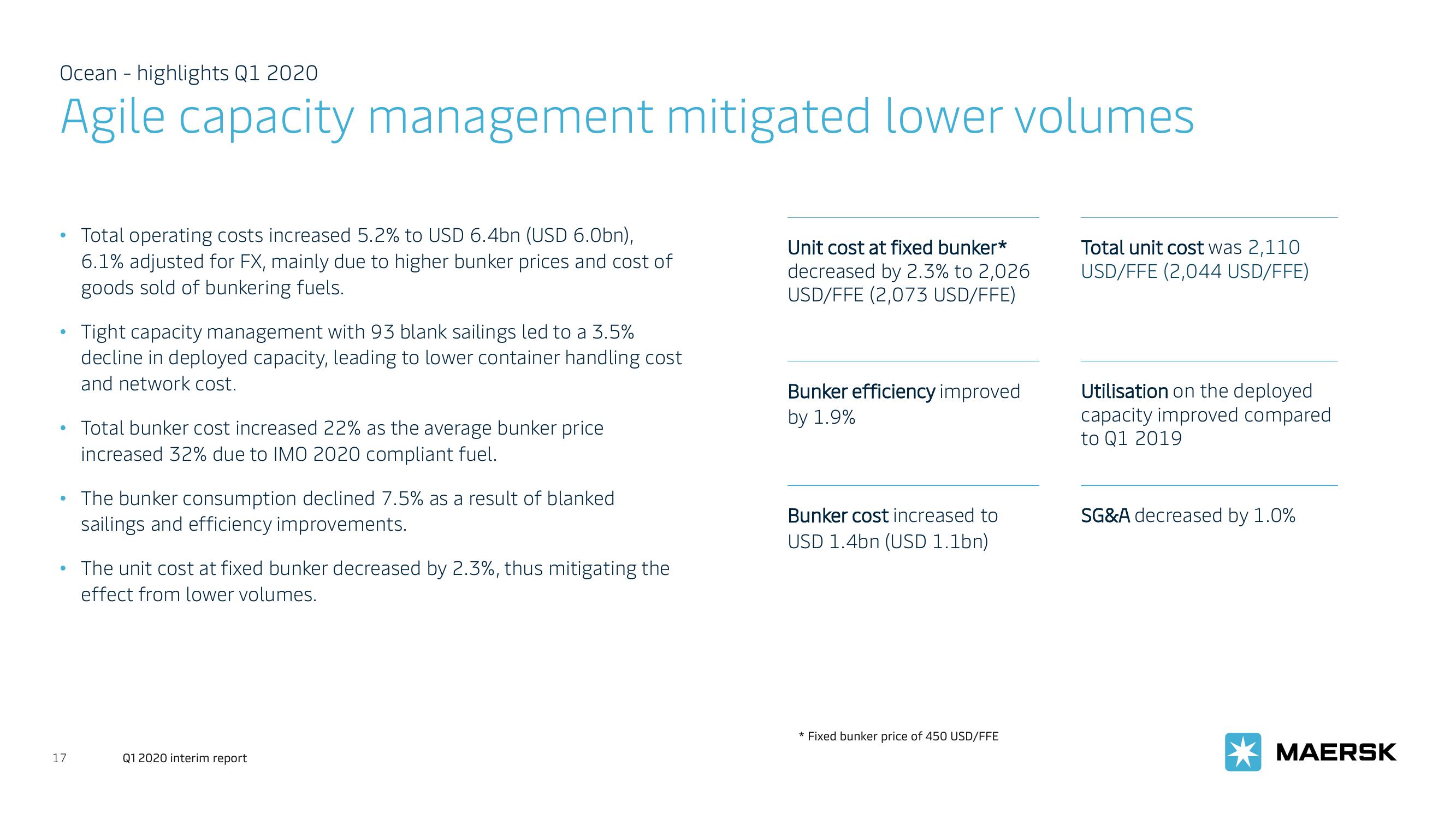

Agile capacity management mitigated lower volumes

●

17

Total operating costs increased 5.2% to USD 6.4bn (USD 6.0bn),

6.1% adjusted for FX, mainly due to higher bunker prices and cost of

goods sold of bunkering fuels.

Tight capacity management with 93 blank sailings led to a 3.5%

decline in deployed capacity, leading to lower container handling cost

and network cost.

Total bunker cost increased 22% as the average bunker price

increased 32% due to IMO 2020 compliant fuel.

The bunker consumption declined 7.5% as a result of blanked

sailings and efficiency improvements.

The unit cost at fixed bunker decreased by 2.3%, thus mitigating the

effect from lower volumes.

Q1 2020 interim report

Unit cost at fixed bunker*

decreased by 2.3% to 2,026

USD/FFE (2,073 USD/FFE)

Bunker efficiency improved

by 1.9%

Bunker cost increased to

USD 1.4bn (USD 1.1bn)

* Fixed bunker price of 450 USD/FFE

Total unit cost was 2,110

USD/FFE (2,044 USD/FFE)

Utilisation on the deployed

capacity improved compared

to Q1 2019

SG&A decreased by 1.0%

MAERSKView entire presentation