Deutsche Bank Results Presentation Deck

Corporate & Other

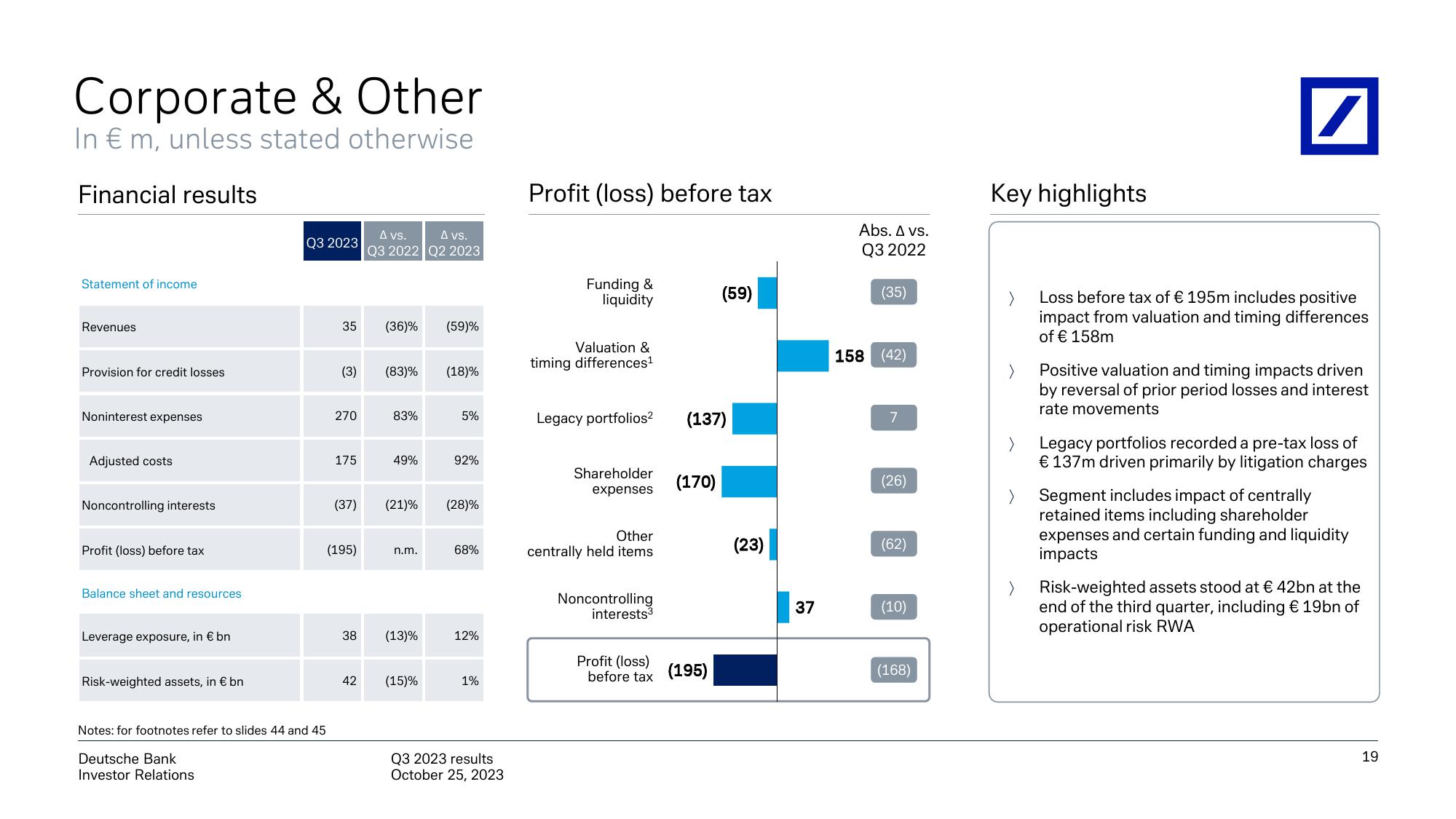

In € m, unless stated otherwise

Financial results

Statement of income

Revenues

Provision for credit losses

Noninterest expenses

Adjusted costs

Noncontrolling interests

Profit (loss) before tax

Balance sheet and resources

Leverage exposure, in € bn

Risk-weighted assets, in € bn

Q3 2023

35

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

(3)

270

175

(195)

A vs.

A vs.

Q3 2022 Q2 2023

(36)%

42

(83)%

83%

49%

n.m.

38 (13)%

(37) (21)% (28)%

(59)%

(15)%

(18)%

5%

92%

68%

12%

1%

Q3 2023 results

October 25, 2023

Profit (loss) before tax

Funding &

liquidity

Valuation &

timing differences¹

Legacy portfolios²

Shareholder

expenses

Other

centrally held items

Noncontrolling

interests³

Profit (loss)

before tax

(137)

(170)

(59)

(195)

(23)

37

Abs. A vs.

Q3 2022

(35)

158 (42)

7

(26)

(62)

(10)

(168)

Key highlights

/

Loss before tax of € 195m includes positive

impact from valuation and timing differences

of € 158m

Positive valuation and timing impacts driven

by reversal of prior period losses and interest

rate movements

Legacy portfolios recorded a pre-tax loss of

€ 137m driven primarily by litigation charges

Segment includes impact of centrally

retained items including shareholder

expenses and certain funding and liquidity

impacts

Risk-weighted assets stood at € 42bn at the

end of the third quarter, including € 19bn of

operational risk RWA

19View entire presentation