Fort Capital Investment Banking Pitch Book

WACC Analysis

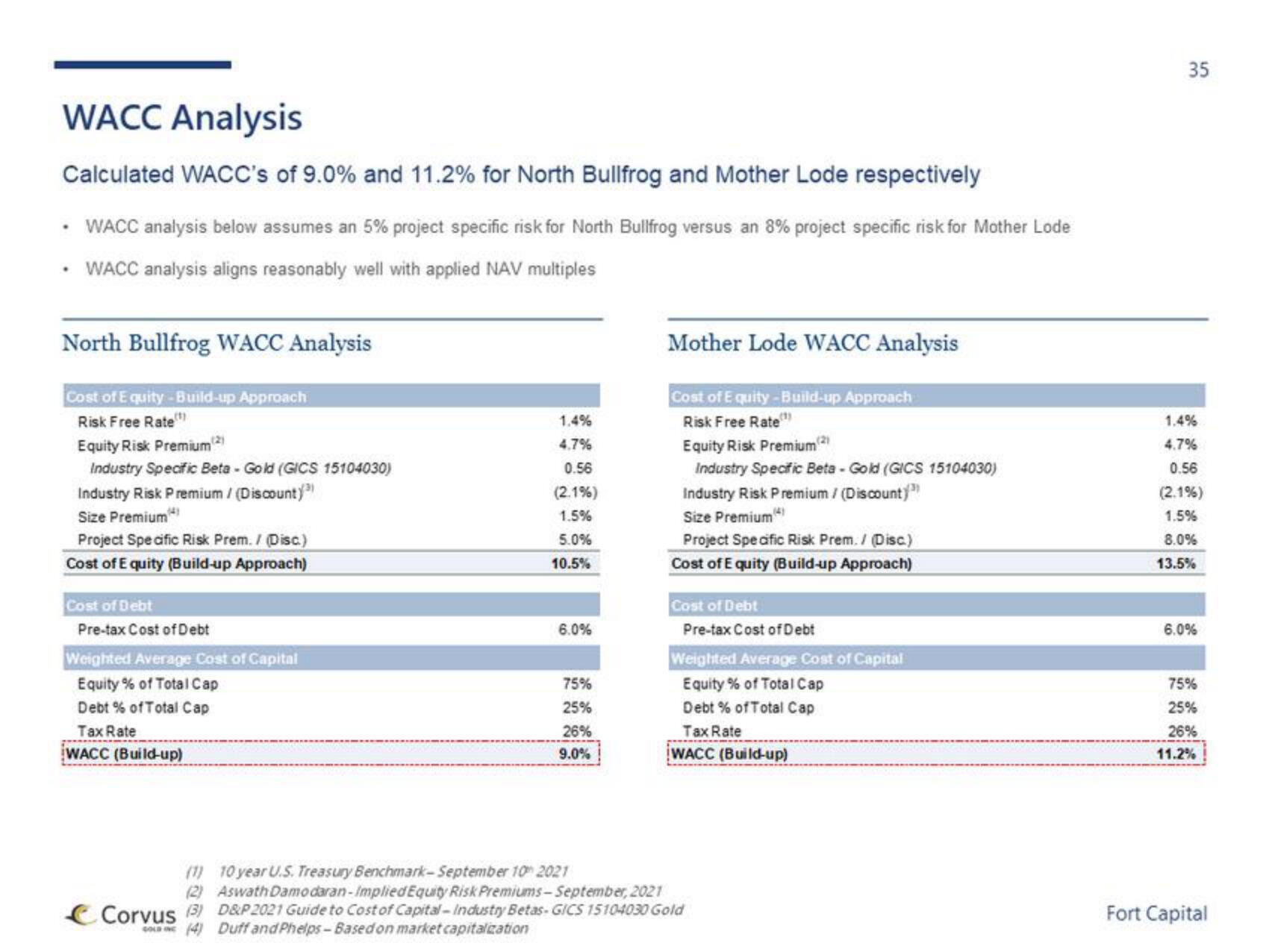

Calculated WACC's of 9.0% and 11.2% for North Bullfrog and Mother Lode respectively

WACC analysis below assumes an 5% project specific risk for North Bullfrog versus an 8% project specific risk for Mother Lode

• WACC analysis aligns reasonably well with applied NAV multiples

North Bullfrog WACC Analysis

Cost of Equity-Build-up Approach

Risk Free Rate

Equity Risk Premium (2)

Industry Specific Beta - Gold (GICS 15104030)

Industry Risk Premium / (Discount) ³)

Size Premium¹

Project Specific Risk Prem. / (Disc.)

Cost of Equity (Build-up Approach)

Cost of Debt

Pre-tax Cost of Debt

Weighted Average Cost of Capital

Equity % of Total Cap

Debt % of Total Cap

Tax Rate

WACC (Build-up)

1.4%

4.7%

0.56

(2.1%)

1.5%

5.0%

10.5%

6.0%

75%

25%

26%

9.0%

Mother Lode WACC Analysis

Cost of Equity-Build-up Approach

Risk Free Rate

Equity Risk Premium (²)

Industry Specific Beta-Gold (GICS 15104030)

Industry Risk Premium / (Discount))

Size Premium

Project Specific Risk Prem. / (Disc.)

Cost of Equity (Build-up Approach)

Cost of Debt

Pre-tax Cost of Debt

Weighted Average Cost of Capital

Equity % of Total Cap

Debt % of Total Cap

Tax Rate

WACC (Build-up)

(1)

10 year U.S. Treasury Benchmark-September 10 2021

(2)

Aswath Damodaran-Implied Equity Risk Premiums-September, 2021

Corvus (3) D&P 2021 Guide to Cost of Capital-Industry Betas- GICS 15104030 Gold

COL (4) Duff and Phelps-Based on market capitalization

35

1.4%

4.7%

0.56

(2.1%)

1.5%

8.0%

13.5%

6.0%

75%

25%

26%

11.2%

Fort CapitalView entire presentation