Evercore Investment Banking Pitch Book

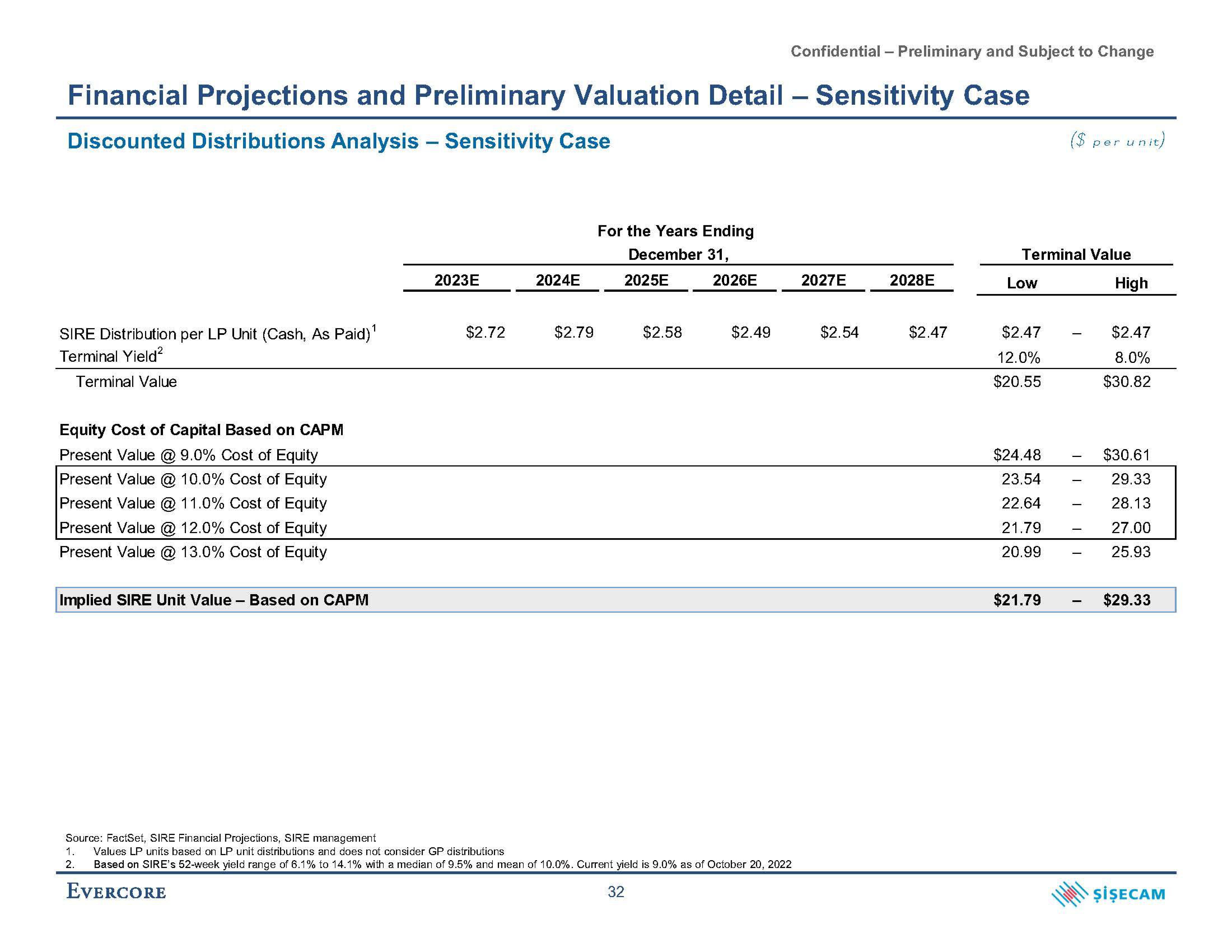

Financial Projections and Preliminary Valuation Detail - Sensitivity Case

Discounted Distributions Analysis - Sensitivity Case

SIRE Distribution per LP Unit (Cash, As Paid)¹

Terminal Yield²

Terminal Value

Equity Cost of Capital Based on CAPM

Present Value @ 9.0% Cost of Equity

Present Value @ 10.0% Cost of Equity

Present Value @ 11.0% Cost of Equity

Present Value @ 12.0% Cost of Equity

Present Value @ 13.0 % Cost of Equity

Implied SIRE Unit Value - Based on CAPM

2023E

$2.72

2024E

$2.79

For the Years Ending

December 31,

2025E

$2.58

2026E

Confidential - Preliminary and Subject to Change

$2.49

Source: FactSet, SIRE Financial Projections, SIRE management

1. Values LP units based on LP unit distributions and does not consider GP distributions

2.

Based on SIRE's 52-week yield range of 6.1% to 14.1% with a median of 9.5% and mean of 10.0%. Current yield is 9.0% as of October 20, 2022

EVERCORE

32

2027E

$2.54

2028E

$2.47

Low

Terminal Value

$2.47

12.0%

$20.55

$24.48

23.54

22.64

21.79

20.99

($

$21.79

-

-

per unit)

-

High

$2.47

8.0%

$30.82

$30.61

29.33

28.13

27.00

25.93

$29.33

ŞİŞECAMView entire presentation