Baird Investment Banking Pitch Book

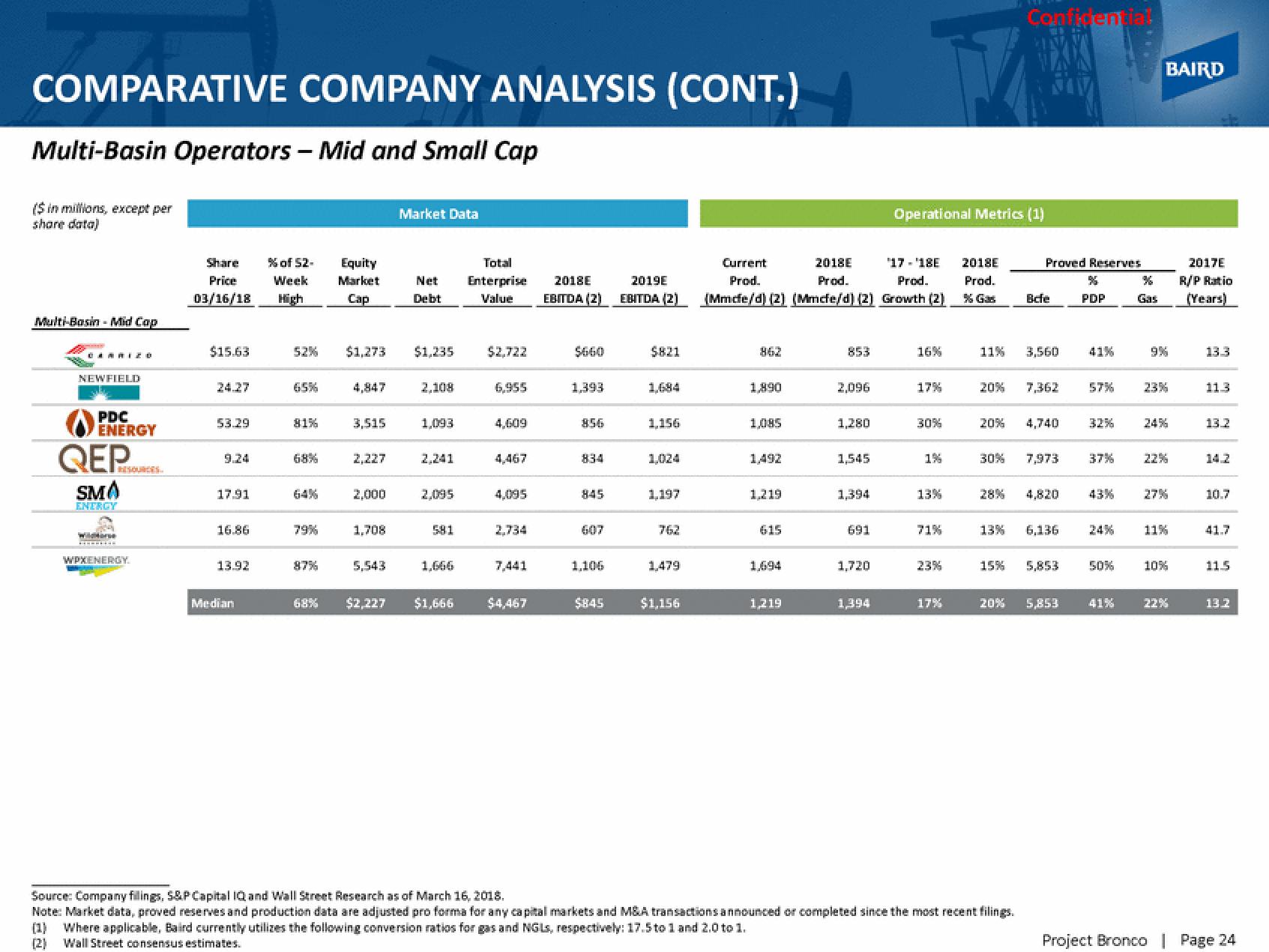

COMPARATIVE COMPANY ANALYSIS (CONT.)

Multi-Basin Operators - Mid and Small Cap

($ in millions, except per

share data)

Multi-Basin - Mid Cap

CARRIZO

NEWFIELD

PDC

ENERGY

QEP

SMA

ENERGY

widterse

WPXENERGY

Share % of 52-

Price

Week

03/16/18 High

$15.63

53.29

9.24

17.91

16.86

13.92

Median

65%

81%

52% $1,273 $1,235

68%

79%

Equity

Market

Cap

87%

4,847

3,515

2,227

2,000

1,708

Market Data

5,543

Net

2,108

1,093

2.241

2,095

581

1,666

68% $2,227 $1,666

Total

Enterprise 2018E

Value EBITDA (2)

$2,722

6,955

4,609

4,467

4,095

2,734

7,441

$4,467

$660

1,393

856

834

845

1,106

$845

2019E

EBITDA (2)

$821

1,684

1.156

1,024

1.197

762

1,479

$1,156

Current

2018E '17-'18E

Prod.

Prod.

Prod.

(Mmcfe/d) (2) (Mmcfe/d) (2) Growth (2)

862

1,890

1,085

1,492

1,219

615

1,694

1,219

853

2,096

1,280

1,545

1,394

691

1,720

1,394

Operational Metrics (1)

16%

17%

30%

1%

13%

71%

23%

17%

2018E

Prod.

% Gas

11%

20%

30%

13%

Confidential

20% 7,362

15%

Proved Reserves

Source: Company filings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2)

Wall Street consensus estimates.

Befe

3,560

4,740

7,973

4,820

6.136

20% 5,853

PDP

41%

57%

32%

50%

36

Gas

41%

BAIRD

23%

37% 22%

24%

11%

10%

22%

2017E

R/P Ratio

(Years)

13.3

11.3

13.2

14.2

10.7

41.7

115

13.2

Project Bronco | Page 24View entire presentation