Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

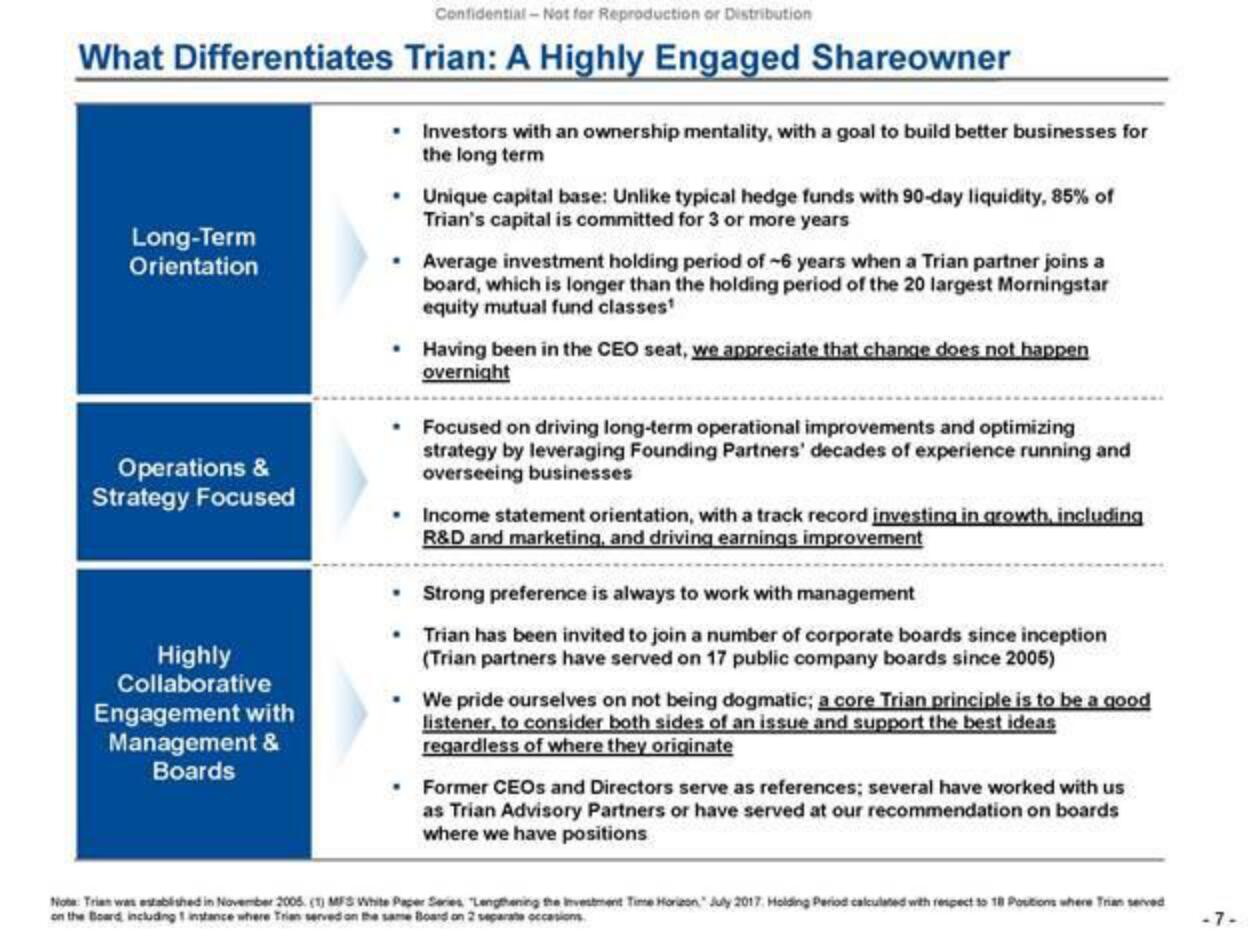

What Differentiates Trian: A Highly Engaged Shareowner

Long-Term

Orientation

Operations &

Strategy Focused

Highly

Collaborative

Engagement with

Management &

Boards

. Investors with an ownership mentality, with a goal to build better businesses for

the long term

• Unique capital base: Unlike typical hedge funds with 90-day liquidity, 85% of

Trian's capital is committed for 3 or more years

• Average investment holding period of -6 years when a Trian partner joins a

board, which is longer than the holding period of the 20 largest Morningstar

equity mutual fund classes¹

• Having been in the CEO seat, we appreciate that change does not happen

overnight

• Focused on driving long-term operational improvements and optimizing

strategy by leveraging Founding Partners' decades of experience running and

overseeing businesses

• Income statement orientation, with a track record investing in growth, including

R&D and marketing, and driving earnings improvement

•

•

Strong preference is always to work with management

Trian has been invited to join a number of corporate boards since inception

(Trian partners have served on 17 public company boards since 2005)

. We pride ourselves on not being dogmatic; a core Trian principle is to be a good

listener, to consider both sides of an issue and support the best ideas

regardless of where they originate

• Former CEOs and Directors serve as references; several have worked with us

as Trian Advisory Partners or have served at our recommendation on boards

where we have positions

Note: Trian was established in November 2005 (1) MFS White Paper Series Lengthening the investment Time Horizon July 2017. Holding Period calculated with respect to 18 Positions where Trian served

on the Board, including 1 instance where Trian served on the same Board on 2 separate occasions

-7-View entire presentation