jetBlue Mergers and Acquisitions Presentation Deck

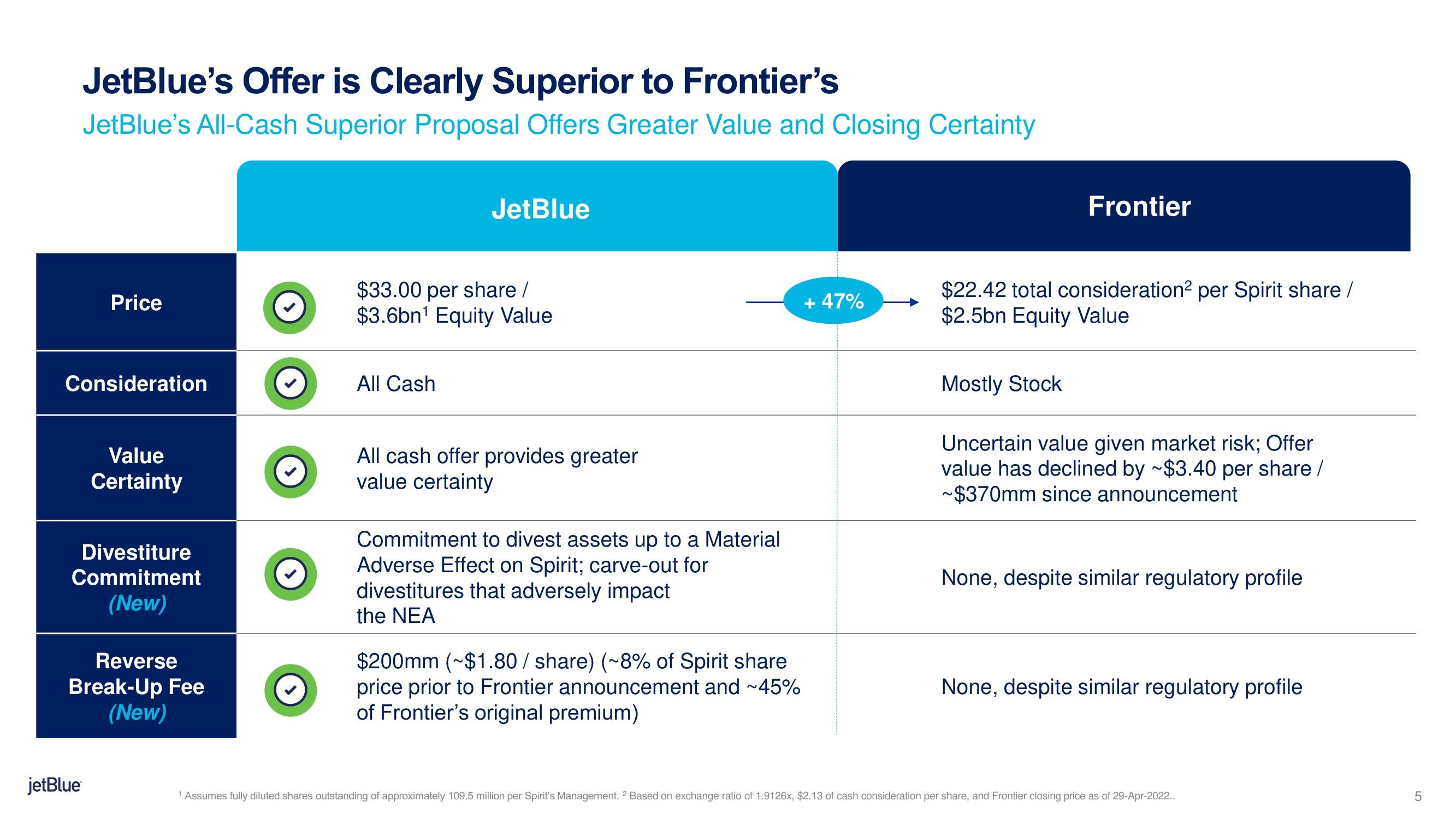

JetBlue's Offer is Clearly Superior to Frontier's

JetBlue's All-Cash Superior Proposal Offers Greater Value and Closing Certainty

Price

Consideration

jetBlue

Value

Certainty

Divestiture

Commitment

(New)

Reverse

Break-Up Fee

(New)

JetBlue

$33.00 per share /

$3.6bn¹ Equity Value

All Cash

All cash offer provides greater

value certainty

Commitment to divest assets up to a Material

Adverse Effect on Spirit; carve-out for

divestitures that adversely impact

the NEA

$200mm (~$1.80 / share) (~8% of Spirit share

price prior to Frontier announcement and ~45%

of Frontier's original premium)

+ 47%

Frontier

$22.42 total consideration² per Spirit share /

$2.5bn Equity Value

Mostly Stock

Uncertain value given market risk; Offer

value has declined by ~$3.40 per share /

~$370mm since announcement

None, despite similar regulatory profile

None, despite similar regulatory profile

¹ Assumes fully diluted shares outstanding of approximately 109.5 million per Spirit's Management. 2 Based on exchange ratio of 1.9126x, $2.13 of cash consideration per share, and Frontier closing price as of 29-Apr-2022..

LO

5View entire presentation