Citi Investment Banking Pitch Book

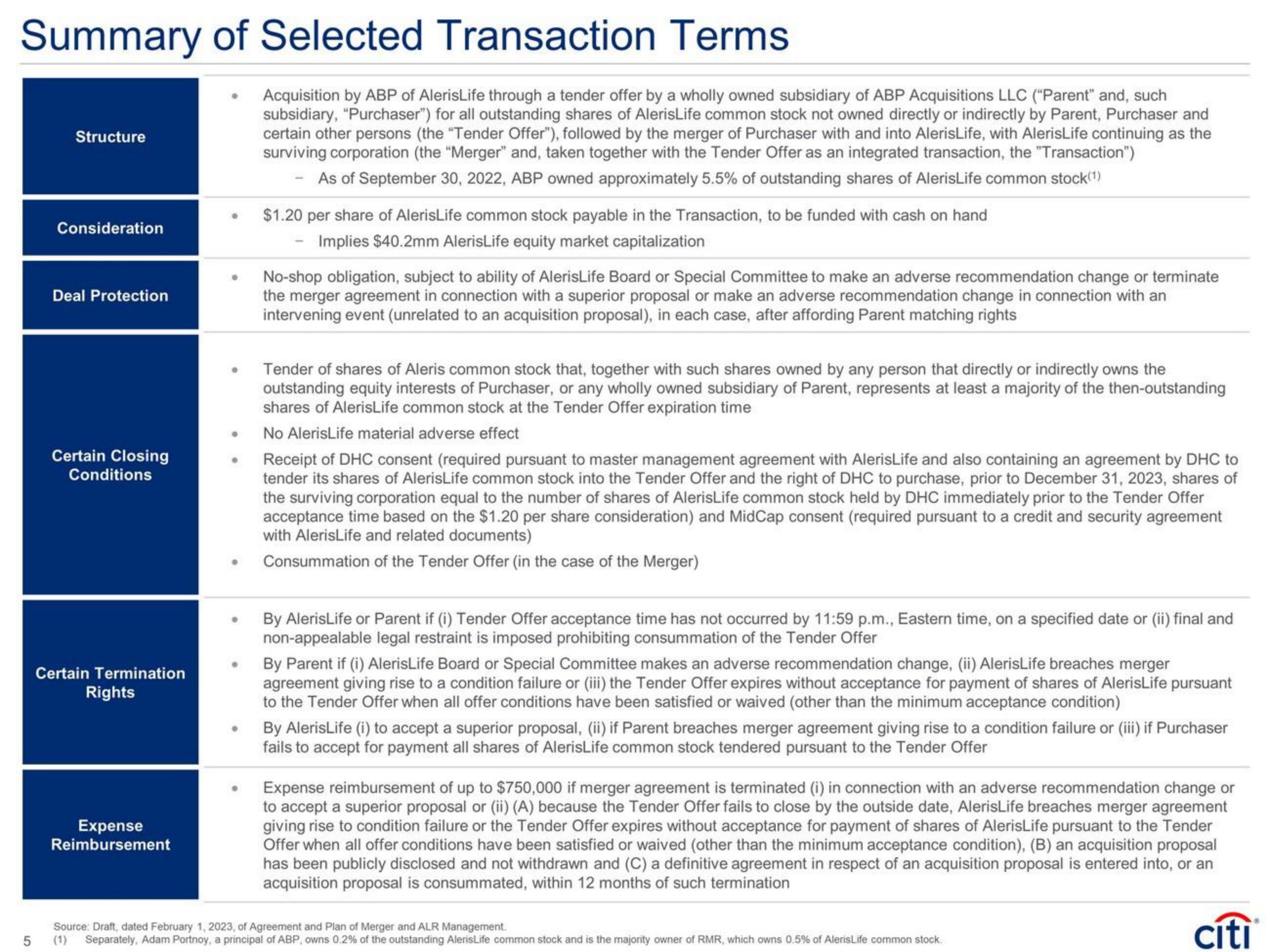

Summary of Selected Transaction Terms

5

Structure

Consideration

Deal Protection

Certain Closing

Conditions

Certain Termination

Rights

Expense

Reimbursement

●

●

●

Acquisition by ABP of AlerisLife through a tender offer by a wholly owned subsidiary of ABP Acquisitions LLC ("Parent" and, such

