Deutsche Bank Results Presentation Deck

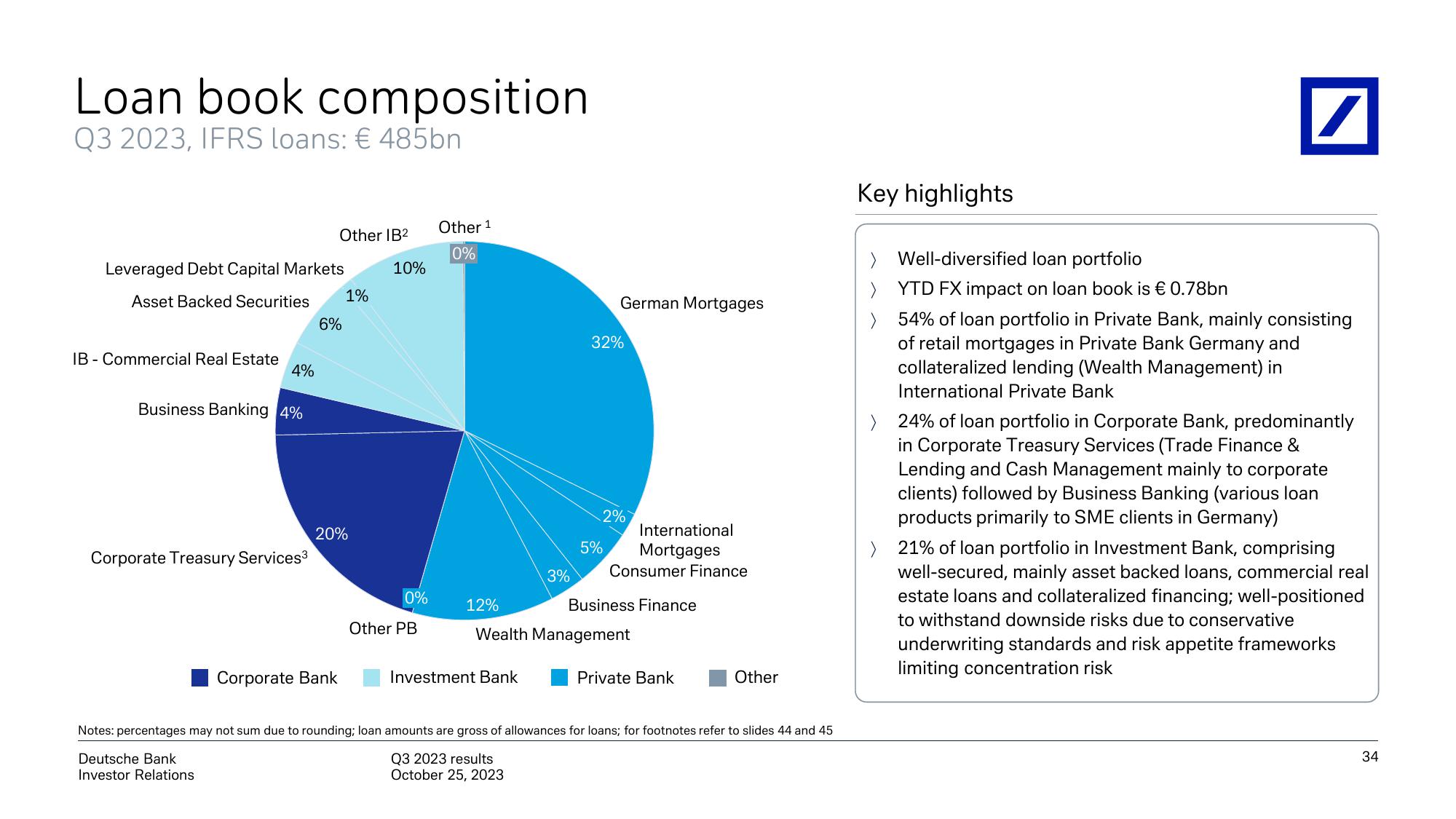

Loan book composition

Q3 2023, IFRS loans: € 485bn

Leveraged Debt Capital Markets

Asset Backed Securities

IB - Commercial Real Estate

4%

Business Banking 4%

Corporate Treasury Services³

Deutsche Bank

Investor Relations

Other IB²

6%

Corporate Bank

1%

20%

10%

0%

Other PB

Other ¹

0%

Investment Bank

German Mortgages

32%

5%

2%

International

Mortgages

3% Consumer Finance

12%

Business Finance

Wealth Management

Private Bank

Other

Notes: percentages may not sum due to rounding; loan amounts are gross of allowances for loans; for footnotes refer to slides 44 and 45

Q3 2023 results

October 25, 2023

Key highlights

/

> Well-diversified loan portfolio

YTD FX impact on loan book is € 0.78bn

54% of loan portfolio in Private Bank, mainly consisting

of retail mortgages in Private Bank Germany and

collateralized lending (Wealth Management) in

International Private Bank

> 24% of loan portfolio in Corporate Bank, predominantly

in Corporate Treasury Services (Trade Finance &

Lending and Cash Management mainly to corporate

clients) followed by Business Banking (various loan

products primarily to SME clients in Germany)

> 21% of loan portfolio in Investment Bank, comprising

well-secured, mainly asset backed loans, commercial real

estate loans and collateralized financing; well-positioned

to withstand downside risks due to conservative

underwriting standards and risk appetite frameworks

limiting concentration risk

34View entire presentation