Factset Mergers and Acquisitions Presentation Deck

FACTSET

FactSet contemplating inaugural bond issuance

Longer-term capital structure

FactSet to pursue credit ratings in conjunction with potential bond issuance

Shelf-registration statement (Form S-3) filed on Tuesday, January 4

Rating agency meetings to be scheduled during January

Considering bond issuance of approximately $1 billion

Bank of America and PNC Bank would lead any anticipated bond issuance

2 Anticipated Bond issuance proceeds used to replace initially committed bank

financing (namely, the 18-Month Term Loan A)

3 Following closing of CGS acquisition and financing transactions:

Prioritize excess cash flow to repay debt

Will suspend share repurchases for the remainder of fiscal 2022 1

No change to dividend policy

-

1. Excluding minor share repurchases to offset dilution impact from stock option grants

Copyright © 2022 FactSet Research Systems Inc. All rights reserved.

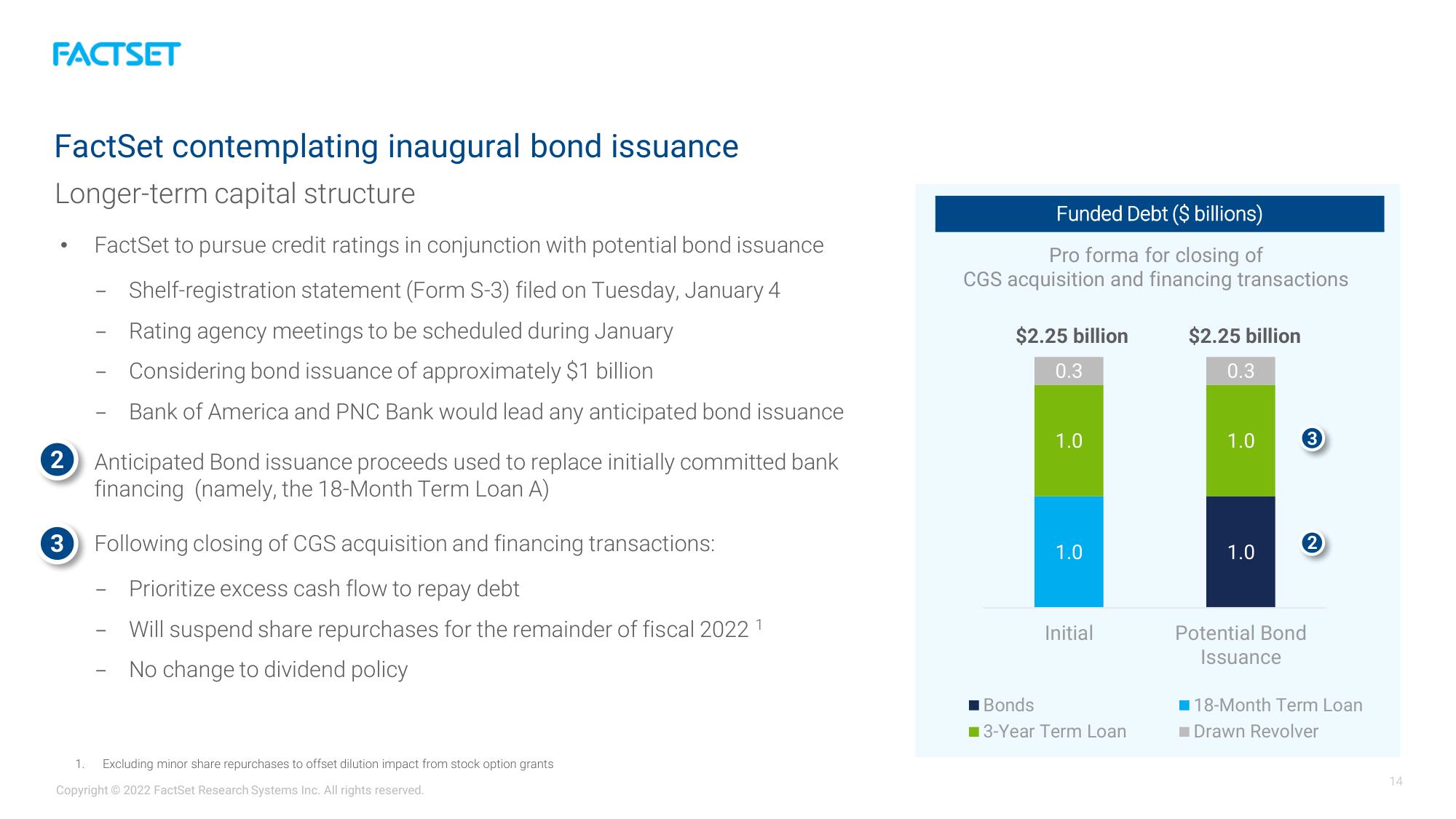

Funded Debt ($ billions)

Pro forma for closing of

CGS acquisition and financing transactions

$2.25 billion

0.3

1.0

1.0

Initial

Bonds

3-Year Term Loan

$2.25 billion

0.3

1.0

1.0

3

Potential Bond

Issuance

18-Month Term Loan

Drawn Revolver

14View entire presentation