LionTree Investment Banking Pitch Book

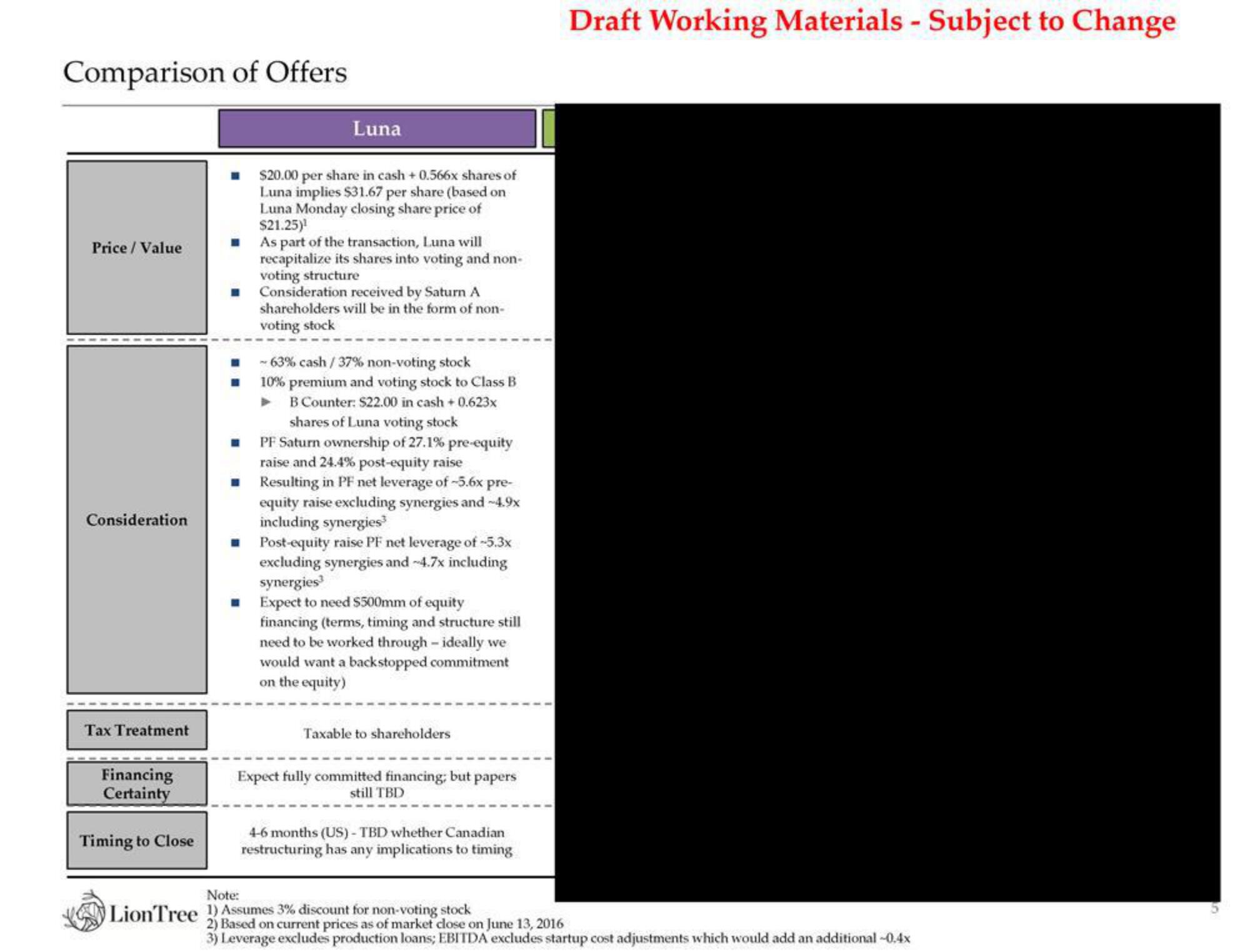

Comparison of Offers

Price / Value

Consideration

Tax Treatment

Financing

Certainty

Timing to Close

Luna

$20.00 per share in cash +0.566x shares of

Luna implies $31.67 per share (based on

Luna Monday closing share price of

$21.25)¹

As part of the transaction, Luna will

recapitalize its shares into voting and non-

voting structure

Consideration received by Saturn A

shareholders will be in the form of non-

voting stock

-63% cash / 37% non-voting stock

10% premium and voting stock to Class B

B Counter: $22.00 in cash +0.623x

shares of Luna voting stock

PF Saturn ownership of 27.1% pre-equity

raise and 24.4% post-equity raise

Resulting in PF net leverage of -5.6x pre-

equity raise excluding synergies and -4.9x

including synergies³

Post-equity raise PF net leverage of -5.3x

excluding synergies and -4.7x including

synergies³

Expect to need $500mm of equity

financing (terms, timing and structure still

need to be worked through - ideally we

would want a backstopped commitment

on the equity)

Taxable to shareholders

Expect fully committed financing; but papers

still TBD

4-6 months (US)- TBD whether Canadian

restructuring has any implications to timing

Note:

LionTree 1) Assumes 3% discount for non-voting stock

Draft Working Materials - Subject to Change

2) Based on current prices as of market close on June 13, 2016

3) Leverage excludes production loans; EBITDA excludes startup cost adjustments which would add an additional -0.4xView entire presentation