Flutter Results Presentation Deck

Appendices

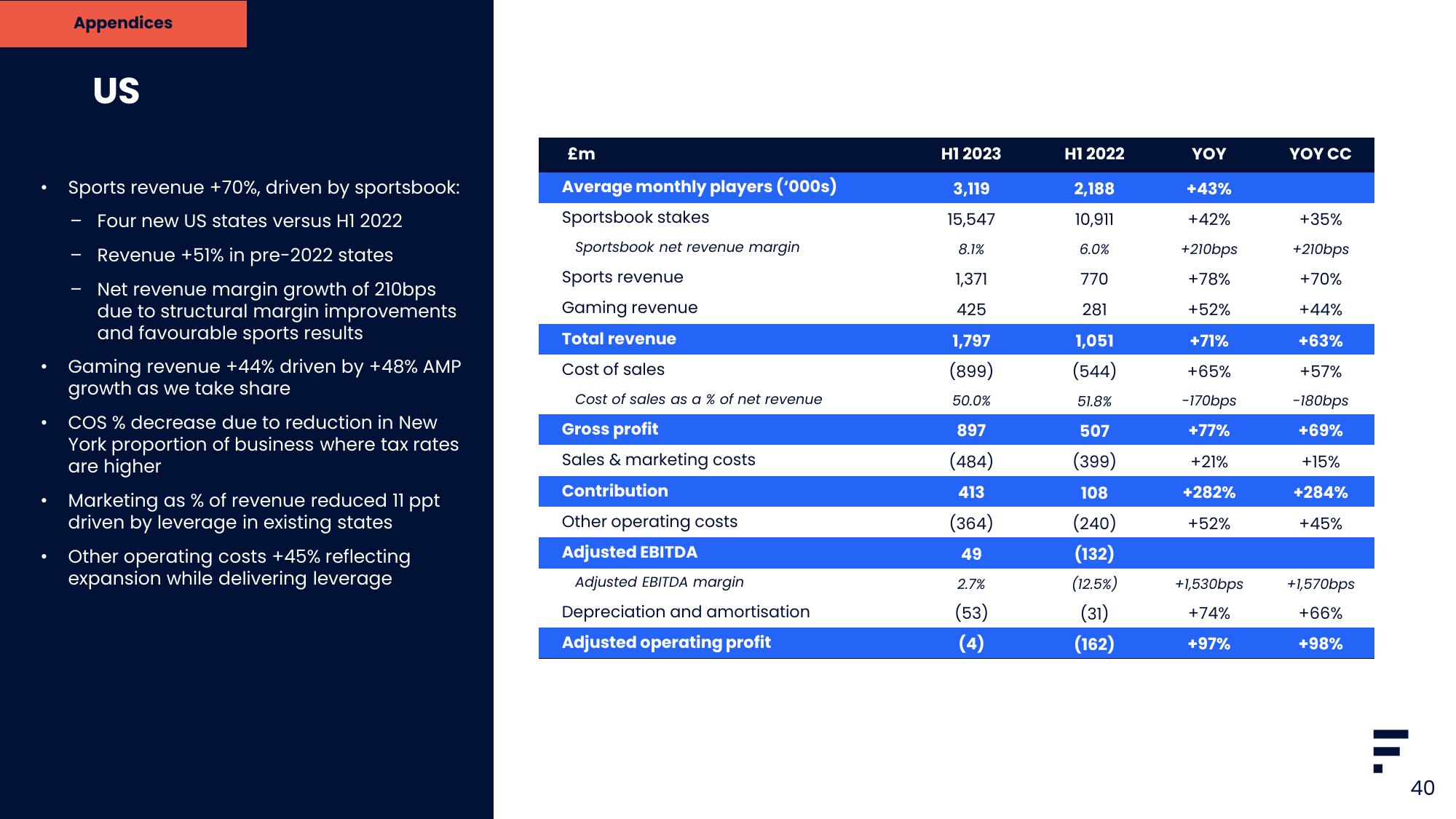

US

Sports revenue +70%, driven by sportsbook:

Four new US states versus H1 2022

Revenue +51% in pre-2022 states

Net revenue margin growth of 210bps

due to structural margin improvements

and favourable sports results

Gaming revenue +44% driven by +48% AMP

growth as we take share

COS % decrease due to reduction in New

York proportion of business where tax rates

are higher

Marketing as % of revenue reduced 11 ppt

driven by leverage in existing states

Other operating costs +45% reflecting

expansion while delivering leverage

£m

Average monthly players ('000s)

Sportsbook stakes

Sportsbook net revenue margin

Sports revenue

Gaming revenue

Total revenue

Cost of sales

Cost of sales as a % of net revenue

Gross profit

Sales & marketing costs

Contribution

Other operating costs

Adjusted EBITDA

Adjusted EBITDA margin

Depreciation and amortisation

Adjusted operating profit

H1 2023

3,119

15,547

8.1%

1,371

425

1,797

(899)

50.0%

897

(484)

413

(364)

49

2.7%

(53)

H12022

2,188

10,911

6.0%

770

281

1,051

(544)

51.8%

507

(399)

108

(240)

(132)

(12.5%)

(31)

(162)

YOY

+43%

+42%

+210bps

+78%

+52%

+71%

+65%

-170bps

+77%

+21%

+282%

+52%

+1,530bps

+74%

+97%

YOY CC

+35%

+210bps

+70%

+44%

+63%

+57%

-180bps

+69%

+15%

+284%

+45%

+1,570bps

+66%

+98%

F

II.

40View entire presentation