AstraZeneca Results Presentation Deck

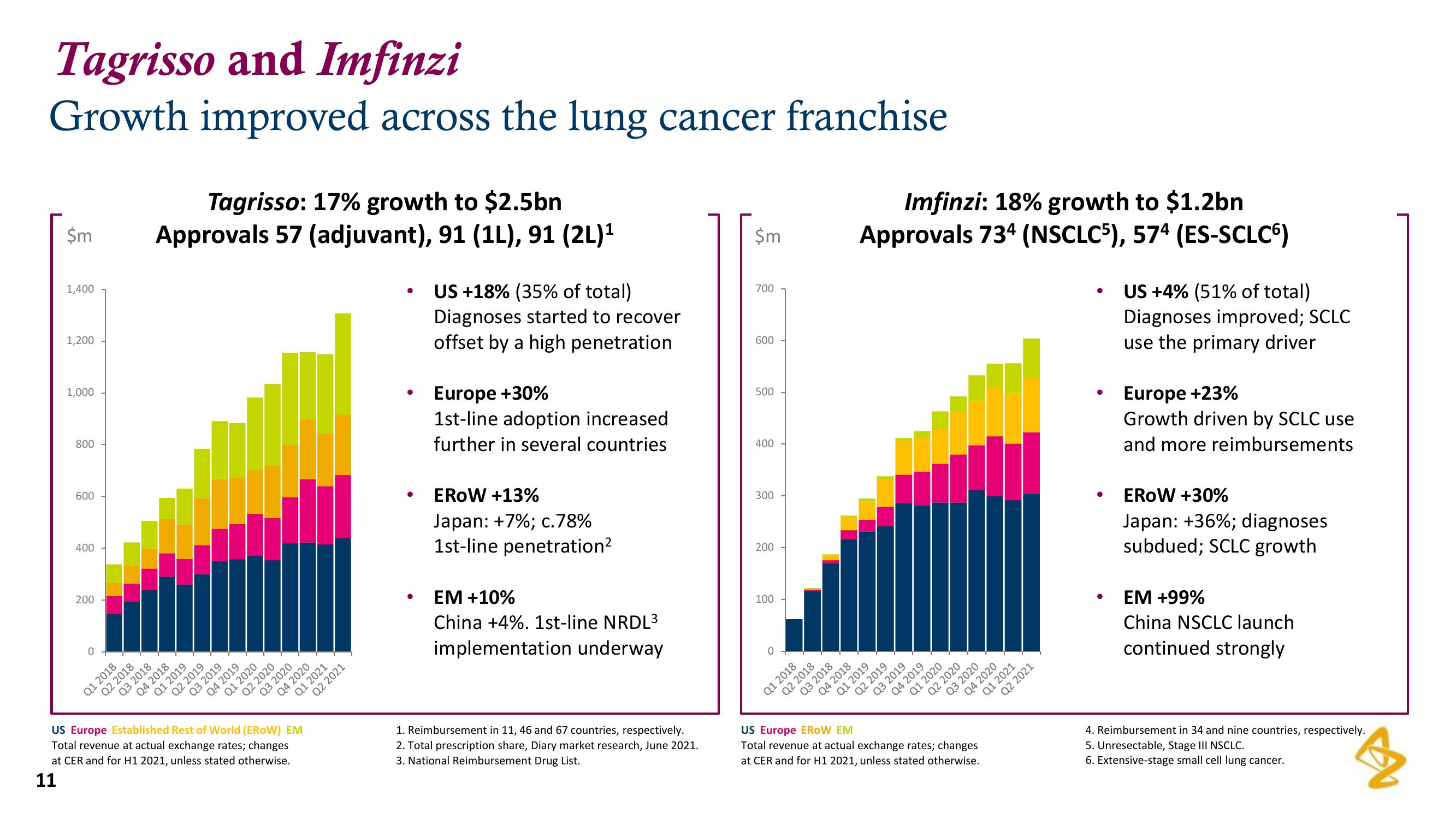

Tagrisso and Imfinzi

Growth improved across the lung cancer franchise

$m

1,400

1,200

1,000

800

600

400

200

0

Q1 2018

Q2 2018

Q3 2018

Tagrisso: 17% growth to $2.5bn

Approvals 57 (adjuvant), 91 (1L), 91 (2L)¹

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

US Europe Established Rest of World (EROW) EM

Total revenue at actual exchange rates; changes

at CER and for H1 2021, unless stated otherwise.

11

Q4 2020

Q1 2021

Q2 2021

●

●

●

US +18% (35% of total)

Diagnoses started to recover

offset by a high penetration

Europe +30%

1st-line adoption increased

further in several countries

EROW +13%

Japan: +7%; c.78%

1st-line penetration²

EM +10%

China +4%. 1st-line NRDL³

implementation underway

1. Reimbursement in 11, 46 and 67 countries, respectively.

2. Total prescription share, Diary market research, June 2021.

3. National Reimbursement Drug List.

$m

700

600

500

400

300

200

100

T

T

Q1 2018

Q2 2018

Q3

2018

Q4

Imfinzi: 18% growth to $1.2bn

Approvals 734 (NSCLC5), 574 (ES-SCLC6)

2018

Q1 2019

Q2 2019

Q3

2019

Q4

2019

Q1

2020

Q2 2020

Q3 2020

US Europe

EROW EM

Total revenue at actual

rates; changes

exchange

at CER and for H1 2021, unless stated otherwise.

Q4 2020

Q1 2021

Q2 2021

●

●

●

●

US +4% (51% of total)

Diagnoses improved; SCLC

use the primary driver

Europe +23%

Growth driven by SCLC use

and more reimbursements

EROW +30%

Japan: +36%; diagnoses

subdued; SCLC growth

EM +99%

China NSCLC launch

continued strongly

4. Reimbursement in 34 and nine countries, respectively.

5. Unresectable, Stage III NSCLC.

6. Extensive-stage small cell lung cancer.

gView entire presentation