KKR Real Estate Finance Trust Results Presentation Deck

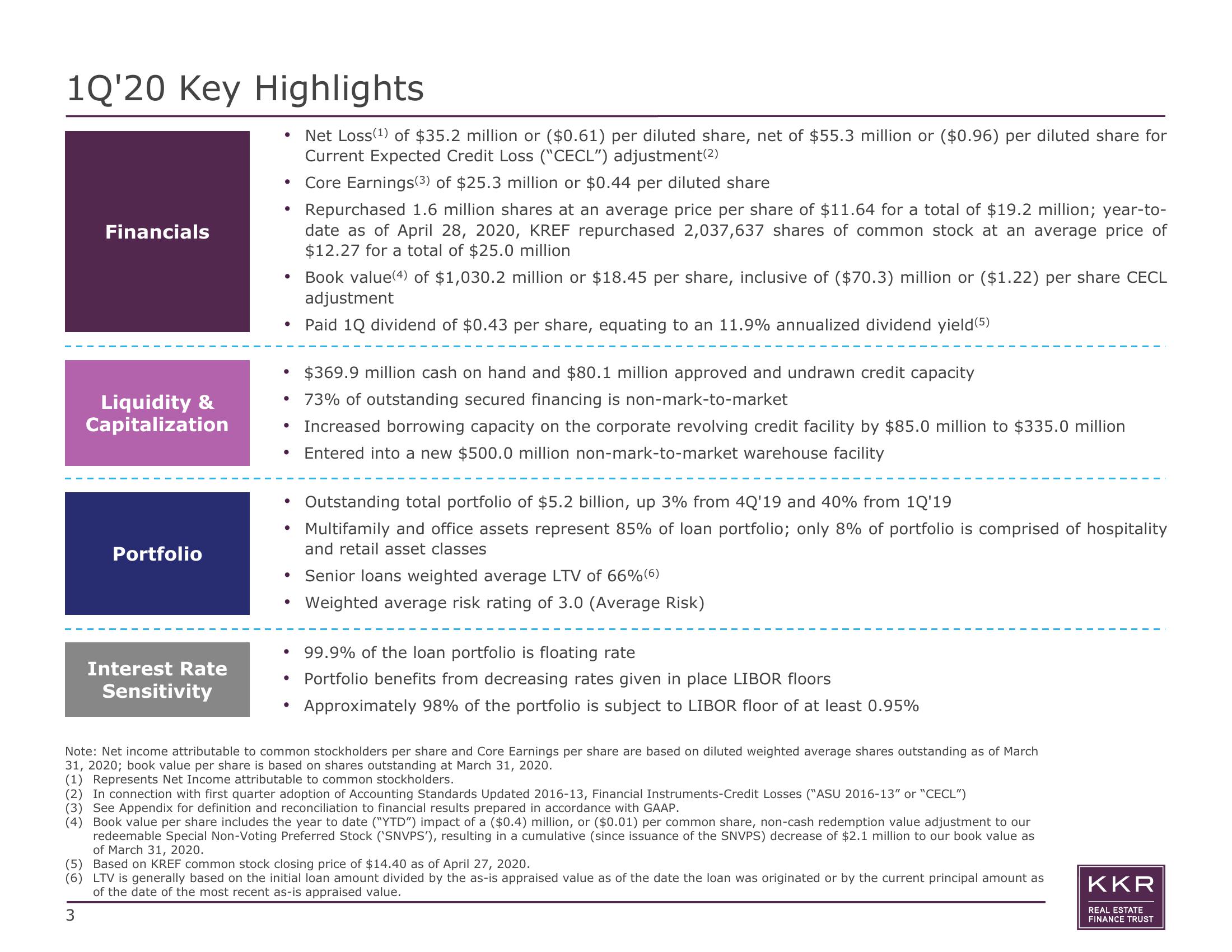

1Q'20 Key Highlights

Financials

Liquidity &

Capitalization

Portfolio

Interest Rate

Sensitivity

Net Loss(¹) of $35.2 million or ($0.61) per diluted share, net of $55.3 million or ($0.96) per diluted share for

Current Expected Credit Loss ("CECL") adjustment(²)

Core Earnings (3) of $25.3 million or $0.44 per diluted share

Repurchased 1.6 million shares at an average price per share of $11.64 for a total of $19.2 million; year-to-

date as of April 28, 2020, KREF repurchased 2,037,637 shares of common stock at an average price of

$12.27 for a total of $25.0 million

Book value(4) of $1,030.2 million or $18.45 per share, inclusive of ($70.3) million or ($1.22) per share CECL

adjustment

• Paid 1Q dividend of $0.43 per share, equating to an 11.9% annualized dividend yield(5)

●

●

●

●

●

●

●

●

●

●

●

●

$369.9 million cash on hand and $80.1 million approved and undrawn credit capacity

73% of outstanding secured financing is non-mark-to-market

Increased borrowing capacity on the corporate revolving credit facility by $85.0 million to $335.0 million

Entered into a new $500.0 million non-mark-to-market warehouse facility

Outstanding total portfolio of $5.2 billion, up 3% from 4Q'19 and 40% from 1Q'19

Multifamily and office assets represent 85% of loan portfolio; only 8% of portfolio is comprised of hospitality

and retail asset classes

Senior loans weighted average LTV of 66%(6)

Weighted average risk rating of 3.0 (Average Risk)

99.9% of the loan portfolio is floating rate

Portfolio benefits from decreasing rates given in place LIBOR floors

Approximately 98% of the portfolio is subject to LIBOR floor of at least 0.95%

Note: Net income attributable to common stockholders per share and Core Earnings per share are based on diluted weighted average shares outstanding as of March

31, 2020; book value per share is based on shares outstanding at March 31, 2020.

(1) Represents Net Income attributable to common stockholders.

(2) In connection with first quarter adoption of Accounting Standards Updated 2016-13, Financial Instruments-Credit Losses ("ASU 2016-13" or "CECL")

(3) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP.

(4) Book value per share includes the year to date ("YTD") impact of a ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our

redeemable Special Non-Voting Preferred Stock (SNVPS'), resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as

of March 31, 2020.

(5) Based on KREF common stock closing price of $14.40 as of April 27, 2020.

(6) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as

of the date of the most recent as-is appraised value.

3

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation