HSBC Results Presentation Deck

Credit performance.

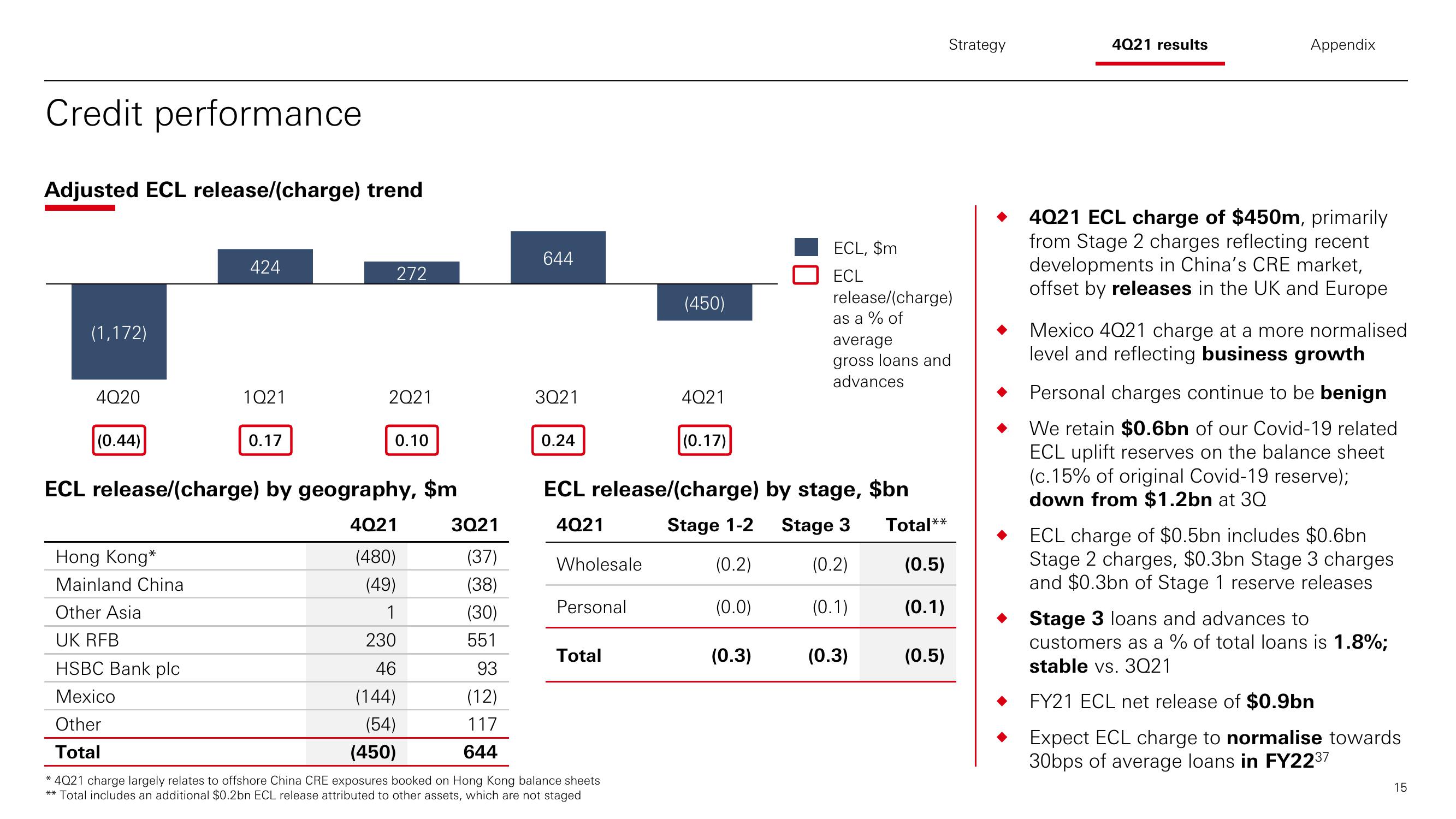

Adjusted ECL release/(charge) trend

(1,172)

4Q20

(0.44)

Hong Kong*

Mainland China

424

Other Asia

UK RFB

HSBC Bank plc

Mexico

Other

Total

1Q21

0.17

272

2021

ECL release/(charge) by geography, $m

4Q21

(480)

(49)

1

230

46

(144)

(54)

(450)

0.10

3Q21

(37)

(38)

(30)

551

93

(12)

117

644

644

3Q21

0.24

Wholesale

Personal

Total

(450)

* 4021 charge largely relates to offshore China CRE exposures booked on Hong Kong balance sheets

** Total includes an additional $0.2bn ECL release attributed to other assets, which are not staged

4Q21

(0.17)

ECL release/(charge) by stage, $bn

4Q21

Stage 1-2

Stage 3

(0.2)

(0.2)

(0.0)

(0.1)

ECL, $m

ECL

(0.3)

release/(charge)

as a % of

average

gross loans and

advances

(0.3)

Strategy

Total**

(0.5)

(0.1)

(0.5)

4021 results

Appendix

4021 ECL charge of $450m, primarily

from Stage 2 charges reflecting recent

developments in China's CRE market,

offset by releases in the UK and Europe

Mexico 4021 charge at a more normalised

level and reflecting business growth

Personal charges continue to be benign

We retain $0.6bn of our Covid-19 related

ECL uplift reserves on the balance sheet

(c.15% of original Covid-19 reserve);

down from $1.2bn at 30

ECL charge of $0.5bn includes $0.6bn

Stage 2 charges, $0.3bn Stage 3 charges.

and $0.3bn of Stage 1 reserve releases

Stage 3 loans and advances to

customers as a % of total loans is 1.8%;

stable vs. 3Q21

FY21 ECL net release of $0.9bn

Expect ECL charge to normalise towards

30bps of average loans in FY2237

15View entire presentation