subsidiary, "Purchaser") for all outstanding shares of AlerisLife common stock not owned directly or indirectly by Parent, Purchaser and

certain other persons (the "Tender Offer"), followed by the merger of Purchaser with and into AlerisLife, with AlerisLife continuing as the

surviving corporation (the "Merger" and, taken together with the Tender Offer as an integrated transaction, the "Transaction")

- As of September 30, 2022, ABP owned approximately 5.5% of outstanding shares of AlerisLife common stock(1)

$1.20 per share of AlerisLife common stock payable in the Transaction, to be funded with cash on hand

- Implies $40.2mm AlerisLife equity market capitalization

No-shop obligation, subject to ability of AlerisLife Board or Special Committee to make an adverse recommendation change or terminate

the merger agreement in connection with a superior proposal or make an adverse recommendation change in connection with an

intervening event (unrelated to an acquisition proposal), in each case, after affording Parent matching rights

Tender of shares of Aleris common stock that, together with such shares owned by any person that directly or indirectly owns the

outstanding equity interests of Purchaser, or any wholly owned subsidiary of Parent, represents at least a majority of the then-outstanding

shares of AlerisLife common stock at the Tender Offer expiration time

No AlerisLife material adverse effect

Receipt of DHC consent (required pursuant to master management agreement with AlerisLife and also containing an agreement by DHC to

tender its shares of AlerisLife common stock into the Tender Offer and the right of DHC to purchase, prior to December 31, 2023, shares of

the surviving corporation equal to the number of shares of AlerisLife common stock held by DHC immediately prior to the Tender Offer

acceptance time based on the $1.20 per share consideration) and MidCap consent (required pursuant to a credit and security agreement

with AlerisLife and related documents)

Consummation of the Tender Offer (in the case of the Merger)

By AlerisLife or Parent if (i) Tender Offer acceptance time has not occurred by 11:59 p.m., Eastern time, on a specified date or (ii) final and

non-appealable legal restraint is imposed prohibiting consummation of the Tender Offer

By Parent if (i) AlerisLife Board or Special Committee makes an adverse recommendation change, (ii) AlerisLife breaches merger

agreement giving rise to a condition failure or (iii) the Tender Offer expires without acceptance for payment of shares of AlerisLife pursuant

to the Tender Offer when all offer conditions have been satisfied or waived (other than the minimum acceptance condition)

By AlerisLife (i) to accept a superior proposal, (ii) if Parent breaches merger agreement giving rise to a condition failure or (iii) if Purchaser

fails to accept for payment all shares of AlerisLife common stock tendered pursuant to the Tender Offer

Expense reimbursement of up to $750,000 if merger agreement is terminated (i) in connection with an adverse recommendation change or

to accept a superior proposal or (ii) (A) because the Tender Offer fails to close by the outside date, AlerisLife breaches merger agreement

giving rise to condition failure or the Tender Offer expires without acceptance for payment of shares of AlerisLife pursuant to the Tender

Offer when all offer conditions have been satisfied or waived (other than the minimum acceptance condition), (B) an acquisition proposal

has been publicly disclosed and not withdrawn and (C) a definitive agreement in respect of an acquisition proposal is entered into, or an

acquisition proposal is consummated, within 12 months of such termination

citi

Source: Draft, dated February 1, 2023, of Agreement and Plan of Merger and ALR Management.

Separately, Adam Portnoy, a principal of ABP, owns 0.2% of the outstanding AlerisLife common stock and is the majority owner of RMR, which owns 0.5% of AlerisLife common stock.View entire presentation