Apollo Global Management Investor Day Presentation Deck

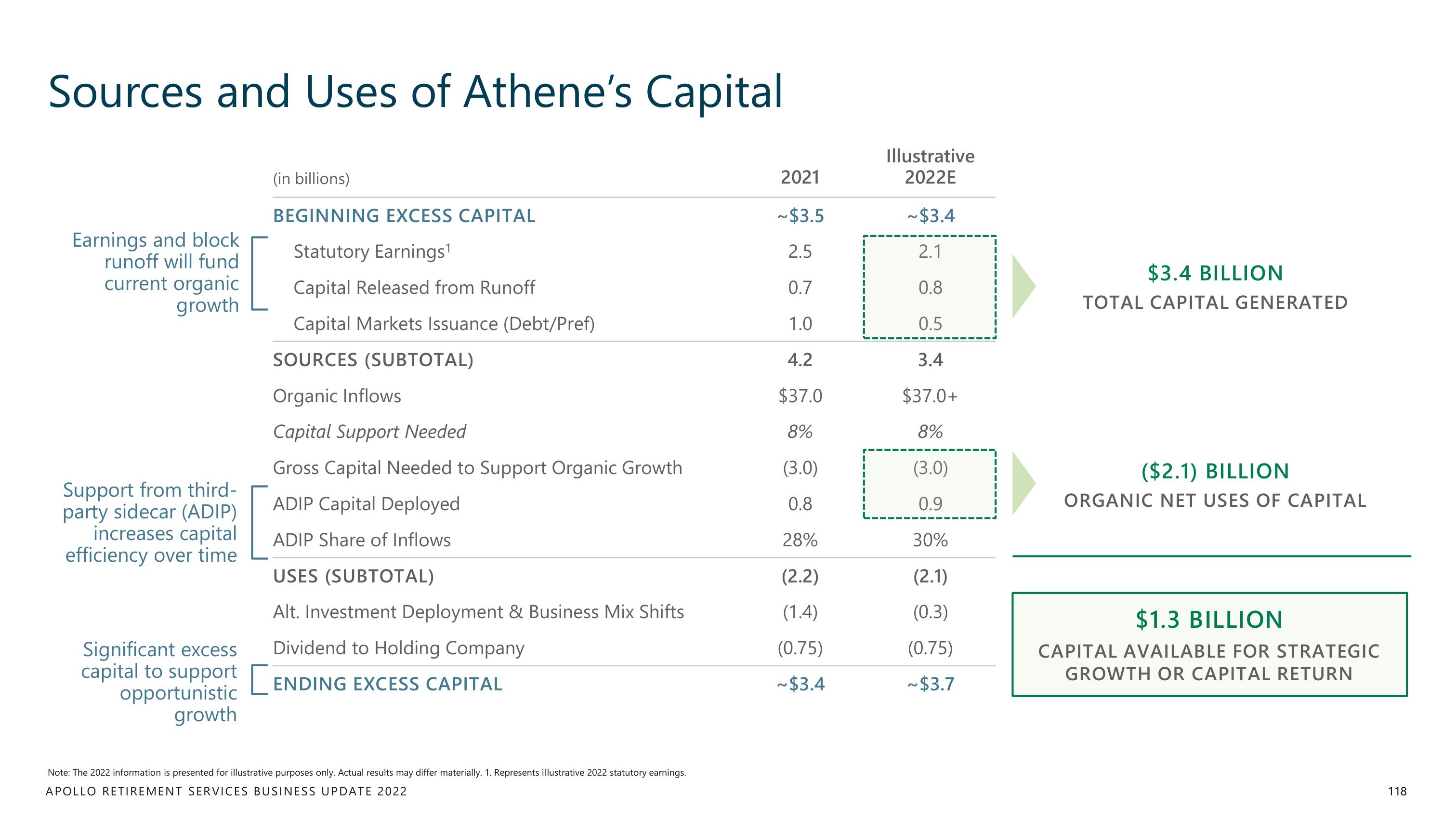

Sources and Uses of Athene's Capital

(in billions)

BEGINNING EXCESS CAPITAL

Statutory Earnings¹

Capital Released from Runoff

Capital Markets Issuance (Debt/Pref)

SOURCES (SUBTOTAL)

Organic Inflows

Capital Support Needed

Gross Capital Needed to Support Organic Growth

ADIP Capital Deployed

ADIP Share of Inflows

USES (SUBTOTAL)

Alt. Investment Deployment & Business Mix Shifts

Significant excess

Dividend to Holding Company

capital to support [ENDING EXCESS CAPITAL

opportunistic

growth

Earnings and block

runoff will fund

current organic

growth

Support from third-

party sidecar (ADIP)

increases capital

efficiency over time

Note: The 2022 information is presented for illustrative purposes only. Actual results may differ materially. 1. Represents illustrative 2022 statutory earnings.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

2021

~$3.5

2.5

0.7

1.0

4.2

$37.0

8%

(3.0)

0.8

28%

(2.2)

(1.4)

(0.75)

~$3.4

Illustrative

2022E

~$3.4

2.1

0.8

0.5

3.4

$37.0+

8%

(3.0)

0.9

30%

(2.1)

(0.3)

(0.75)

~$3.7

$3.4 BILLION

TOTAL CAPITAL GENERATED

($2.1) BILLION

ORGANIC NET USES OF CAPITAL

$1.3 BILLION

CAPITAL AVAILABLE FOR STRATEGIC

GROWTH OR CAPITAL RETURN

118View entire presentation