Maersk Investor Presentation Deck

Ocean highlights Q3 2020

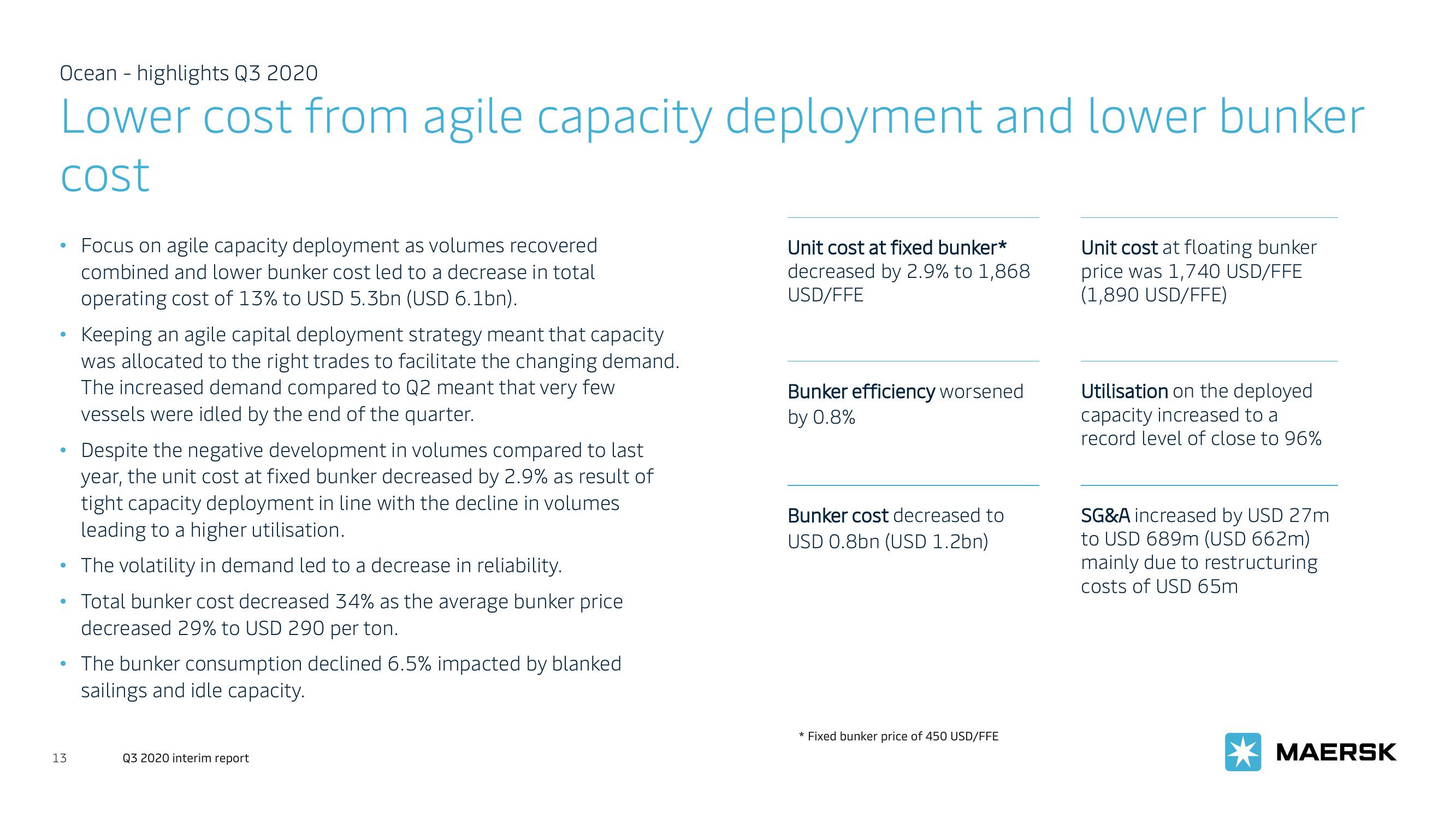

Lower cost from agile capacity deployment and lower bunker

cost

●

●

Focus on agile capacity deployment as volumes recovered

combined and lower bunker cost led to a decrease in total

operating cost of 13% to USD 5.3bn (USD 6.1bn).

• Despite the negative development in volumes compared to last

year, the unit cost at fixed bunker decreased by 2.9% as result of

tight capacity deployment in line with the decline in volumes.

leading to a higher utilisation.

The volatility in demand led to a decrease in reliability.

Total bunker cost decreased 34% as the average bunker price

decreased 29% to USD 290 per ton.

Keeping an agile capital deployment strategy meant that capacity

was allocated to the right trades to facilitate the changing demand.

The increased demand compared to Q2 meant that very few

vessels were idled by the end of the quarter.

13

• The bunker consumption declined 6.5% impacted by blanked

sailings and idle capacity.

Q3 2020 interim report

Unit cost at fixed bunker*

decreased by 2.9% to 1,868

USD/FFE

Bunker efficiency worsened

by 0.8%

Bunker cost decreased to

USD 0.8bn (USD 1.2bn)

* Fixed bunker price of 450 USD/FFE

Unit cost at floating bunker

price was 1,740 USD/FFE

(1,890 USD/FFE)

Utilisation on the deployed

capacity increased to a

record level of close to 96%

SG&A increased by USD 27m

to USD 689m (USD 662m)

mainly due to restructuring

costs of USD 65m

MAERSKView entire presentation