Cboe Results Presentation Deck

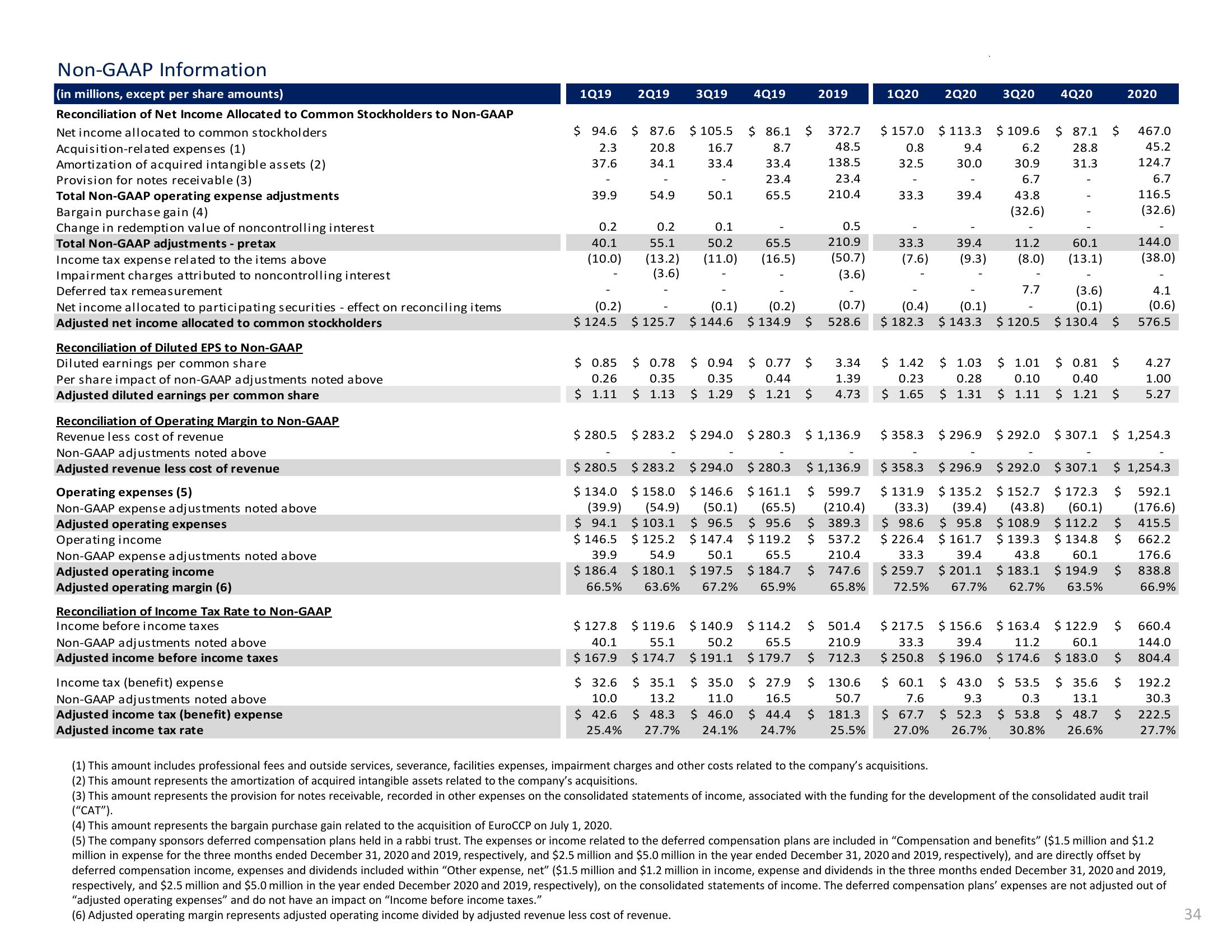

Non-GAAP Information

(in millions, except per share amounts)

Reconciliation of Net Income Allocated to Common Stockholders to Non-GAAP

Net income allocated to common stockholders

Acquisition-related expenses (1)

Amortization of acquired intangible assets (2)

Provision for notes receivable (3)

Total Non-GAAP operating expense adjustments

Bargain purchase gain (4)

Change in redemption value of noncontrolling interest

Total Non-GAAP adjustments - pretax

Income tax expense related to the items above

Impairment charges attributed to noncontrolling interest

Deferred tax remeasurement

Net income allocated to participating securities - effect on reconciling items

Adjusted net income allocated to common stockholders

Reconciliation of Diluted EPS to Non-GAAP

Diluted earnings per common share

Per share impact of non-GAAP adjustments noted above

Adjusted diluted earnings per common share

Reconciliation of Operating Margin to Non-GAAP

Revenue less cost of revenue

Non-GAAP adjustments noted above

Adjusted revenue less cost of revenue

Operating expenses (5)

Non-GAAP expense adjustments noted above

Adjusted operating expenses

Operating income

Non-GAAP expense adjustments noted above

Adjusted operating income

Adjusted operating margin (6)

Reconciliation of Income Tax Rate to Non-GAAP

Income before income taxes

Non-GAAP adjustments noted above

Adjusted income before income taxes

Income tax (benefit) expense

Non-GAAP adjustments noted above

Adjusted income tax (benefit) expense

Adjusted income tax rate

1Q19 2Q19 3Q19 4Q19

$94.6

2.3

37.6

39.9

0.2

40.1

(10.0)

(0.2)

$ 124.5

$ 0.85

0.26

$ 1.11

$ 280.5

$ 280.5

$ 134.0

(39.9)

$94.1

$ 146.5

39.9

$ 186.4

66.5%

$ 87.6

20.8

34.1

54.9

0.2

55.1

(13.2)

(3.6)

$ 125.7

$ 0.78

0.35

$ 1.13

$ 283.2

$ 283.2

$ 158.0

(54.9)

$ 103.1

$ 125.2

54.9

$ 180.1

63.6%

$ 105.5 $ 86.1

16.7

8.7

33.4

33.4

23.4

65.5

$ 119.6

55.1

$ 174.7

50.1

0.1

50.2

(11.0)

(0.1)

$ 144.6

$ 0.94

0.35

$ 1.29

$ 294.0

65.5

(16.5)

(0.2)

$ 134.9 $

$ 0.77 $

0.44

$ 1.21 $

$ 294.0

$ 280.3

$161.1

(65.5)

$ 95.6

$ 119.2

50.1

65.5

$197.5 $ 184.7

67.2% 65.9%

$ 146.6

(50.1)

$ 96.5

$ 147.4

$ 127.8

40.1

$ 167.9

$ 32.6

10.0

$ 42.6

$140.9 $ 114.2

50.2 65.5

$ 191.1 $ 179.7

$ 35.1 $ 35.0

13.2

11.0

$48.3 $ 46.0

25.4% 27.7% 24.1%

$ 372.7

48.5

138.5

23.4

210.4

2019

$ 27.9

16.5

$ 44.4

24.7%

0.5

210.9

(50.7)

(3.6)

$280.3 $ 1,136.9

(0.7)

528.6

3.34

1.39

4.73

$ 1,136.9

$ 599.7

(210.4)

$ 389.3

$ 537.2

210.4

$ 747.6

65.8%

$ 501.4

210.9

$ 712.3

$ 130.6

50.7

$ 181.3

25.5%

1Q20

$ 157.0

0.8

32.5

33.3

33.3

(7.6)

(0.4)

$ 182.3

$ 1.42

0.23

$ 1.65

$ 358.3

$ 358.3

$ 131.9

(33.3)

$ 98.6

$ 226.4

33.3

$ 259.7

72.5%

$ 217.5

33.3

$ 250.8

$ 60.1

7.6

$ 67.7

27.0%

2Q20 3Q20

$ 113.3

9.4

30.0

39.4

39.4

(9.3)

(0.1)

$ 143.3

$ 296.9

$ 109.6

6.2

30.9

6.7

43.8

(32.6)

$ 296.9

$135.2

(39.4)

$ 95.8

$ 161.7

39.4

$201.1

67.7%

11.2

(8.0)

$ 1.03 $ 1.01

0.28 0.10

$ 1.31 $ 1.11

$ 292.0

7.7 (3.6)

(0.1)

$ 120.5 $130.4 $

$ 292.0

$152.7

(43.8)

$108.9

$ 139.3

43.8

$ 183.1

62.7%

$ 156.6 $ 163.4

39.4

11.2

$ 196.0

$ 174.6

4Q20

$ 43.0

9.3

$ 53.5

0.3

$ 52.3 $ 53.8

26.7% 30.8%

$ 87.1 $

28.8

31.3

60.1

(13.1)

$ 0.81

$

0.40

$ 1.21 $

$ 122.9

60.1

$ 183.0

$ 35.6

13.1

$ 48.7

26.6%

$

$

$

2020

$

$

$

$

467.0

45.2

124.7

6.7

116.5

(32.6)

144.0

(38.0)

$307.1 $ 1,254.3

$ 307.1 $ 1,254.3

$172.3 $ 592.1

(60.1) (176.6)

$ 112.2

415.5

$ 134.8

60.1

$ 194.9

63.5%

662.2

176.6

838.8

66.9%

4.1

(0.6)

576.5

4.27

1.00

5.27

660.4

144.0

804.4

192.2

30.3

222.5

27.7%

(1) This amount includes professional fees and outside services, severance, facilities expenses, impairment charges and other costs related to the company's acquisitions.

(2) This amount represents the amortization of acquired intangible assets related to the company's acquisitions.

(3) This amount represents the provision for notes receivable, recorded in other expenses on the consolidated statements of income, associated with the funding for the development of the consolidated audit trail

("CAT").

(4) This amount represents the bargain purchase gain related to the acquisition of EuroCCP on July 1, 2020.

(5) The company sponsors deferred compensation plans held in a rabbi trust. The expenses or income related to the deferred compensation plans are included in "Compensation and benefits" ($1.5 million and $1.2

million in expense for the three months ended December 31, 2020 and 2019, respectively, and $2.5 million and $5.0 million in the year ended December 31, 2020 and 2019, respectively), and are directly offset by

deferred compensation income, expenses and dividends included within "Other expense, net" ($1.5 million and $1.2 million in income, expense and dividends in the three months ended December 31, 2020 and 2019,

respectively, and $2.5 million and $5.0 million in the year ended December 2020 and 2019, respectively), on the consolidated statements of income. The deferred compensation plans' expenses are not adjusted out of

"adjusted operating expenses" and do not have an impact on "Income before income taxes."

(6) Adjusted operating margin represents adjusted operating income divided by adjusted revenue less cost of revenue.

34View entire presentation