Snap Inc Results Presentation Deck

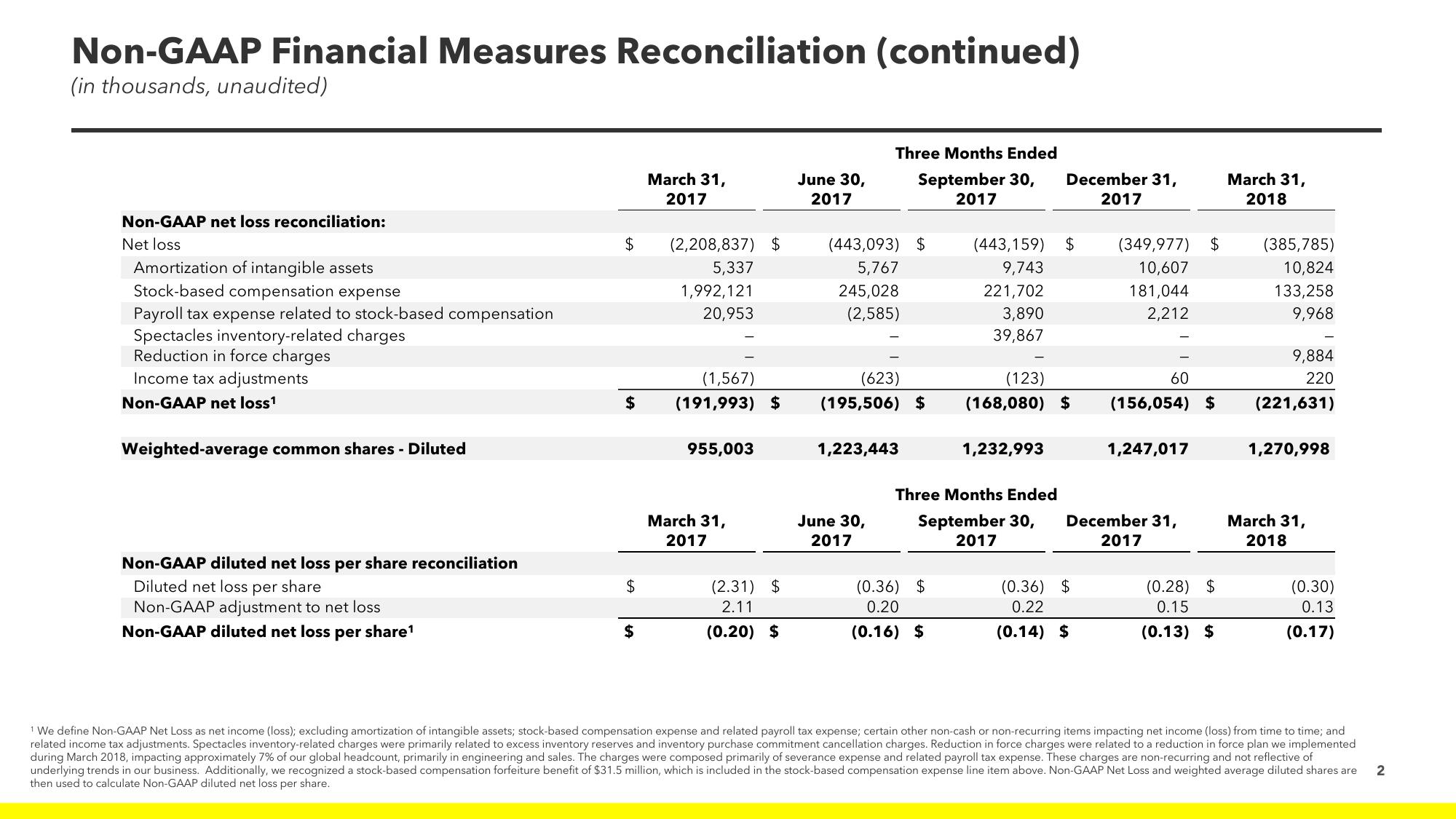

Non-GAAP Financial Measures Reconciliation (continued)

(in thousands, unaudited)

Non-GAAP net loss reconciliation:

Net loss

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

les inventory-related

Reduction in force charges

Income tax adjustments

Non-GAAP net loss¹

Weighted-average common shares - Diluted

Non-GAAP diluted net loss per share reconciliation

Diluted net loss per share

Non-GAAP adjustment to net loss

Non-GAAP diluted net loss per share¹

$

$

March 31,

2017

(1,567)

$ (191,993) $

$

(2,208,837) $

5,337

1,992,121

20,953

955,003

March 31,

2017

(2.31) $

2.11

(0.20) $

June 30,

2017

Three Months Ended

September 30,

2017

(443,093) $

5,767

245,028

(2,585)

(623)

(195,506) $

1,223,443

June 30,

2017

(0.36) $

0.20

(0.16) $

(443,159) $

9,743

221,702

3,890

39,867

December 31,

2017

(123)

(168,080) $

1,232,993

Three Months Ended

September 30,

2017

(349,977)

10,607

181,044

2,212

(0.36) $

0.22

(0.14) $

60

(156,054) $

1,247,017

December 31,

2017

$

(0.28) $

0.15

(0.13) $

March 31,

2018

(385,785)

10,824

133,258

9,968

9,884

220

(221,631)

1,270,998

March 31,

2018

(0.30)

0.13

(0.17)

¹ We define Non-GAAP Net Loss as net income (loss); excluding amortization of intangible assets; stock-based compensation expense and related payroll tax expense; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and

related income tax adjustments. Spectacles inventory-related charges were primarily related to excess inventory reserves and inventory purchase commitment cancellation charges. Reduction in force charges were related to a reduction in force plan we implemented

during March 2018, impacting approximately 7% of our global headcount, primarily in engineering and sales. The charges were composed primarily of severance expense and related payroll tax expense. These charges are non-recurring and not reflective of

underlying trends in our business. Additionally, we recognized a stock-based compensation forfeiture benefit of $31.5 million, which is included in the stock-based compensation expense line item above. Non-GAAP Net Loss and weighted average diluted shares are

then used to calculate Non-GAAP diluted net loss per share.

2View entire presentation