Pershing Square Activist Presentation Deck

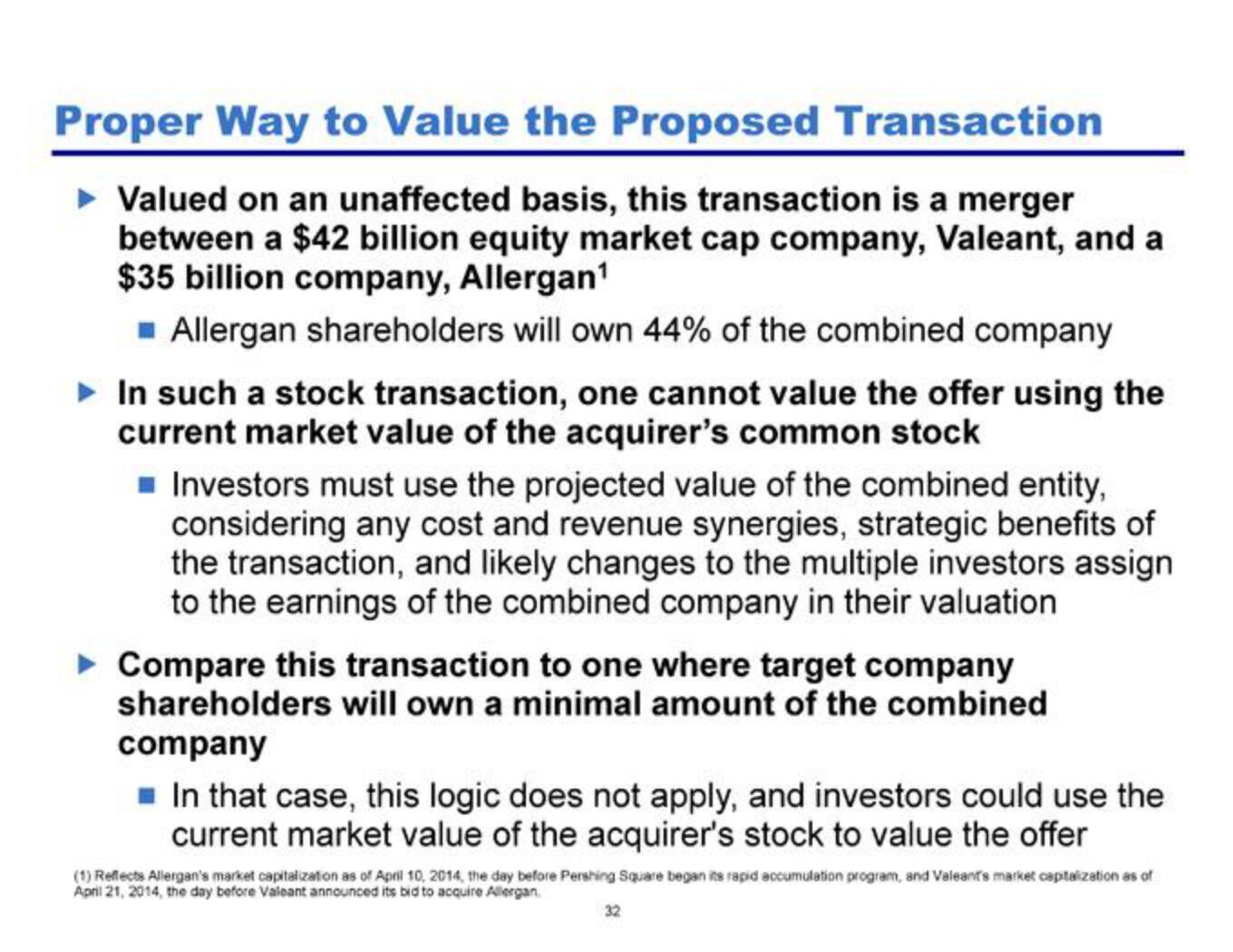

Proper Way to Value the Proposed Transaction

Valued on an unaffected basis, this transaction is a merger

between a $42 billion equity market cap company, Valeant, and a

$35 billion company, Allergan¹

Allergan shareholders will own 44% of the combined company

► In such a stock transaction, one cannot value the offer using the

current market value of the acquirer's common stock

■ Investors must use the projected value of the combined entity,

considering any cost and revenue synergies, strategic benefits of

the transaction, and likely changes to the multiple investors assign

to the earnings of the combined company in their valuation

► Compare this transaction to one where target company

shareholders will own a minimal amount of the combined

company

■ In that case, this logic does not apply, and investors could use the

current market value of the acquirer's stock to value the offer

(1) Reffects Allergan's market capitalization as of April 10, 2014, the day before Pershing Square began its rapid accumulation program, and Valeant's market capitalization as of

April 21, 2014, the day before Valeant announced its bid to acquire Allergan.View entire presentation