LSE Investor Presentation Deck

Information Services

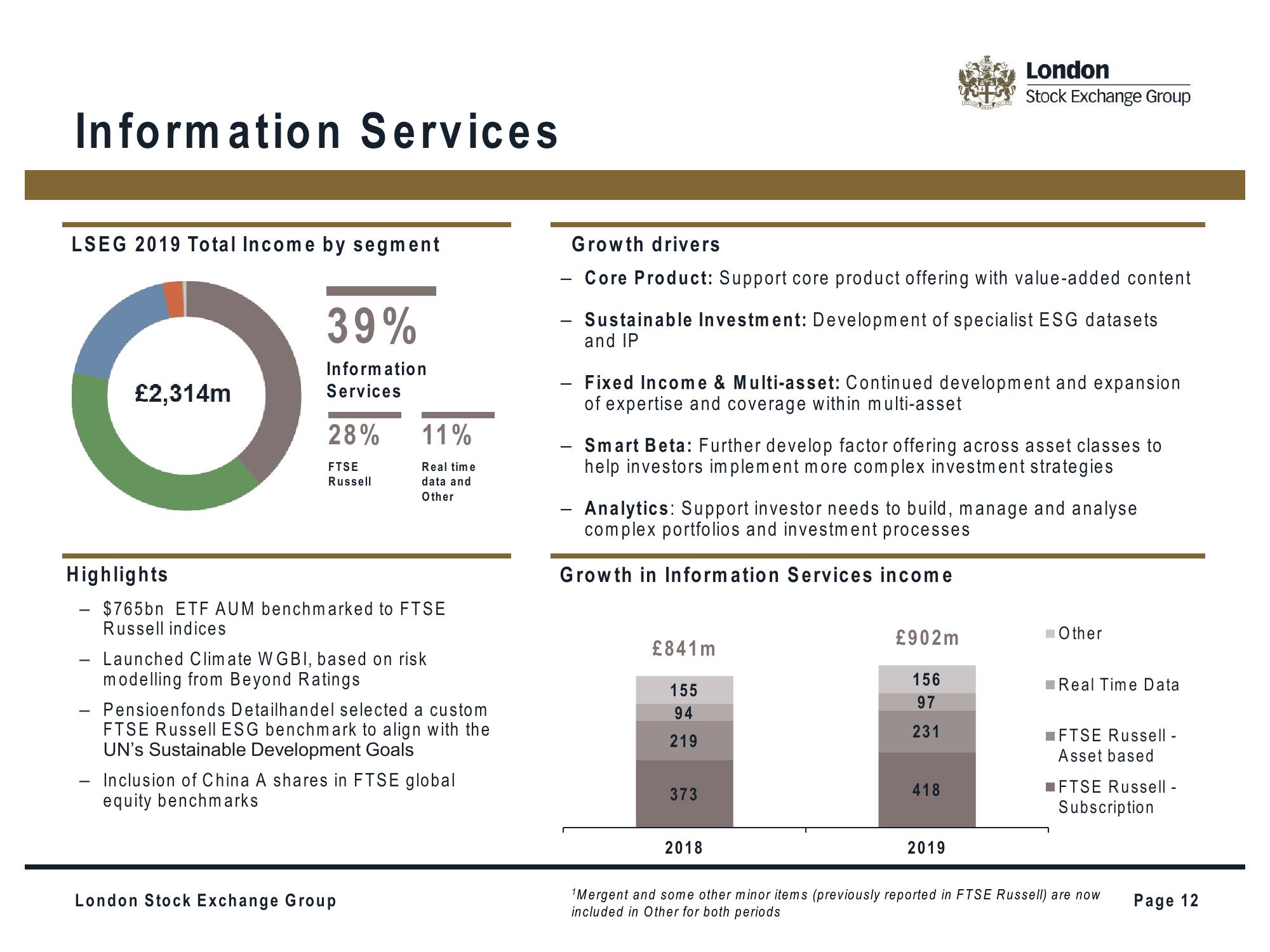

LSEG 2019 Total Income by segment

£2,314m

39%

Information

Services

-

28%

FTSE

Russell

Highlights

- $765bn ETF AUM benchmarked to FTSE

Russell indices

11%

Real time

data and

Other

- Launched Climate WGBI, based on risk

modelling from Beyond Ratings

Pensioenfonds Detailhandel selected a custom

FTSE Russell ESG benchmark to align with the

UN's Sustainable Development Goals

Inclusion of China A shares in FTSE global

equity benchmarks

London Stock Exchange Group

Growth drivers

Core Product: Support core product offering with value-added content

- Sustainable Investment: Development of specialist ESG datasets

and IP

- Fixed Income & Multi-asset: Continued development and expansion

of expertise and coverage within multi-asset

Smart Beta: Further develop factor offering across asset classes to

help investors implement more complex investment strategies

Analytics: Support investor needs to build, manage and analyse

complex portfolios and investment processes

Growth in Information Services income

£841m

155

94

219

373

London

Stock Exchange Group

2018

£902m

156

97

231

418

2019

Other

Real Time Data

FTSE Russell -

Asset based

FTSE Russell -

Subscription

¹Mergent and some other minor items (previously reported in FTSE Russell) are now

included in Other for both periods

Page 12View entire presentation