Deutsche Bank Results Presentation Deck

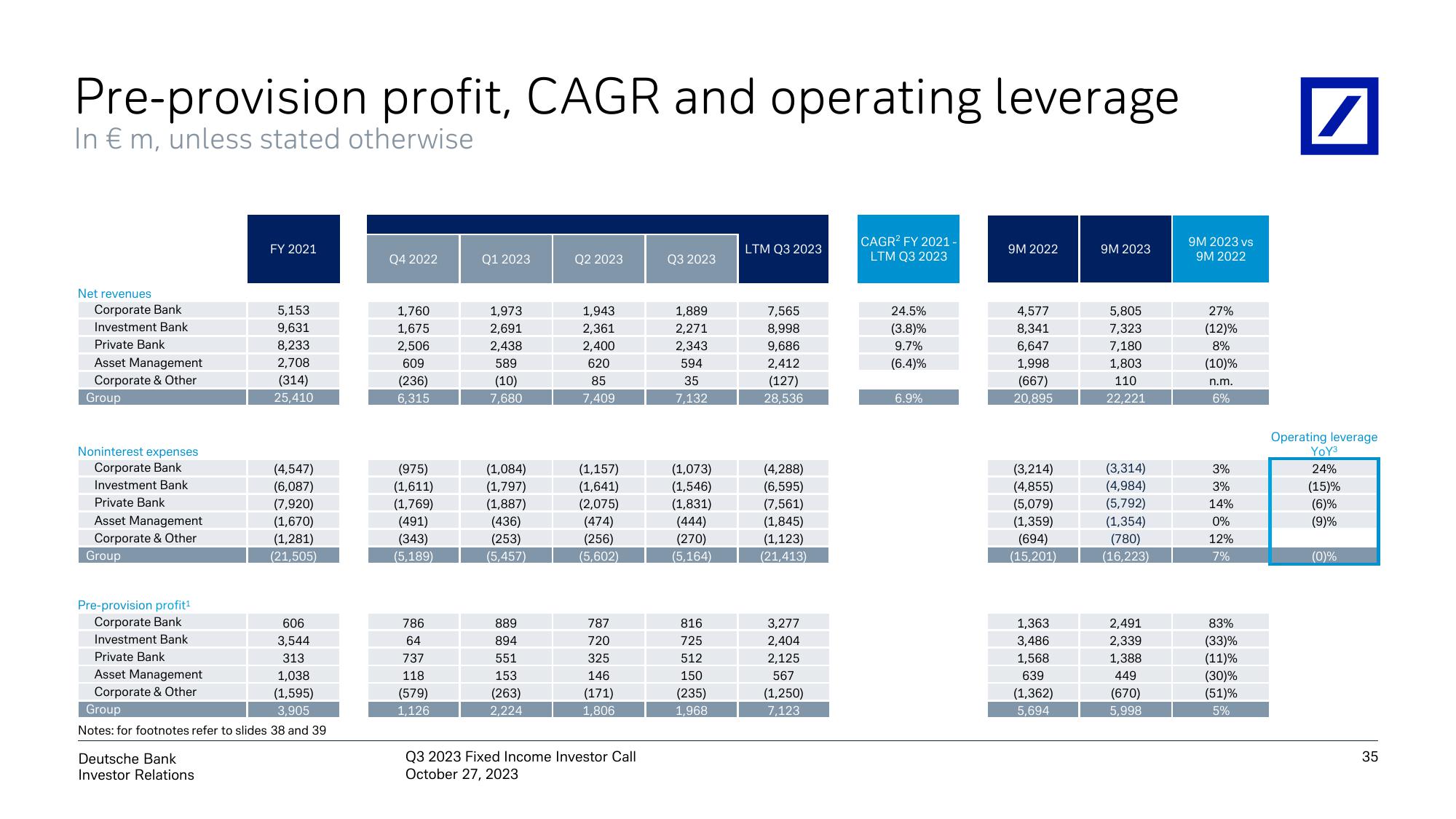

Pre-provision profit, CAGR and operating leverage

In € m, unless stated otherwise

Net revenues

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

Group

Noninterest expenses

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

Group

Pre-provision profit¹

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

FY 2021

Deutsche Bank

Investor Relations

5,153

9,631

8,233

2,708

(314)

25,410

(4,547)

(6,087)

(7,920)

(1,670)

(1,281)

(21,505)

606

3,544

313

1,038

(1,595)

Group

3,905

Notes: for footnotes refer to slides 38 and 39

Q4 2022

1,760

1,675

2,506

609

(236)

6,315

(975)

(1,611)

(1,769)

(491)

(343)

(5,189)

786

64

737

118

(579)

1,126

Q1 2023

1,973

2,691

2,438

589

(10)

7,680

(1,084)

(1,797)

(1,887)

(436)

(253)

(5,457)

889

894

551

153

(263)

2,224

Q2 2023

1,943

2,361

2,400

620

85

7,409

(1,157)

(1,641)

(2,075)

(474)

(256)

(5,602)

787

720

325

146

(171)

1,806

Q3 2023 Fixed Income Investor Call

October 27, 2023

Q3 2023

1,889

2,271

2,343

594

35

7,132

(1,073)

(1,546)

(1,831)

(444)

(270)

(5,164)

816

725

512

150

(235)

1,968

LTM Q3 2023

7,565

8,998

9,686

2,412

(127)

28,536

(4,288)

(6,595)

(7,561)

(1,845)

(1,123)

(21,413)

3,277

2,404

2,125

567

(1,250)

7,123

CAGR2 FY 2021-

LTM Q3 2023

24.5%

(3.8)%

9.7%

(6.4)%

6.9%

9M 2022

4,577

8,341

6,647

1,998

(667)

20,895

(3,214)

(4,855)

(5,079)

(1,359)

(694)

(15,201)

1,363

3,486

1,568

639

(1,362)

5,694

9M 2023

5,805

7,323

7,180

1,803

110

22,221

(3,314)

(4,984)

(5,792)

(1,354)

(780)

(16,223)

2,491

2,339

1,388

449

(670)

5,998

9M 2023 vs

9M 2022

27%

(12)%

8%

(10)%

n.m.

6%

3%

3%

14%

0%

12%

7%

83%

(33)%

(11)%

(30)%

(51)%

5%

/

Operating leverage

YoY³

24%

(15)%

(6)%

(9)%

(0)%

35View entire presentation