P3 Health Partners SPAC Presentation Deck

Right Space

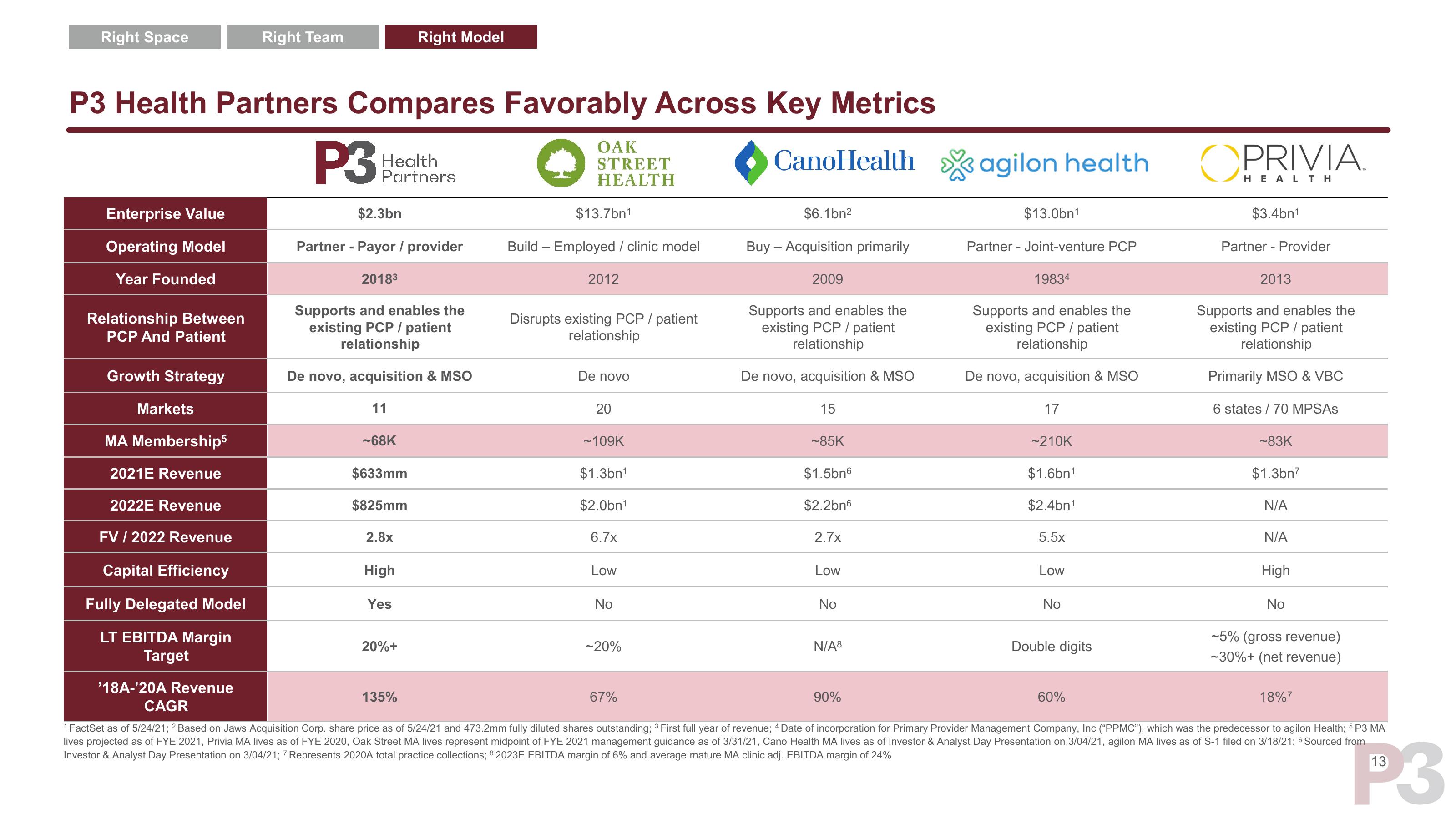

Enterprise Value

Operating Model

Year Founded

P3 Health Partners Compares Favorably Across Key Metrics

Health

Partners

Relationship Between

PCP And Patient

Growth Strategy

Markets

MA Membership5

2021E Revenue

2022E Revenue

FV / 2022 Revenue

Capital Efficiency

Fully Delegated Model

LT EBITDA Margin

Target

Right Team

'18A-'20A Revenue

P3

$2.3bn

Partner - Payor / provider

20183

Supports and enables the

existing PCP / patient

relationship

De novo, acquisition & MSO

11

-68K

$633mm

$825mm

2.8x

Right Model

High

Yes

20%+

135%

OAK

STREET

HEALTH

$13.7bn¹

Build - Employed / clinic model

2012

Disrupts existing PCP / patient

relationship

De novo

20

~109K

$1.3bn¹

$2.0bn¹

6.7x

Low

No

~20%

67%

CanoHealth agilon health

$6.1bn²

Buy - Acquisition primarily

2009

Supports and enables the

existing PCP / patient

relationship

De novo, acquisition & MSO

15

~85K

$1.5bn6

$2.2bn6

2.7x

Low

No

N/A8

90%

$13.0bn¹

Partner - Joint-venture PCP

19834

Supports and enables the

existing PCP / patient

relationship

De novo, acquisition & MSO

17

~210K

$1.6bn¹

$2.4bn¹

5.5x

Low

No

Double digits

60%

OPRIVIA

$3.4bn¹

Partner - Provider

2013

Supports and enables the

existing PCP / patient

relationship

Primarily MSO & VBC

6 states/70 MPSAs

~83K

$1.3bn7

N/A

N/A

High

No

~5% (gross revenue)

-30%+ (net revenue)

18%7

CAGR

1 FactSet as of 5/24/21; 2 Based on Jaws Acquisition Corp. share price as of 5/24/21 and 473.2mm fully diluted shares outstanding; ³ First full year of revenue; 4 Date of incorporation for Primary Provider Management Company, Inc ("PPMC"), which was the predecessor to agilon Health; 5 P3 MA

lives projected as of FYE 2021, Privia MA lives as of FYE 2020, Oak Street MA lives represent midpoint of FYE 2021 management guidance as of 3/31/21, Cano Health MA lives as of Investor & Analyst Day Presentation on 3/04/21, agilon MA lives as of S-1 filed on 3/18/21; 6 Sourced from

Investor & Analyst Day Presentation on 3/04/21; 7 Represents 2020A total practice collections; 82023E EBITDA margin of 6% and average mature MA clinic adj. EBITDA margin of 24%

13

P3View entire presentation