Planet SPAC Presentation Deck

24

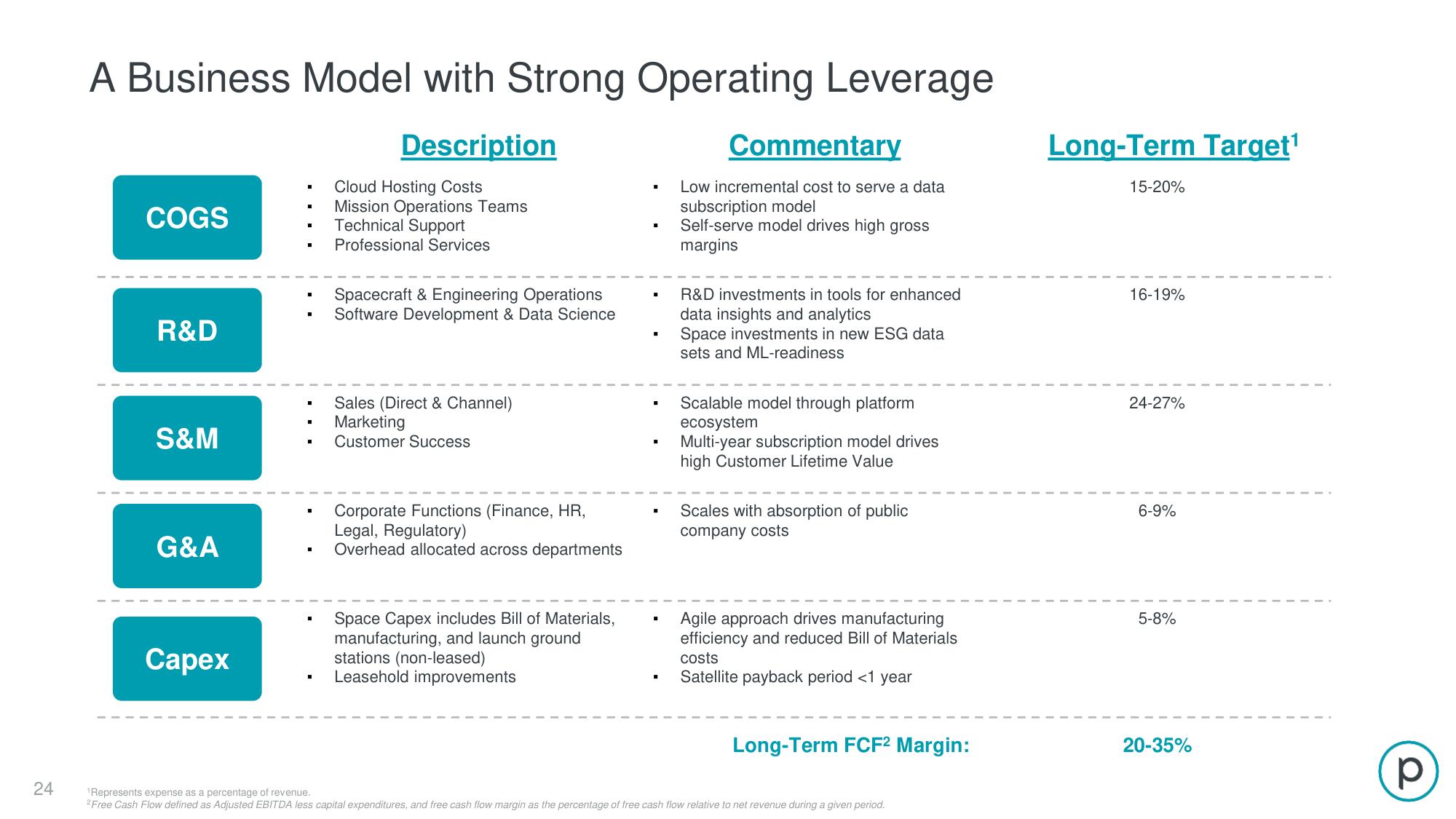

A Business Model with Strong Operating Leverage

Description

COGS

R&D

S&M

G&A

Capex

■

I

■

.

Cloud Hosting Costs

Mission Operations Teams

Technical Support

Professional Services

Spacecraft & Engineering Operations

Software Development & Data Science

Sales (Direct & Channel)

Marketing

Customer Success

Corporate Functions (Finance, HR,

Legal, Regulatory)

Overhead allocated across departments

Space Capex includes Bill of Materials,

manufacturing, and launch ground

stations (non-leased)

Leasehold improvements

.

I

■

Commentary

Low incremental cost to serve a data

subscription model

Self-serve model drives high gross

margins

R&D investments in tools for enhanced

data insights and analytics

Space investments in new ESG data

sets and ML-readiness

Scalable model through platform

ecosystem

Multi-year subscription model drives

high Customer Lifetime Value

Scales with absorption of public

company costs

Agile approach drives manufacturing

efficiency and reduced Bill of Materials

costs

Satellite payback period <1 year

Long-Term FCF² Margin:

¹Represents expense as a percentage of revenue.

2Free Cash Flow defined as Adjusted EBITDA less capital expenditures, and free cash flow margin as the percentage of free cash flow relative to net revenue during a given period.

Long-Term Target¹

15-20%

16-19%

24-27%

6-9%

5-8%

20-35%

рView entire presentation