Evercore Investment Banking Pitch Book

Discussion Materials

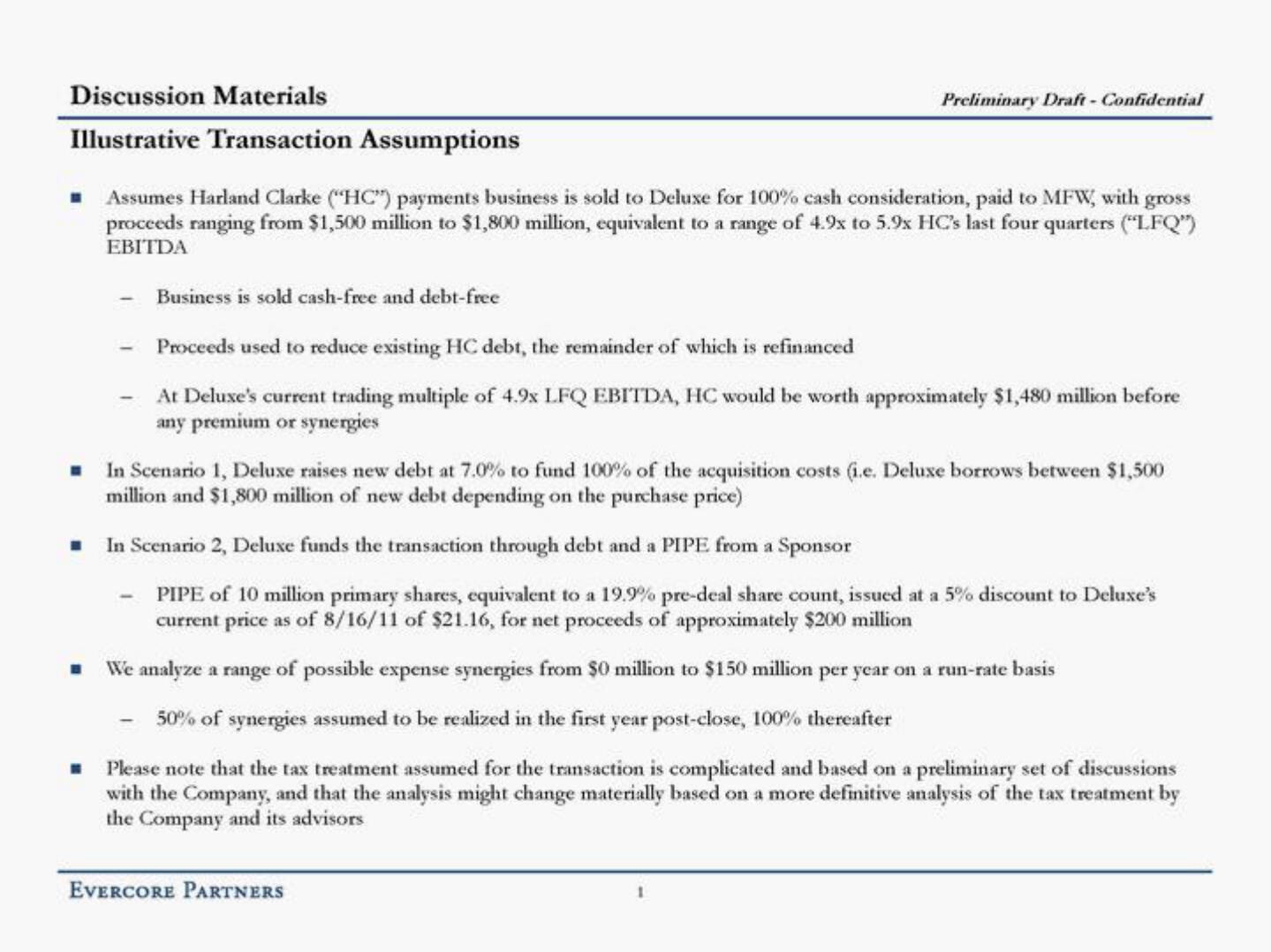

Illustrative Transaction Assumptions

m

Assumes Harland Clarke ("HC") payments business is sold to Deluxe for 100% cash consideration, paid to MFW, with gross

proceeds ranging from $1,500 million to $1,800 million, equivalent to a range of 4.9x to 5.9x HC's last four quarters ("LFQ")

EBITDA

-

Preliminary Draft-Confidential

Business is sold cash-free and debt-free

Proceeds used to reduce existing HC debt, the remainder of which is refinanced

At Deluxe's current trading multiple of 4.9x LFQ EBITDA, HC would be worth approximately $1,480 million before

any premium or synergies

In Scenario 1, Deluxe raises new debt at 7.0% to fund 100% of the acquisition costs (i.e. Deluxe borrows between $1,500

million and $1,800 million of new debt depending on the purchase price)

■ In Scenario 2, Deluxe funds the transaction through debt and a PIPE from a Sponsor

-

PIPE of 10 million primary shares, equivalent to a 19.9% pre-deal share count, issued at a 5% discount to Deluxe's

current price as of 8/16/11 of $21.16, for net proceeds of approximately $200 million

We analyze a range of possible expense synergies from $0 million to $150 million per year on a run-rate basis

50% of synergies assumed to be realized in the first year post-close, 100% thereafter

Please note that the tax treatment assumed for the transaction is complicated and based on a preliminary set of discussions

with the Company, and that the analysis might change materially based on a more definitive analysis of the tax treatment by

the Company and its advisors

EVERCORE PARTNERSView entire presentation