Bakkt Results Presentation Deck

FINANCIAL RESULTS

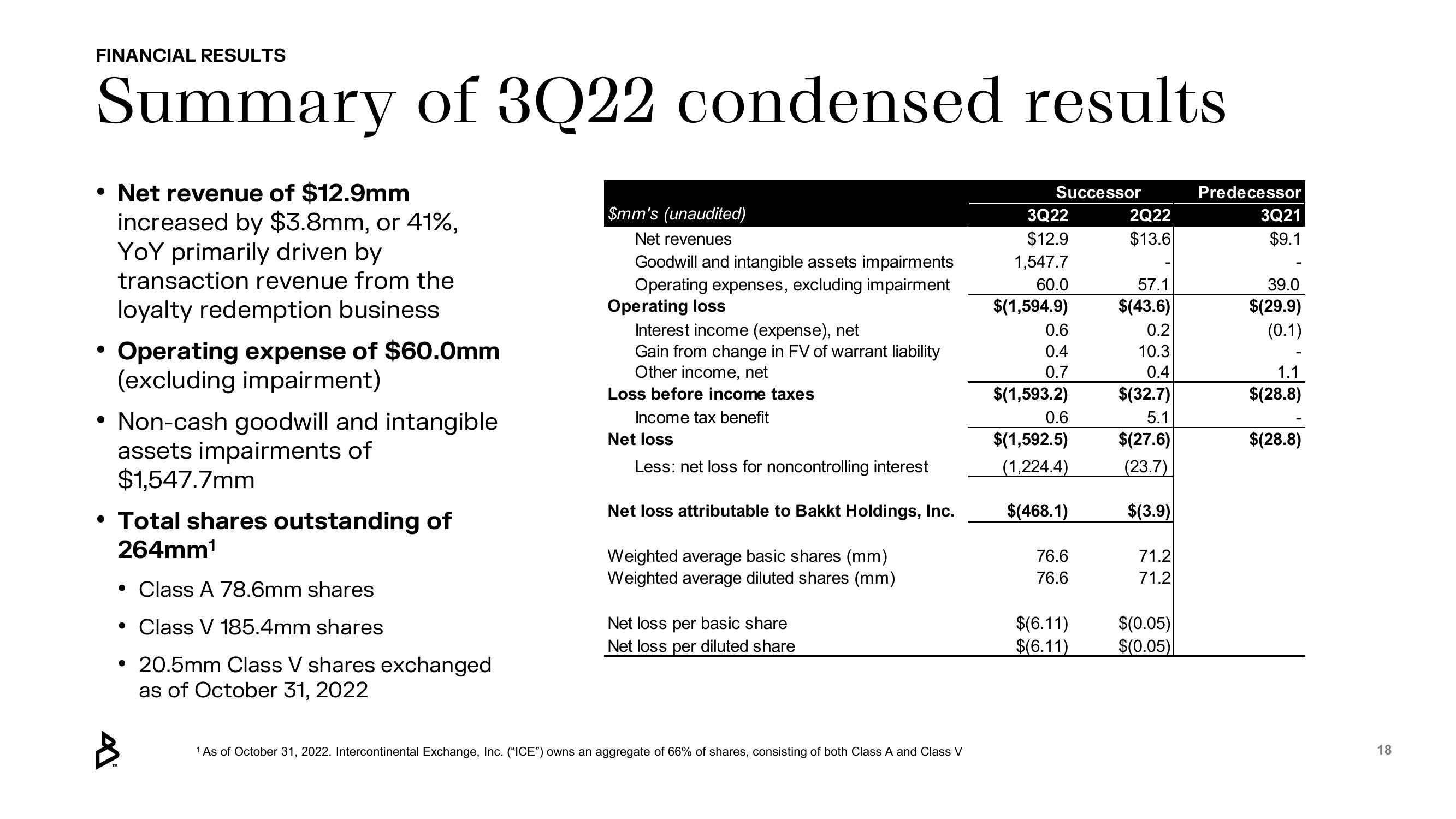

Summary of 3Q22 condensed results

●

Net revenue of $12.9mm

increased by $3.8mm, or 41%,

YOY primarily driven by

transaction revenue from the

loyalty redemption business

Operating expense of $60.0mm

(excluding impairment)

• Non-cash goodwill and intangible

assets impairments of

$1,547.7mm

• Total shares outstanding of

264mm¹

• Class A 78.6mm shares

• Class V 185.4mm shares

20.5mm Class V shares exchanged

as of October 31, 2022

$mm's (unaudited)

Net revenues

Goodwill and intangible assets impairments

Operating expenses, excluding impairment

Operating loss

Interest income (expense), net

Gain from change in FV of warrant liability

Other income, net

Loss before income taxes

Income tax benefit

Net loss

Less: net loss for noncontrolling interest

Net loss attributable to Bakkt Holdings, Inc.

Weighted average basic shares (mm)

Weighted average diluted shares (mm)

Net loss per basic share

Net loss per diluted share

1 As of October 31, 2022. Intercontinental Exchange, Inc. ("ICE") owns an aggregate of 66% of shares, consisting of both Class A and Class V

Successor

3Q22

$12.9

1,547.7

60.0

$(1,594.9)

0.6

0.4

0.7

$(1,593.2)

0.6

$(1,592.5)

(1,224.4)

$(468.1)

76.6

76.6

$(6.11)

$(6.11)

2Q22

$13.6

57.1

$(43.6)

0.2

10.3

0.4

$(32.7)

5.1

$(27.6)

(23.7)

$(3.9)

71.2

71.2

$(0.05)

$(0.05)

Predecessor

3Q21

$9.1

39.0

$(29.9)

(0.1)

1.1

$(28.8)

$(28.8)

18View entire presentation