Foxo SPAC Presentation Deck

Transaction Summary

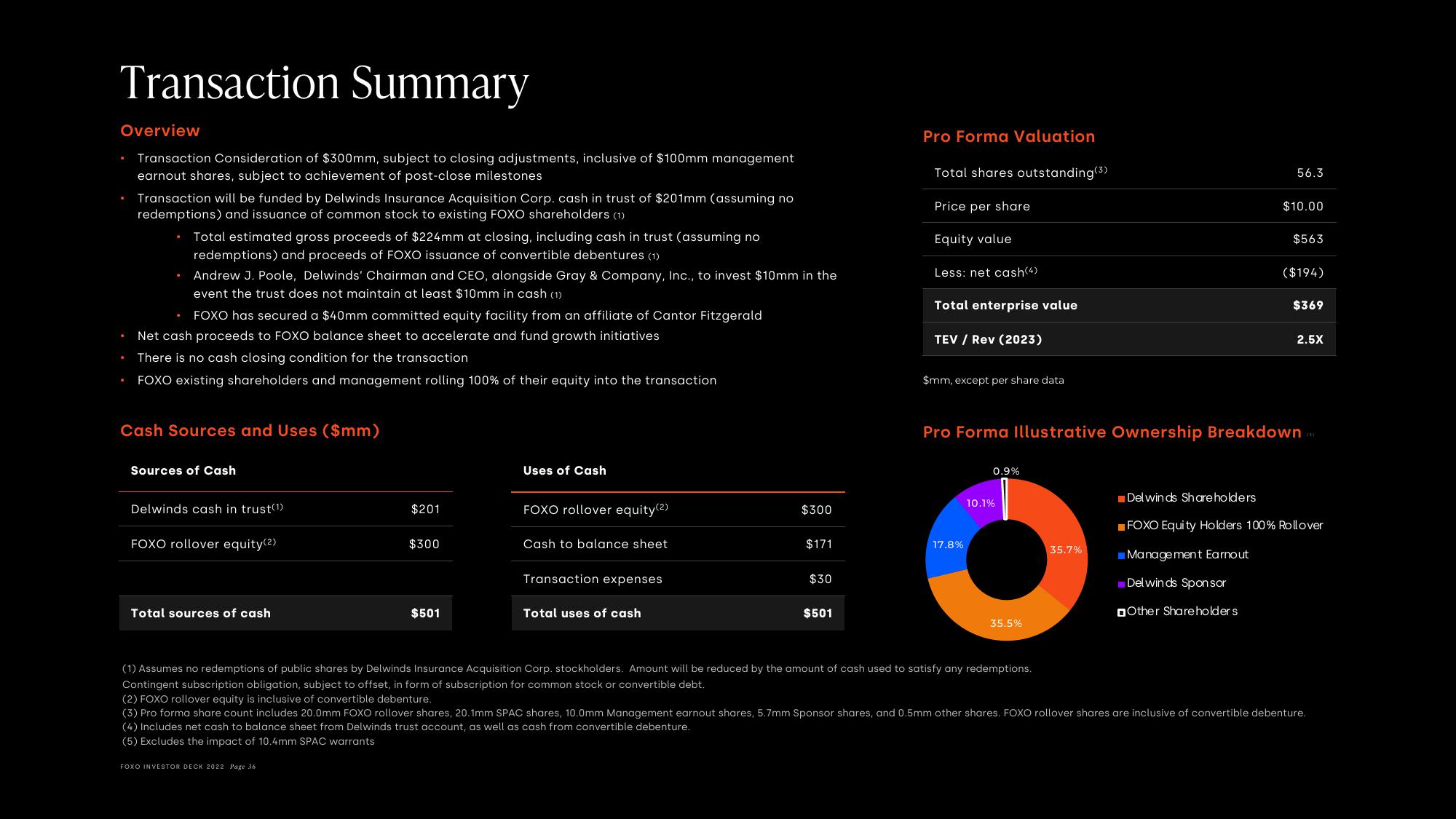

Overview

Transaction Consideration of $300mm, subject to closing adjustments, inclusive of $100mm management

earnout shares, subject to achievement of post-close milestones

Transaction will be funded by Delwinds Insurance Acquisition Corp. cash in trust of $201mm (assuming no

redemptions) and issuance of common stock to existing FOXO shareholders (1)

• Total estimated gross proceeds of $224mm at closing, including cash in trust (assuming no

redemptions) and proceeds of FOXO issuance of convertible debentures (1)

• Andrew J. Poole, Delwinds' Chairman and CEO, alongside Gray & Company, Inc., to invest $10mm in the

event the trust does not maintain at least $10mm in cash (1)

• FOXO has secured a $40mm committed equity facility from an affiliate of Cantor Fitzgerald

Net cash proceeds to FOXO balance sheet to accelerate and fund growth initiatives

There is no cash closing condition for the transaction

FOXO existing shareholders and management rolling 100% of their equity into the transaction

Cash Sources and Uses ($mm)

Sources of Cash

Delwinds cash in trust(1)

FOXO rollover equity(2)

Total sources of cash

$201

FOXO INVESTOR DECK 2022 Page 36

$300

$501

Uses of Cash

FOXO rollover equity(²)

Cash to balance sheet

Transaction expenses

Total uses of cash

$300

$171

$30

$501

Pro Forma Valuation

Total shares outstanding (3)

Price per share

Equity value

Less: net cash(4)

Total enterprise value

TEV / Rev (2023)

$mm, except per share data

17.8%

0.9%

10.1%

35.5%

56.3

35.7%

$10.00

Pro Forma Illustrative Ownership Breakdown

$563

($194)

$369

2.5X

Del winds Shareholders

FOXO Equity Holders 100% Rollover

Management Earnout

Delwinds Sponsor

Other Shareholders

(1) Assumes no redemptions of public shares by Delwinds Insurance Acquisition Corp. stockholders. Amount will be reduced by the amount of cash used to satisfy any redemptions.

Contingent subscription obligation, subject to offset, in form of subscription for common stock or convertible debt.

(2) FOXO rollover equity is inclusive of convertible debenture.

(3) Pro forma share count includes 20.0mm FOXO rollover shares, 20.1mm SPAC shares, 10.0mm Management earnout shares, 5.7mm Sponsor shares, and 0.5mm other shares. FOXO rollover shares are inclusive of convertible debenture.

(4) Includes net cash to balance sheet from Delwinds trust account, as well as cash from convertible debenture.

(5) Excludes the impact of 10.4mm SPAC warrantsView entire presentation