Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

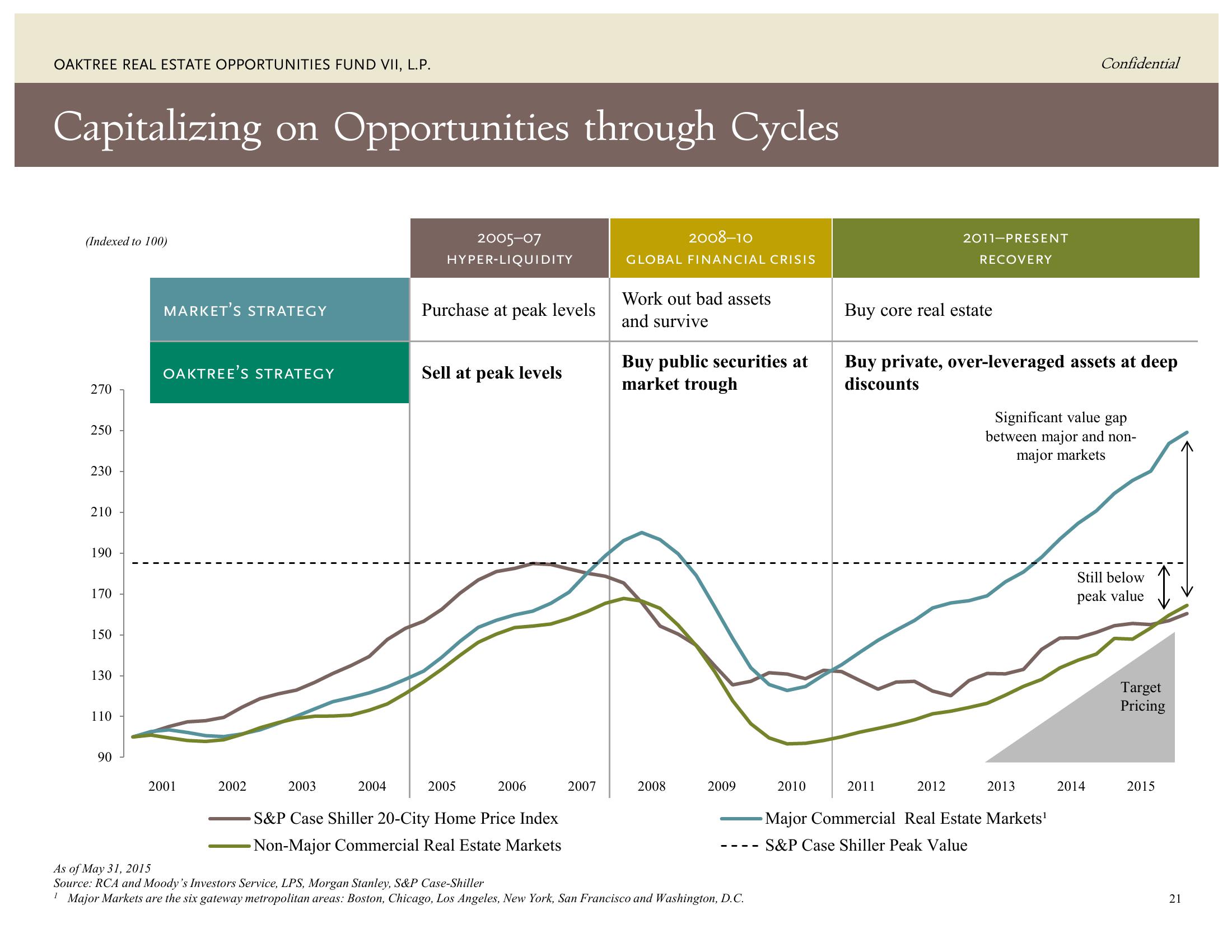

Capitalizing on Opportunities through Cycles

(Indexed to 100)

270

250

230

210

190

170

150

130

110

90

MARKET'S STRATEGY

OAKTREE'S STRATEGY

2001

2002

2003

2004

2005-07

HYPER-LIQUIDITY

Purchase at peak levels

Sell at peak levels

2005

2006

S&P Case Shiller 20-City Home Price Index

Non-Major Commercial Real Estate Markets

2007

2008-10

GLOBAL FINANCIAL CRISIS

Work out bad assets

and survive

Buy public securities at

market trough

2008

2009

As of May 31, 2015

Source: RCA and Moody's Investors Service, LPS, Morgan Stanley, S&P Case-Shiller

1 Major Markets are the six gateway metropolitan areas: Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.

2010

Buy core real estate

2011-PRESENT

RECOVERY

2011

Buy private, over-leveraged assets at deep

discounts

2012

Significant value gap

between major and non-

major markets

2013

Confidential

Major Commercial Real Estate Markets¹

S&P Case Shiller Peak Value

Still below

peak value

2014

Target

Pricing

2015

21View entire presentation