Bausch+Lomb Results Presentation Deck

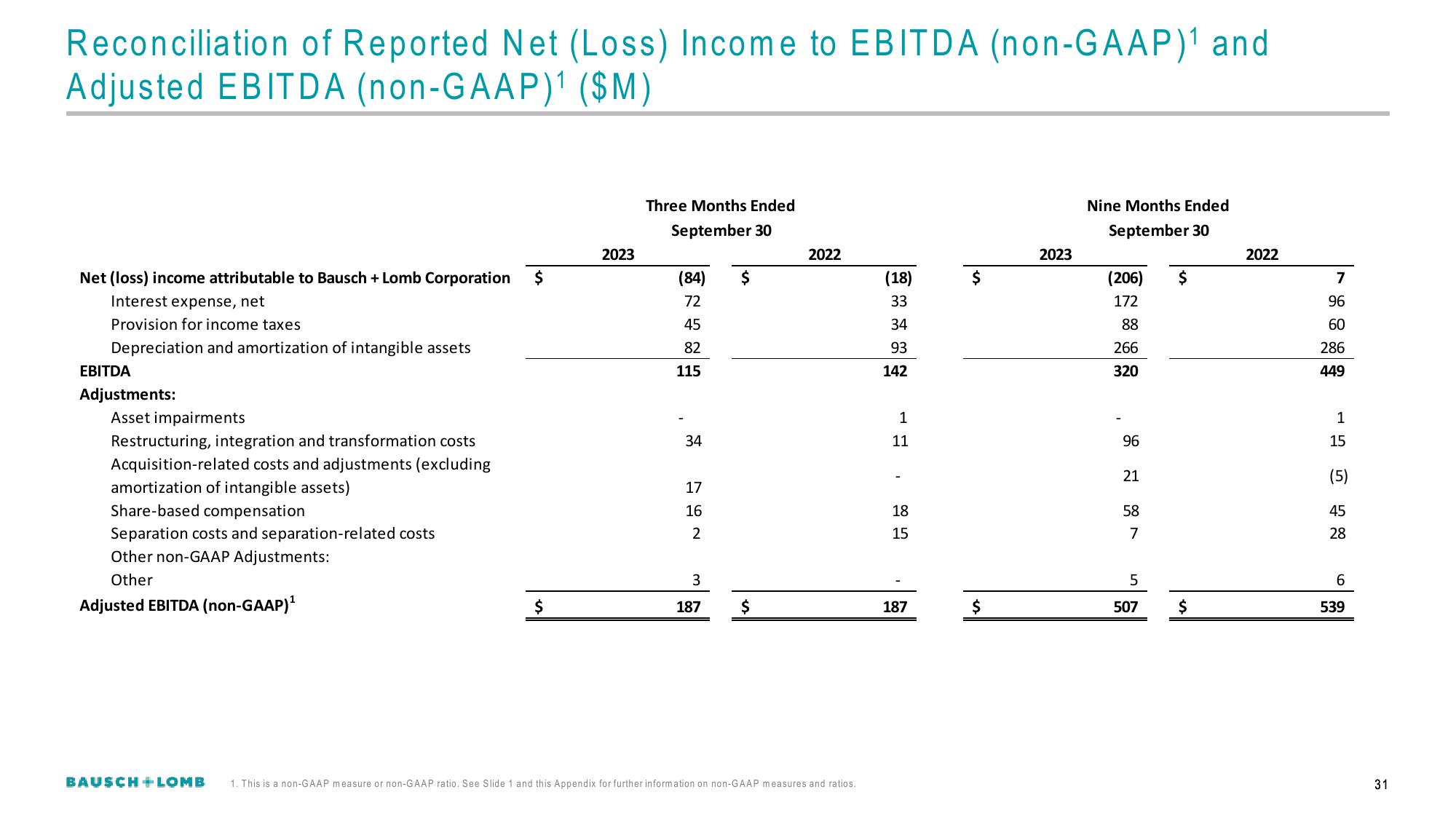

Reconciliation of Reported Net (Loss) Income to EBITDA (non-GAAP)¹ and

Adjusted EBITDA (non-GAAP)¹ ($M)

Net (loss) income attributable to Bausch + Lomb Corporation

Interest expense, net

Provision for income taxes

Depreciation and amortization of intangible assets

EBITDA

Adjustments:

Asset impairments

Restructuring, integration and transformation costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

Share-based compensation

Separation costs and separation-related costs

Other non-GAAP Adjustments:

Other

Adjusted EBITDA (non-GAAP)¹

Three Months Ended

September 30

2022

(84) $

(18)

$

72

33

45

34

82

93

115

142

IT

1

34

11

17

16

18

2

15

$

$

2023

3

187 $

BAUSCH+ LOMB 1. This is a non-GAAP measure or non-GAAP ratio. See Slide 1 and this Appendix for further information on non-GAAP measures and ratios.

187

$

2023

Nine Months Ended

September 30

(206)

172

88

266

320

96

21

58

7

5

507

$

$

2022

7

96

60

286

449

1

15

(5)

45

28

6

539

31View entire presentation