Deutsche Bank Fixed Income Presentation Deck

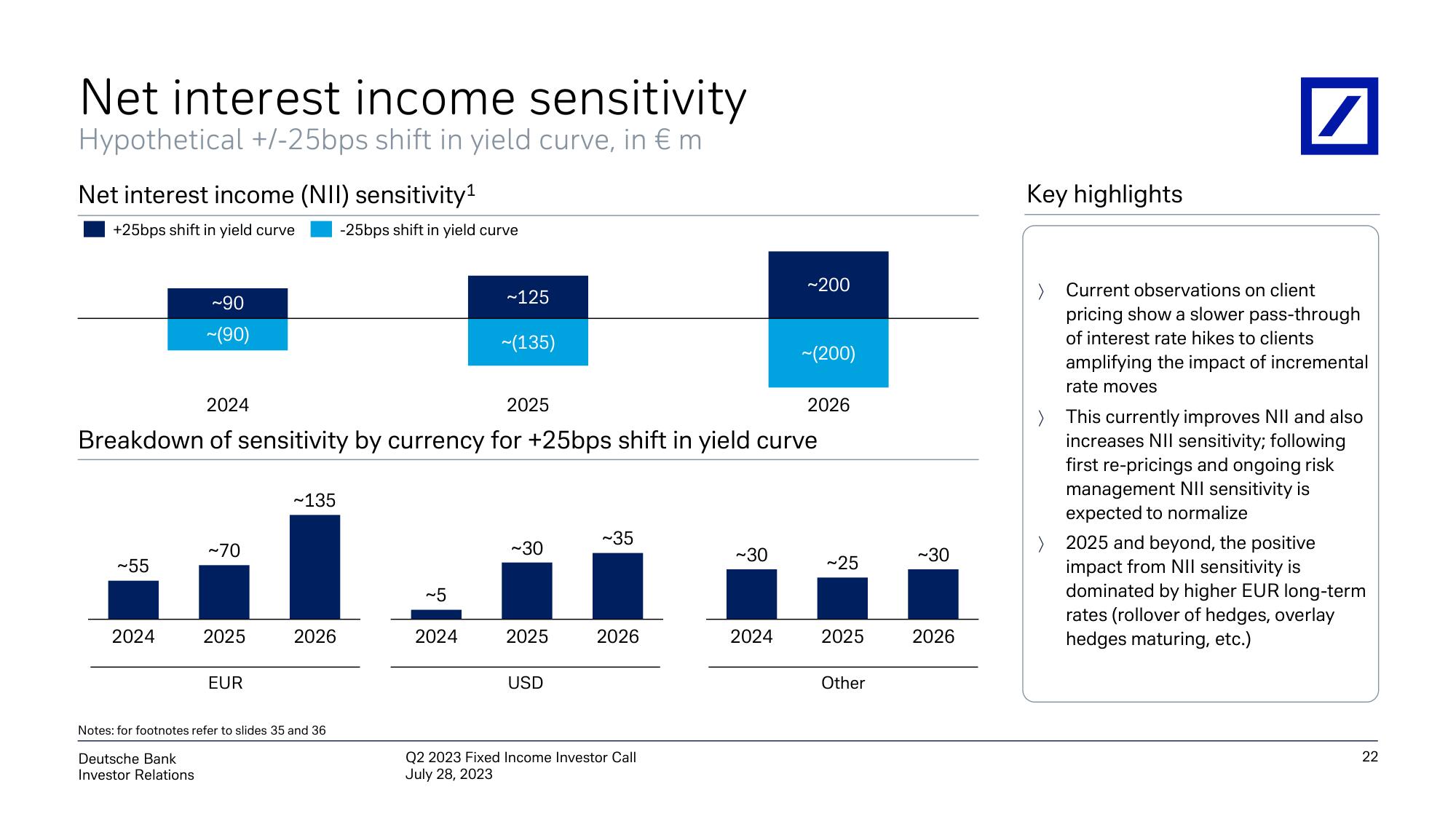

Net interest income sensitivity

Hypothetical +/-25bps shift in yield curve, in € m

Net interest income (NII) sensitivity¹

+25bps shift in yield curve

~55

~90

~(90)

2024

~70

2025

2024

2025

Breakdown of sensitivity by currency for +25bps shift in yield curve

EUR

~135

202

-25bps shift in yield curve

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

~5

~125

2024

~(135)

~30

2025

USD

~35

2026

Q2 2023 Fixed Income Investor Call

July 28, 2023

~30

~200

202

~(200)

2026

~25

2025

Other

~30

2026

Key highlights

/

> Current observations on client

pricing show a slower pass-through

of interest rate hikes to clients

amplifying the impact of incremental

rate moves

> This currently improves NII and also

increases NII sensitivity; following

first re-pricings and ongoing risk

management NII sensitivity is

expected to normalize

> 2025 and beyond, the positive

impact from NII sensitivity is

dominated by higher EUR long-term

rates (rollover of hedges, overlay

hedges maturing, etc.)

22View entire presentation