Ocado Investor Day Presentation Deck

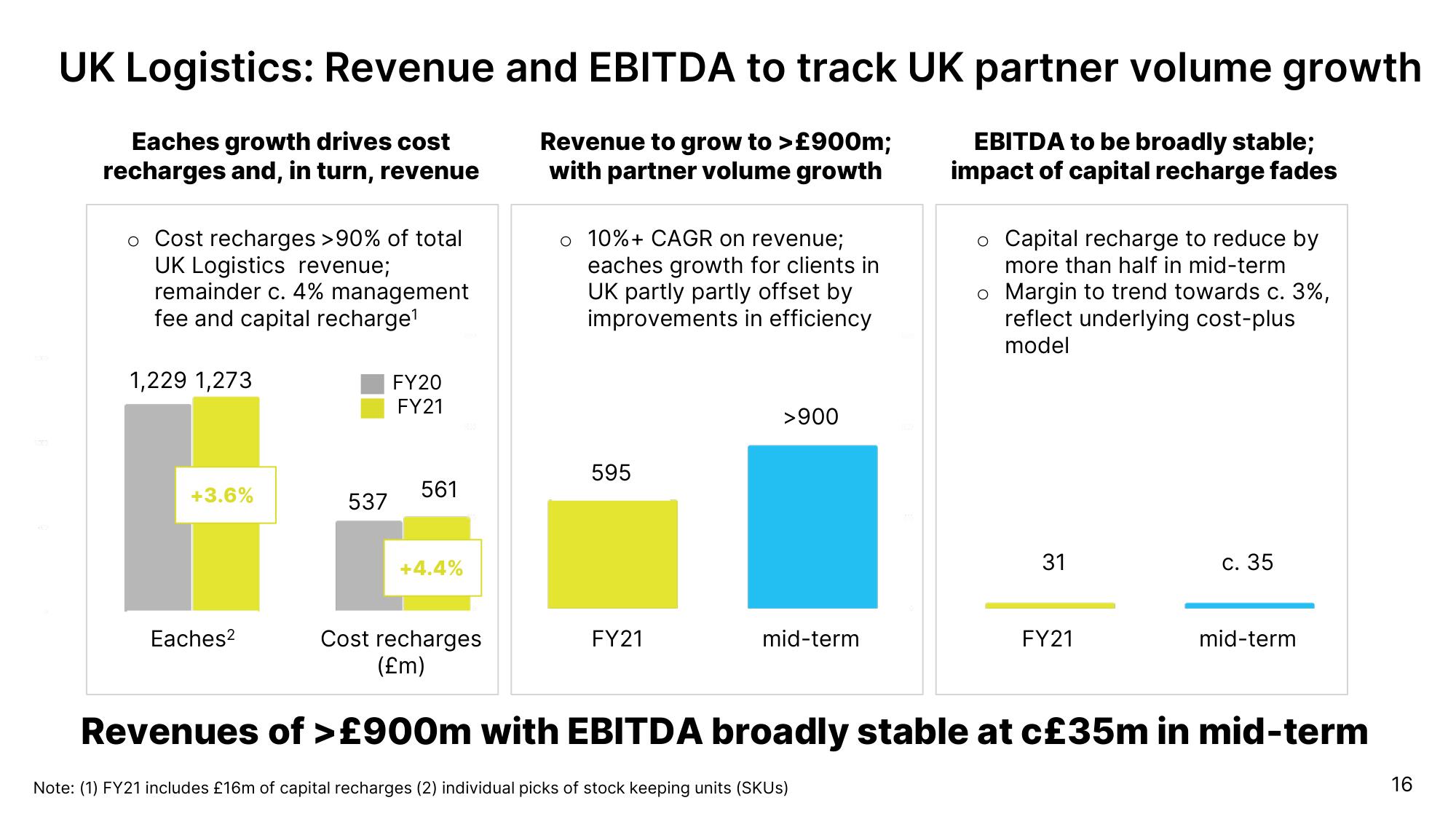

UK Logistics: Revenue and EBITDA to track UK partner volume growth

Eaches growth drives cost

recharges and, in turn, revenue

Revenue to grow to >£900m;

with partner volume growth

EBITDA to be broadly stable;

impact of capital recharge fades

o Cost recharges >90% of total

UK Logistics revenue;

remainder c. 4% management

fee and capital recharge¹

1,229 1,273

+3.6%

Eaches²

537

FY20

FY21

561

+4.4%

Cost recharges

(£m)

o 10%+ CAGR on revenue;

eaches growth for clients in

UK partly partly offset by

improvements in efficiency

595

FY21

>900

mid-term

o Capital recharge to reduce by

more than half in mid-term

o Margin to trend towards c. 3%,

reflect underlying cost-plus

model

31

FY21

c. 35

mid-term

Revenues of >£900m with EBITDA broadly stable at c£35m in mid-term

Note: (1) FY21 includes £16m of capital recharges (2) individual picks of stock keeping units (SKUS)

16View entire presentation