Q3 ‘20 Earnings Supplemental Presentation Liquidity and COVID-19 Update

National CineMedia Business Update - Covid-19 Impact

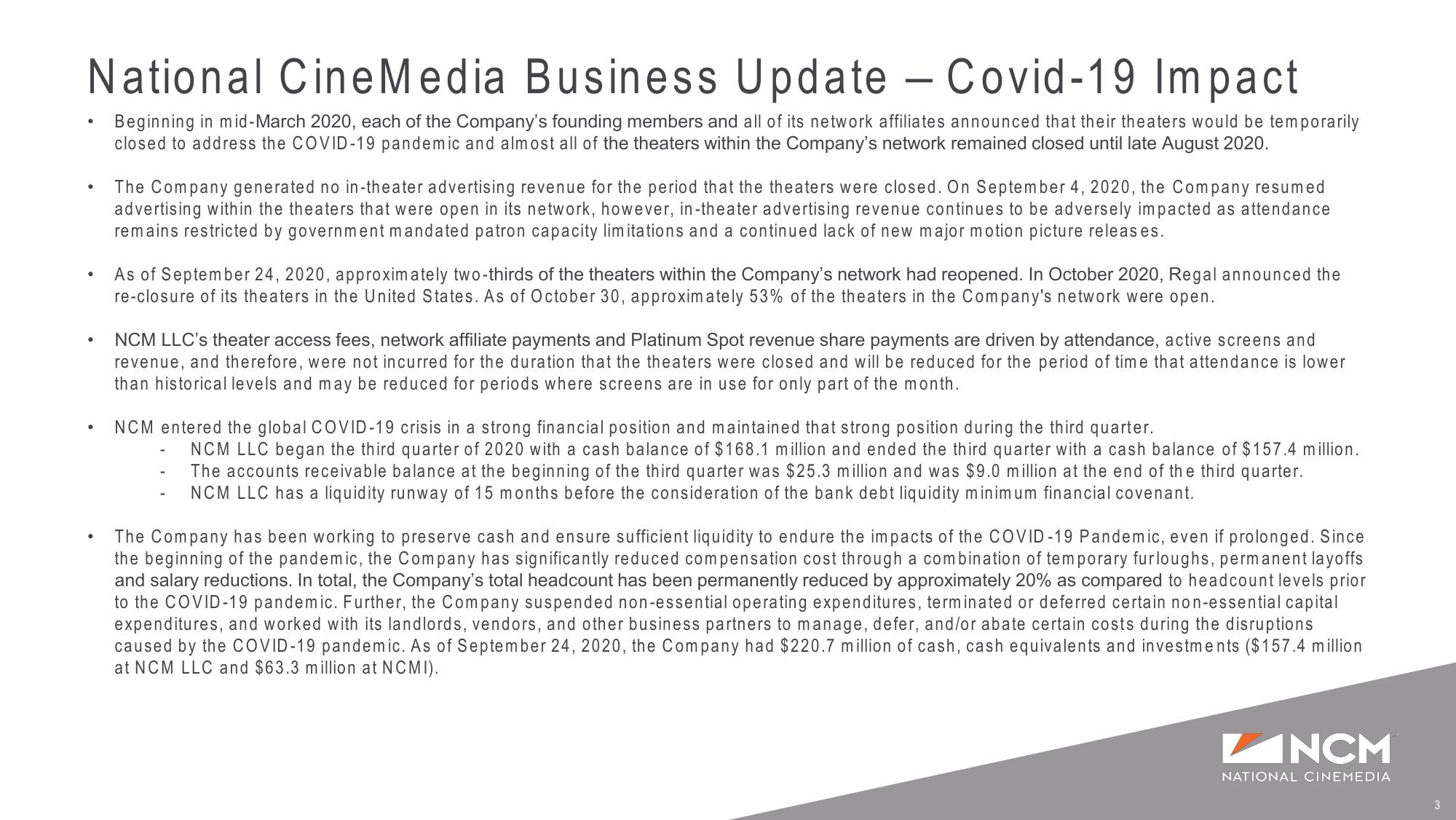

Beginning in mid-March 2020, each of the Company's founding members and all of its network affiliates announced that their theaters would be temporarily

closed to address the COVID-19 pandemic and almost all of the theaters within the Company's network remained closed until late August 2020.

●

●

●

●

●

●

The Company generated no in-theater advertising revenue for the period that the theaters were closed. On September 4, 2020, the Company resumed

advertising within the theaters that were open in its network, however, in-theater advertising revenue continues to be adversely impacted as attendance

remains restricted by government mandated patron capacity limitations and a continued lack of new major motion picture releases.

As of September 24, 2020, approximately two-thirds of the theaters within the Company's network had reopened. In October 2020, Regal announced the

re-closure of its theaters in the United States. As of October 30, approximately 53% of the theaters in the Company's network were open.

NCM LLC's theater access fees, network affiliate payments and Platinum Spot revenue share payments are driven by attendance, active screens and

revenue, and therefore, were not incurred for the duration that the theaters were closed and will be reduced for the period of time that attendance is lower

than historical levels and may be reduced for periods where screens are in use for only part of the month.

NCM entered the global COVID-19 crisis in a strong financial position and maintained that strong position during the third quarter.

NCM LLC began the third quarter of 2020 with a cash balance of $168.1 million and ended the third quarter with a cash balance of $157.4 million.

The accounts receivable balance at the beginning of the third quarter was $25.3 million and was $9.0 million at the end of the third quarter.

NCM LLC has a liquidity runway of 15 months before the consideration of the bank debt liquidity minimum financial covenant.

-

The Company has been working to preserve cash and ensure sufficient liquidity to endure the impacts of the COVID-19 Pandemic, even if prolonged. Since

the beginning of the pandemic, the Company has significantly reduced compensation cost through a combination of temporary furloughs, permanent layoffs

and salary reductions. In total, the Company's total headcount has been permanently reduced by approximately 20% as compared to headcount levels prior

to the COVID-19 pandemic. Further, the Company suspended non-essential operating expenditures, terminated or deferred certain non-essential capital

expenditures, and worked with its landlords, vendors, and other business partners to manage, defer, and/or abate certain costs during the disruptions

caused by the COVID-19 pandemic. As of September 24, 2020, the Company had $220.7 million of cash, cash equivalents and investments ($157.4 million

at NCM LLC and $63.3 million at NCMI).

NCM

NATIONAL CINEMEDIA

3View entire presentation