AngloAmerican Results Presentation Deck

ATTRACTIVE GREENFIELD AND BROWNFIELD OPTIONS

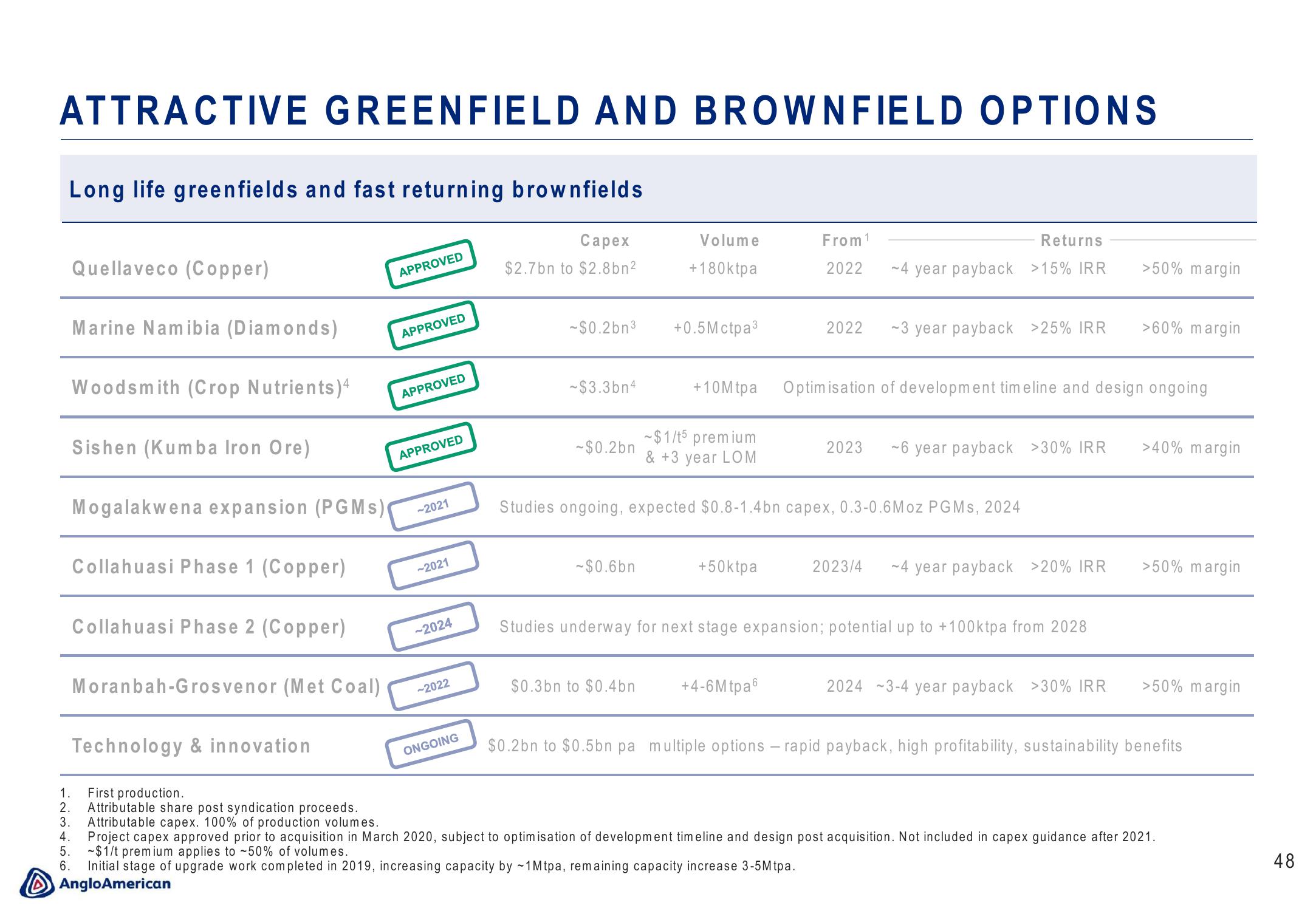

Long life greenfields and fast returning brownfields

Quellaveco (Copper)

Marine Namibia (Diamonds)

Woodsmith (Crop Nutrients)4

Sishen (Kumba Iron Ore)

Mogalakwena expansion (PGMS)

Collahuasi Phase 1 (Copper)

Collahuasi Phase 2 (Copper)

Moranbah-Grosvenor (Met Coal)

Technology & innovation

APPROVED

APPROVED

APPROVED

APPROVED

-2021

-2021

-2024

-2022

ONGOING

Capex

$2.7 bn to $2.8bn²

~$0.2bn³

-$3.3bn4

-$0.2bn

~$0.6bn

Volume

+180ktpa

+0.5M ctpa³

$0.3bn to $0.4bn

+10Mtpa

-$1/t5 premium

& +3 year LOM

+50ktpa

From 1

2022

6

2022

+4-6Mtpa

Studies ongoing, expected $0.8-1.4bn capex, 0.3-0.6Moz PGMs, 2024

Returns

-4 year payback >15% IRR

2023

-3 year payback >25% IRR

Optimisation of development timeline and design ongoing

-6 year payback >30% IRR

Studies underway for next stage expansion; potential up to +100ktpa from 2028

2023/4 -4 year payback >20% IRR

>50% margin

2024 3-4 year payback >30% IRR

>60% margin

>40% margin

>50% margin

>50% margin

$0.2bn to $0.5bn pa multiple options - rapid payback, high profitability, sustainability benefits

1.

First production.

2. Attributable share post syndication proceeds.

3.

Attributable capex. 100% of production volumes.

4.

Project capex approved prior to acquisition in March 2020, subject to optimisation of development timeline and design post acquisition. Not included in capex guidance after 2021.

-$1/t premium applies to -50% of volumes.

5.

6.

Initial stage of upgrade work completed in 2019, increasing capacity by ~1 Mtpa, remaining capacity increase 3-5Mtpa.

Anglo American

48View entire presentation