Allego SPAC Presentation Deck

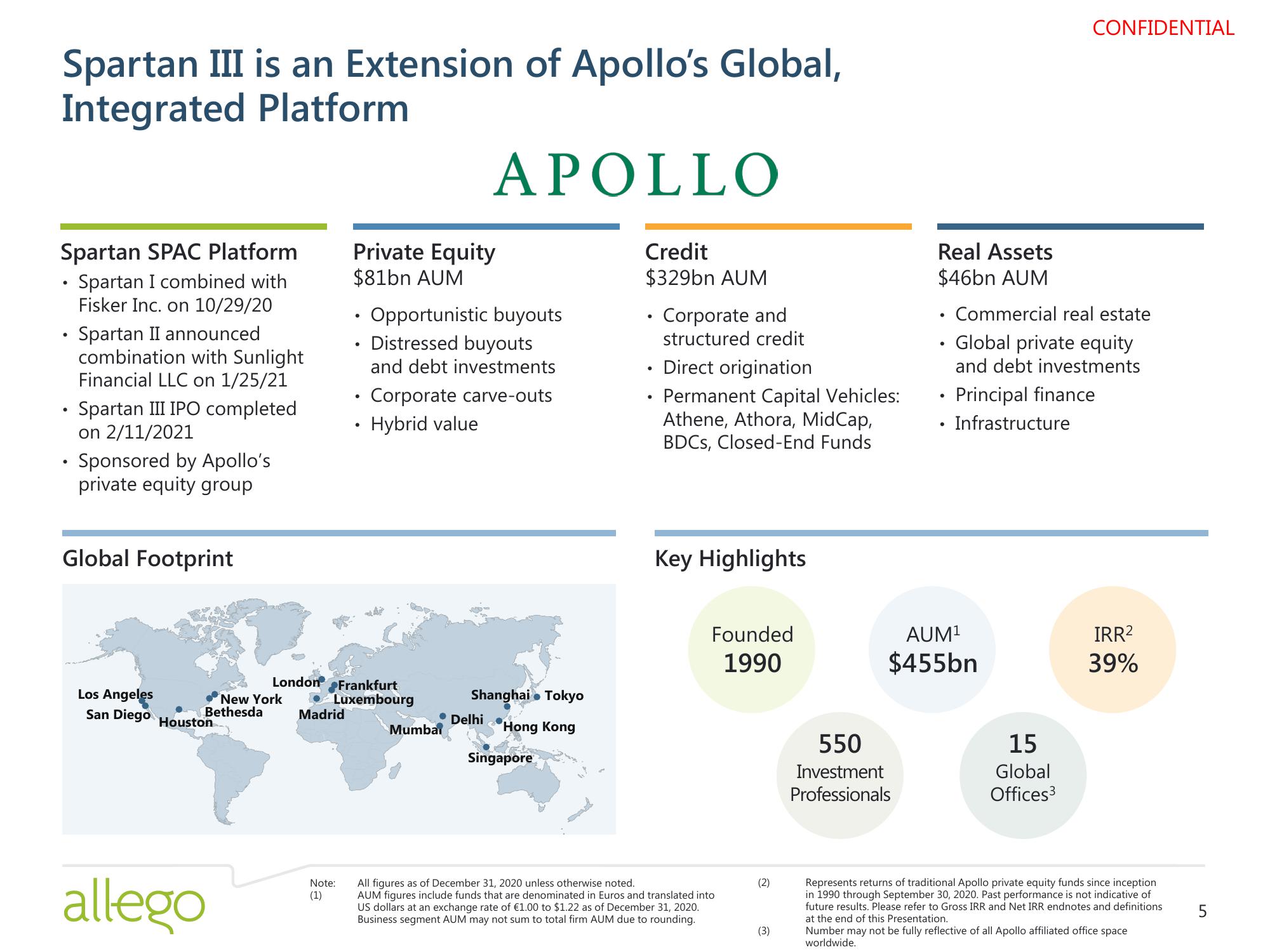

Spartan III is an Extension of Apollo's Global,

Integrated Platform

APOLLO

Spartan SPAC Platform

Spartan I combined with

Fisker Inc. on 10/29/20

●

●

●

Spartan II announced

combination with Sunlight

Financial LLC on 1/25/21

Spartan III IPO completed

on 2/11/2021

Sponsored by Apollo's

private equity group

Global Footprint

Los Angeles

San Diego Houston

New York

Bethesda

allego

Madrid

Private Equity

$81bn AUM

Note:

(1)

• Opportunistic buyouts

●

Distressed buyouts

and debt investments

Corporate carve-outs

• Hybrid value

London Frankfurt

Luxembourg

•

●

Shanghai. Tokyo

Hong Kong

Singapore

• Delhi

Mumbai

Credit

$329bn AUM

●

●

Corporate and

structured credit

Direct origination

Permanent Capital Vehicles:

Athene, Athora, MidCap,

BDCs, Closed-End Funds

Key Highlights

Founded

1990

All figures as of December 31, 2020 unless otherwise noted.

AUM figures include funds that are denominated in Euros and translated into

US dollars at an exchange rate of €1.00 to $1.22 as of December 31, 2020.

Business segment AUM may not sum to total firm AUM due to rounding.

(2)

(3)

Real Assets

$46bn AUM

550

Investment

Professionals

●

Commercial real estate

Global private equity

and debt investments

AUM¹

$455bn

CONFIDENTIAL

• Principal finance

• Infrastructure

15

Global

Offices³

IRR²

39%

Represents returns of traditional Apollo private equity funds since inception

in 1990 through September 30, 2020. Past performance is not indicative of

future results. Please refer to Gross IRR and Net IRR endnotes and definitions

at the end of this Presentation.

Number may not be fully reflective of all Apollo affiliated office space

worldwide.

5View entire presentation