J.P.Morgan Investment Banking Pitch Book

VALUATION SUMMARY

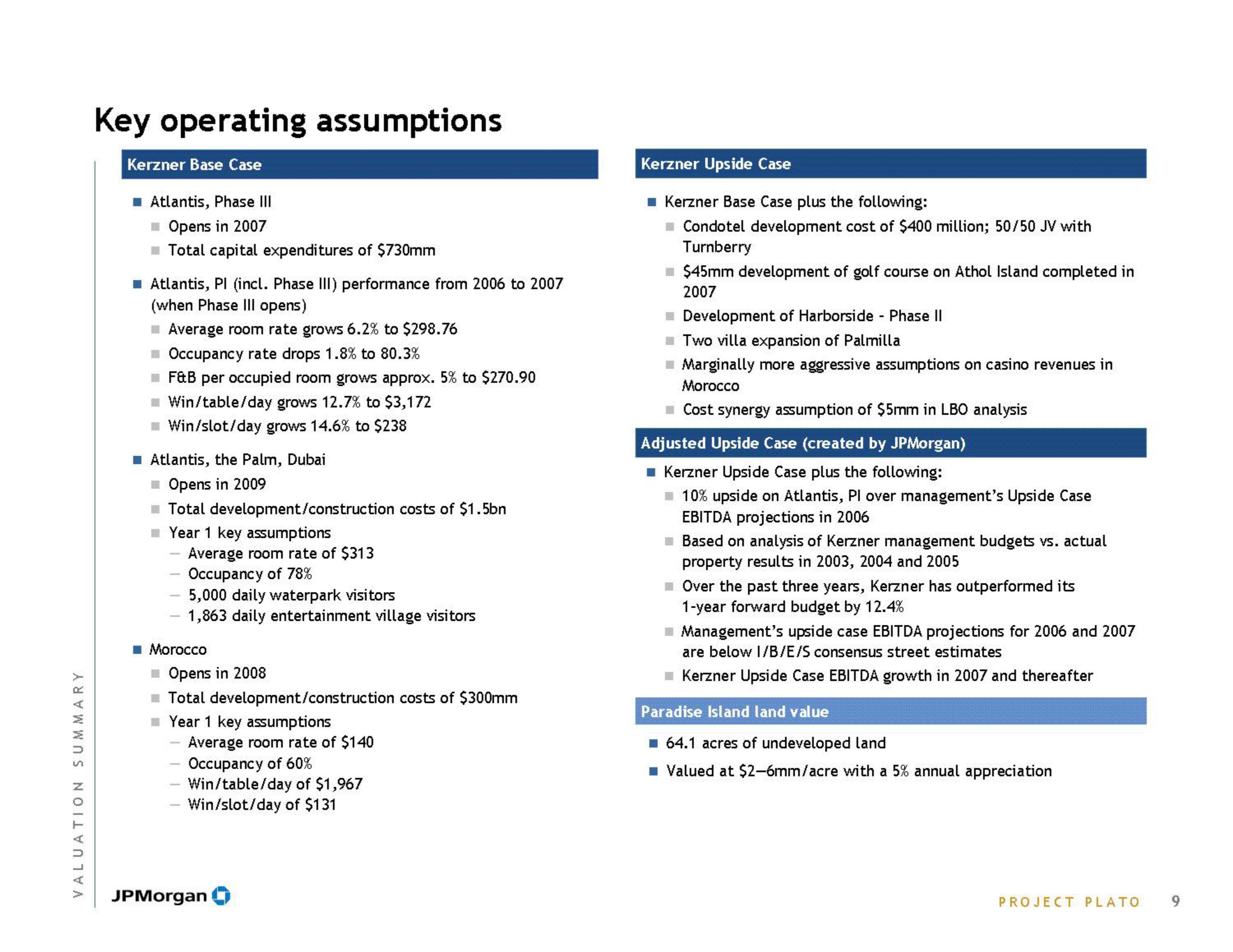

Key operating assumptions

Kerzner Base Case

■ Atlantis, Phase III

■ Opens in 2007

■ Total capital expenditures of $730mm

■ Atlantis, Pl (incl. Phase III) performance from 2006 to 2007

(when Phase III opens)

■ Average room rate grows 6.2% to $298.76

■ Occupancy rate drops 1.8% to 80.3%

■ F&B per occupied room grows approx. 5% to $270.90

■Win/table/day grows 12.7% to $3,172

■Win/slot/day grows 14.6% to $238

■ Atlantis, the Palm, Dubai

■Opens in 2009

■ Total development/construction costs of $1.5bn

■Year 1 key assumptions

Average room rate of $313

Occupancy of 78%

5,000 daily waterpark visitors

1,863 daily entertainment village visitors

■ Morocco

■ Opens in 2008

■ Total development/construction costs of $300mm

■Year 1 key assumptions

Average room rate of $140

Occupancy of 60%

Win/table/day of $1,967

Win/slot/day of $131

JPMorgan

Kerzner Upside Case

■ Kerzner Base Case plus the following:

Condotel development cost of $400 million; 50/50 JV with

Turnberry

■ $45mm development of golf course on Athol Island completed in

2007

Development of Harborside - Phase II

Two villa expansion of Palmilla

■ Marginally more aggressive assumptions on casino revenues in

Morocco

■ Cost synergy assumption of $5mm in LBO analysis

Adjusted Upside Case (created by JPMorgan)

Kerzner Upside Case plus the following:

■ 10% upside on Atlantis, Pl over management's Upside Case

EBITDA projections in 2006

Based on analysis of Kerzner management budgets vs. actual

property results in 2003, 2004 and 2005

Over the past three years, Kerzner has outperformed its

1-year forward budget by 12.4%

Management's upside case EBITDA projections for 2006 and 2007

are below I/B/E/S consensus street estimates

Kerzner Upside Case EBITDA growth in 2007 and thereafter

Paradise Island land value

■ 64.1 acres of undeveloped land

■ Valued at $2-6mm/acre with a 5% annual appreciation

PROJECT PLATO

9View entire presentation