Pershing Square Activist Presentation Deck

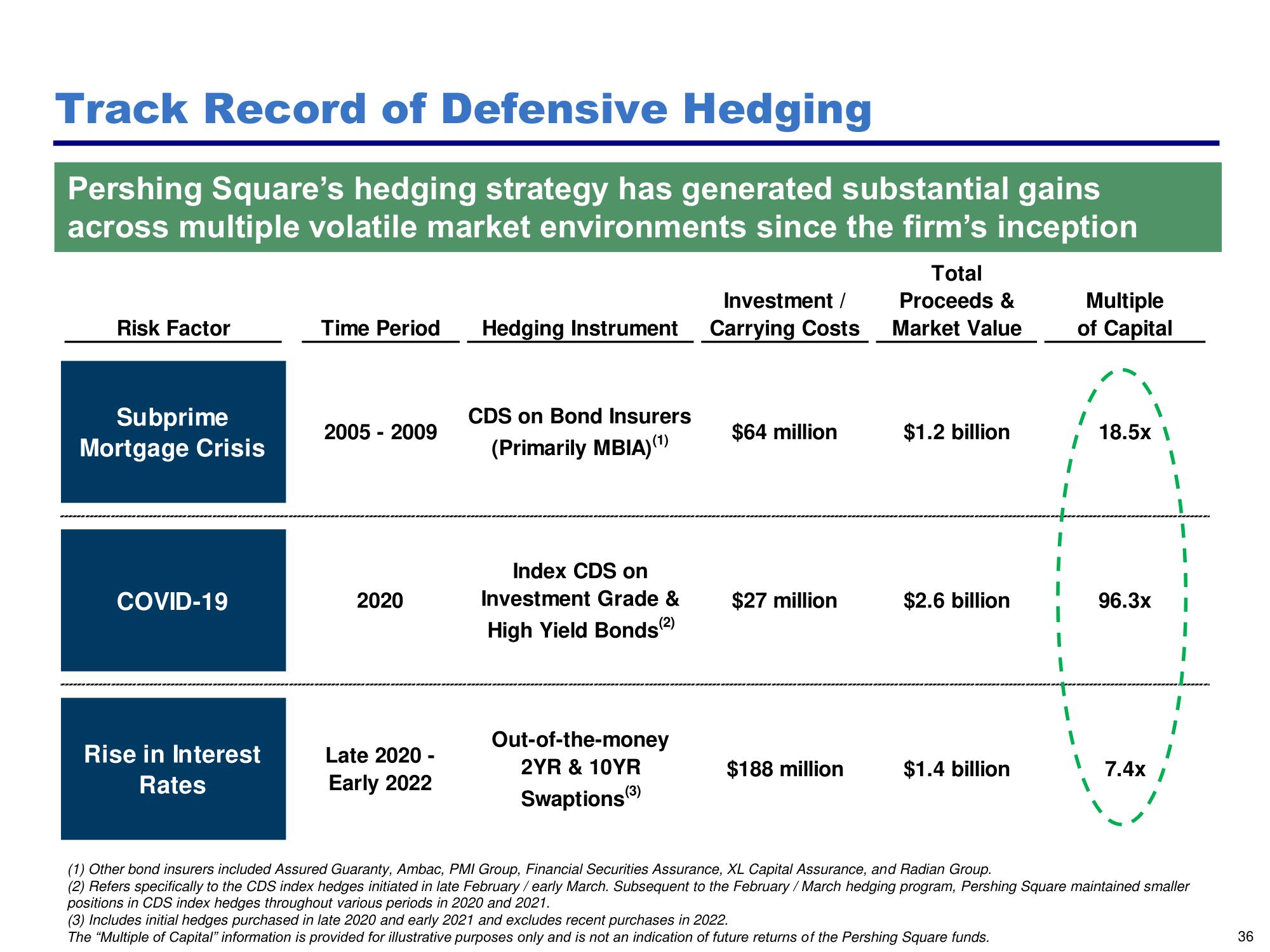

Track Record of Defensive Hedging

Pershing Square's hedging strategy has generated substantial gains

across multiple volatile market environments since the firm's inception

Risk Factor

Subprime

Mortgage Crisis

COVID-19

Rise in Interest

Rates

Time Period

2005 - 2009

2020

Late 2020 -

Early 2022

Hedging Instrument

CDS on Bond Insurers

(Primarily MBIA)(¹)

Index CDS on

Investment Grade &

High Yield Bonds (2)

Out-of-the-money

2YR & 10YR

Swaptions (3)

Investment /

Carrying Costs

$64 million

$27 million

$188 million

Total

Proceeds &

Market Value

$1.2 billion

$2.6 billion

$1.4 billion

Multiple

of Capital

(3) Includes initial hedges purchased in late 2020 and early 2021 and excludes recent purchases in 2022.

The "Multiple of Capital" information is provided for illustrative purposes only and is not an indication of future returns of the Pershing Square funds.

18.5x |

96.3x

7.4x

(1) Other bond insurers included Assured Guaranty, Ambac, PMI Group, Financial Securities Assurance, XL Capital Assurance, and Radian Group.

(2) Refers specifically to the CDS index hedges initiated in late February / early March. Subsequent to the February / March hedging program, Pershing Square maintained smaller

positions in CDS index hedges throughout various periods in 2020 and 2021.

36View entire presentation