DocGo SPAC Presentation Deck

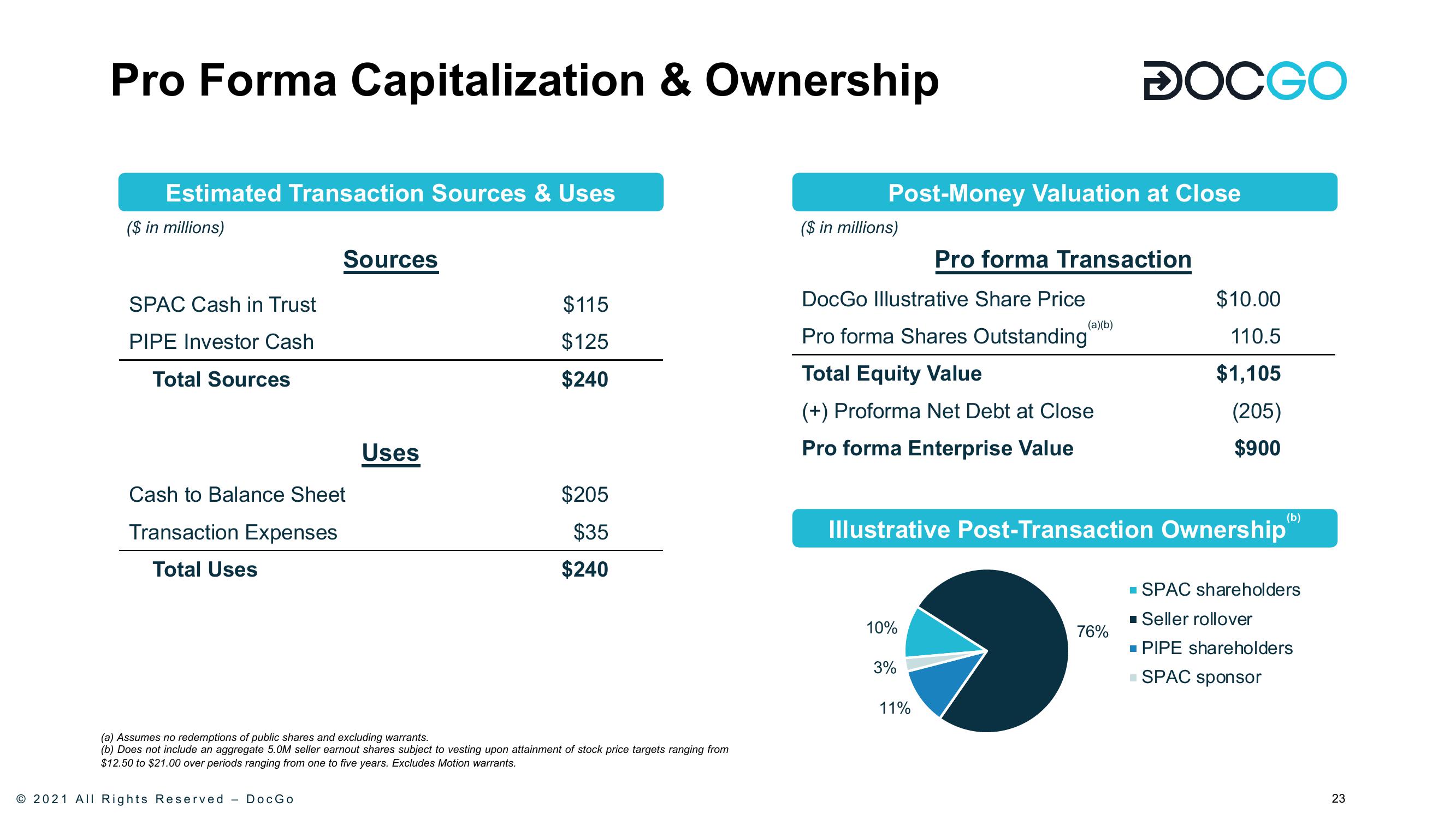

Pro Forma Capitalization & Ownership

Estimated Transaction Sources & Uses

($ in millions)

SPAC Cash in Trust

PIPE Investor Cash

Total Sources

Sources

Cash to Balance Sheet

Transaction Expenses

Total Uses

© 2021 All Rights Reserved - DocGo

Uses

$115

$125

$240

$205

$35

$240

(a) Assumes no redemptions of public shares and excluding warrants.

(b) Does not include an aggregate 5.0M seller earnout shares subject to vesting upon attainment of stock price targets ranging from

$12.50 to $21.00 over periods ranging from one to five years. Excludes Motion warrants.

Post-Money Valuation at Close

($ in millions)

DocGo Illustrative Share Price

Pro forma Shares Outstanding

Total Equity Value

(+) Proforma Net Debt at Close

Pro forma Enterprise Value

10%

3%

Pro forma Transaction

11%

DOCGO

(a)(b)

Illustrative Post-Transaction Ownership

76%

$10.00

110.5

$1,105

(205)

$900

(b)

■ SPAC shareholders

■ Seller rollover

■ PIPE shareholders

■ SPAC sponsor

23View entire presentation