Vici Investor Presentation

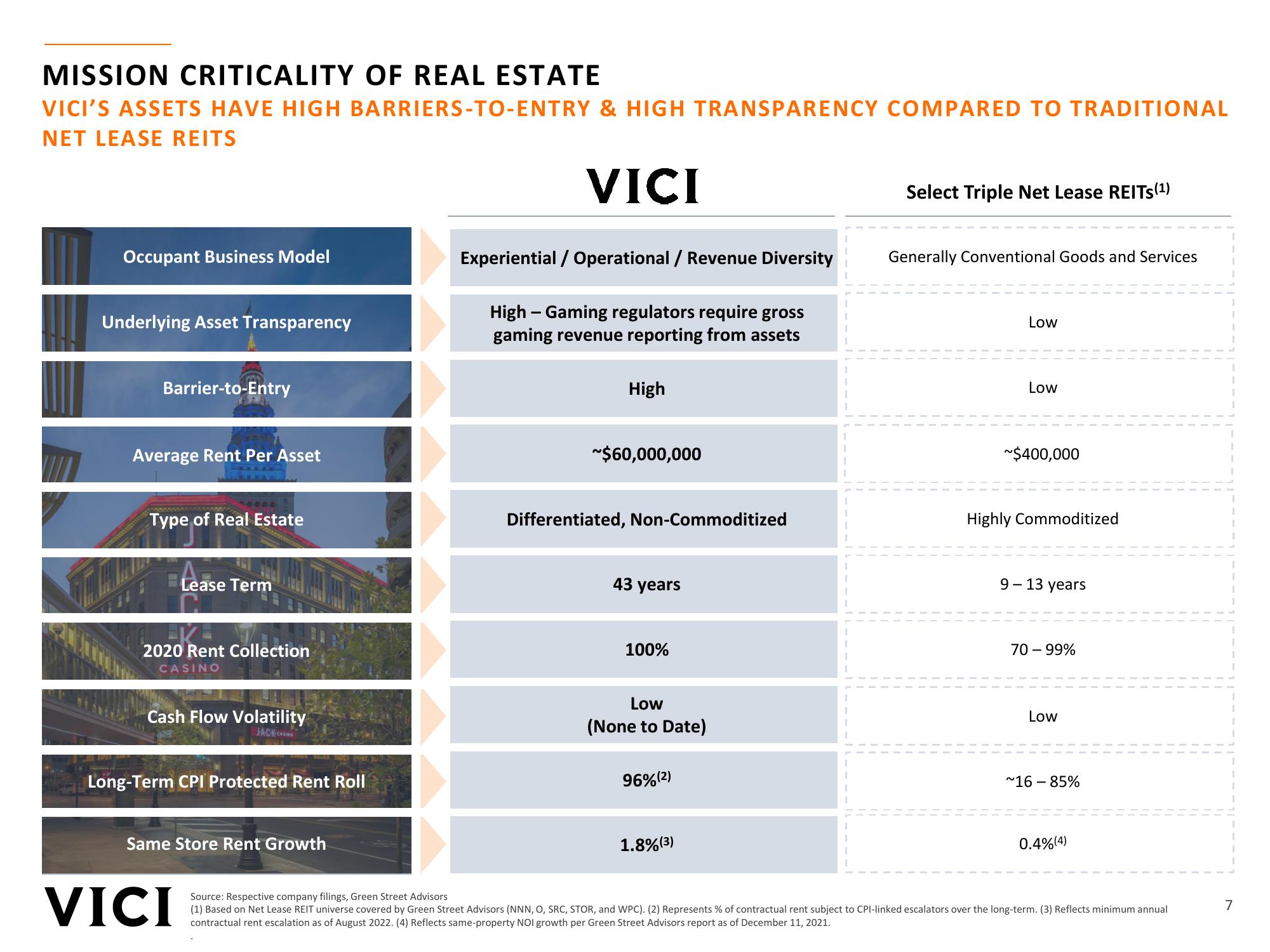

MISSION CRITICALITY OF REAL ESTATE

VICI'S ASSETS HAVE HIGH BARRIERS-TO-ENTRY & HIGH TRANSPARENCY COMPARED TO TRADITIONAL

NET LEASE REITS

VICI

Occupant Business Model

Underlying Asset Transparency

Barrier-to-Entry

Average Rent Per Asset

The late

Type of Real Estate

Lease Term

EKE

2020 Rent Collection

CASINO

Cash Flow Volatility

JACK CASING

Long-Term CPI Protected Rent Roll

Same Store Rent Growth

VICI

Experiential / Operational / Revenue Diversity

High - Gaming regulators require gross

gaming revenue reporting from assets

High

~$60,000,000

Differentiated, Non-Commoditized

43 years

100%

Low

(None to Date)

96% (2)

1.8% (³)

Select Triple Net Lease REITs (¹)

Generally Conventional Goods and Services

Low

Low

~$400,000

Highly Commoditized

9-13 years

70 - 99%

Low

~16-85%

0.4% (4)

Source: Respective company filings, Green Street Advisors

(1) Based on Net Lease REIT universe covered by Green Street Advisors (NNN, O, SRC, STOR, and WPC). (2) Represents % of contractual rent subject to CPI-linked escalators over the long-term. (3) Reflects minimum annual

contractual rent escalation as of August 2022. (4) Reflects same-property NOI growth per Green Street Advisors report as of December 11, 2021.

7View entire presentation