Bank of America Investment Banking Pitch Book

I

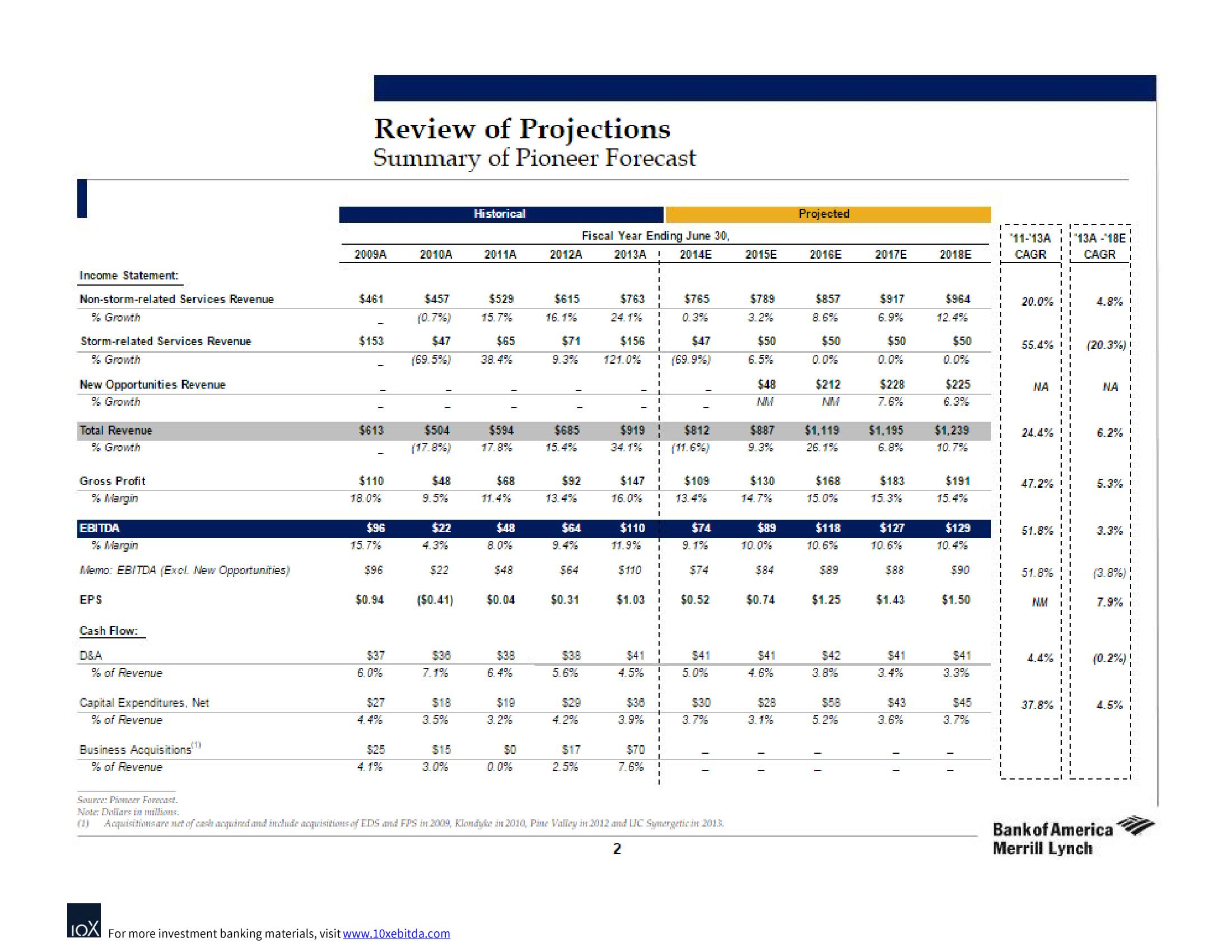

Income Statement:

Non-storm-related Services Revenue

% Growth

Storm-related Services Revenue

% Growth

New Opportunities Revenue

% Growth

Total Revenue

% Growth

Gross Profit

% Margin

EBITDA

% Margin

Memo: EBITDA (Excl New Opportunities)

EPS

Cash Flow:

D&A

% of Revenue

Capital Expenditures, Net

% of Revenue

(1)

Business Acquisitions

% of Revenue

Review of Projections

Summary of Pioneer Forecast

2009A

$461

$153

$613

$110

18.0%

$96

15.7%

$0.94

$37

2010A

$457

(0.7%)

$47

(69.5%)

$504

(17.8%)

$48

9.5%

$22

4.3%

$22

($0.41)

$38

7.1%

$18

3.5%

$15

Historical

LOX For more investment banking materials, visit www.10xebitda.com

2011A

$529

15.7%

$65

38.4%

$594

17.8%

$68

$48

8.0%

$0.04

3.2%

2012A

$615

16.1%

$71

9.3%

$685

15.4%

$92

13.4%

$64

$0.31

$38

5.6%

Fiscal Year Ending June 30,

2013A I 2014E

4.2%

$17

2.5%

$763

24.1%

$156

121.0%

$919

34.1%

$147

16.0%

$110

11.9%

$110

$1.03

$41

4.5%

$70

7.6%

I

I

I

I

$765

$47

(69.9%)

$812

(11.6%)

$109

13.4%

$74

9.1%

$74

$0.52

$41

5.0%

3.7%

Source: Pioneer Forecast.

Note Dollars in millions.

(2) Acquisitions are not of cash acquired and include acquisitions of EDS and FPS in 2009, Klondyke in 2010, Pine Valley in 2012 and UC Synergetic in 2015.

2

2015E

$789

3.2%

$50

6.5%

$48

NM

$887

$130

14.7%

$89

10.0%

$0.74

$41

3.1%

Projected

2016E

$857

8.6%

$50

$212

NM

$1,119

26.1%

$168

15.0%

$118

10.6%

$1.25

$42

3.8%

5.2%

T!

2017E

$917

$50

0.0%

$228

$1,195

6.8%

$183

15.3%

$127

10.6%

$1.43

$41

$43

3.6%

2018E

$964

$50

$225

$1,239

$191

15.4%

$129

10.4%

$90

$1.50

$41

3.3%

$45

3.7%

"'11-'13A

CAGR

20.0%

55.4%

NA

24.4%

47.2%

51.8%

51.8%

NM

4.4%

37.8%

¹13A-18E

CAGR

4.8%

(20.3%)

NA

6.2%

5.3%

7.9%

(0.2%)

4.5%

Bank of America

Merrill LynchView entire presentation