J.P.Morgan Investment Banking

VALUATION SUMMARY

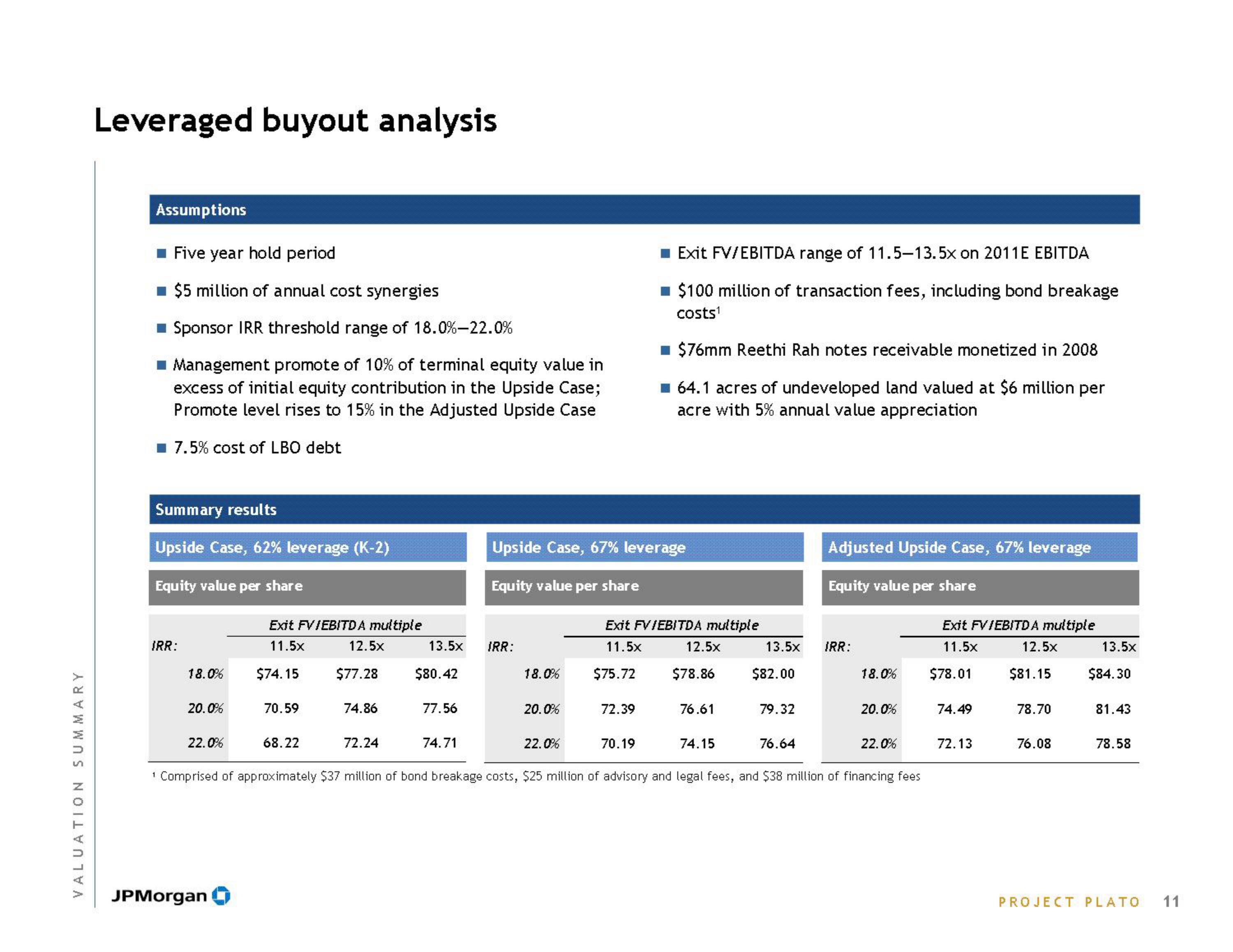

Leveraged buyout analysis

Assumptions

■ Five year hold period

■ $5 million of annual cost synergies

■ Sponsor IRR threshold range of 18.0%-22.0%

■Management promote of 10% of terminal equity value in

excess of initial equity contribution in the Upside Case;

Promote level rises to 15% in the Adjusted Upside Case

7.5% cost of LBO debt

Summary results

Upside Case, 62% leverage (K-2)

Equity value per share

IRR:

18.0%

20.0%

22.0%

Exit FVIEBITDA multiple

11.5×

JPMorgan

$74.15

70.59

68.22

12.5×

$77.28

74.86

72.24

13.5x

$80.42

77.56

74.71

IRR:

Upside Case, 67% leverage

Equity value per share

18.0%

20.0%

22.0%

$75.72

■ Exit FV/EBITDA range of 11.5-13.5x on 2011E EBITDA

$100 million of transaction fees, including bond breakage

costs¹

Exit FVIEBITDA multiple

11.5×

72.39

■ $76mm Reethi Rah notes receivable monetized in 2008

☐ 64.1 acres of undeveloped land valued at $6 million per

acre with 5% annual value appreciation

70.19

12.5×

$78.86

76.61

74.15

13.5x

$82.00

79.32

76.64

Adjusted Upside Case, 67% leverage

Equity value per share

IRR:

18.0%

20.0%

22.0%

¹ Comprised of approximately $37 million of bond breakage costs, $25 million of advisory and legal fees, and $38 million of financing fees

Exit FVIEBITDA multiple

11.5x

$78.01

74.49

72.13

12.5×

$81.15

78.70

76.08

13.5x

$84.30

81.43

78.58

PROJECT PLATO

11View entire presentation