MP Materials SPAC Presentation Deck

INTRODUCTION

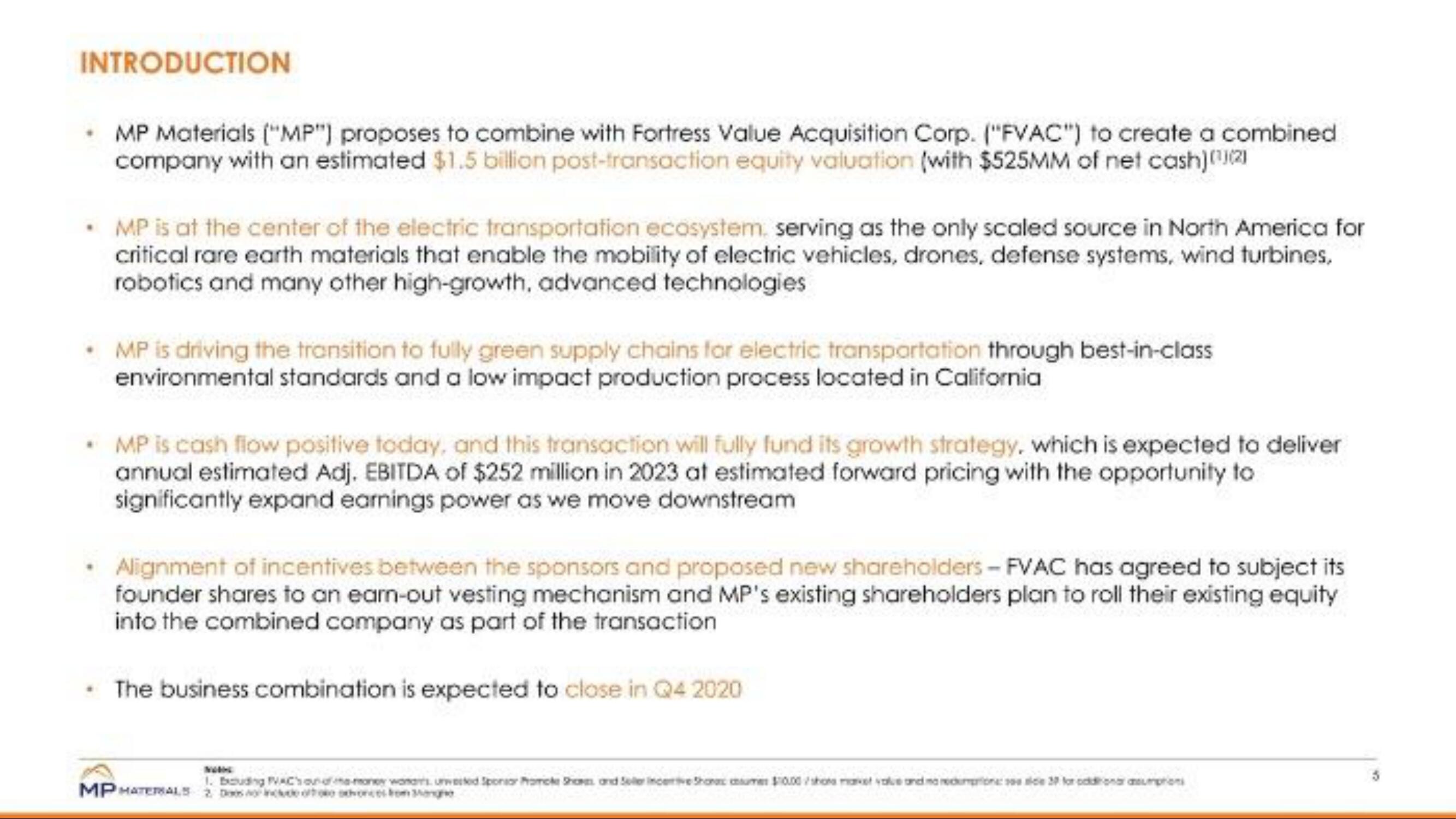

MP Materials ("MP") proposes to combine with Fortress Value Acquisition Corp. ("FVAC") to create a combined

company with an estimated $1.5 billion post-transaction equity valuation (with $525MM of net cash)

MP is at the center of the electric transportation ecosystem, serving as the only scaled source in North America for

critical rare earth materials that enable the mobility of electric vehicles, drones, defense systems, wind turbines,

robotics and many other high-growth, advanced technologies

• MP is driving the transition to fully green supply chains for electric transportation through best-in-class

environmental standards and a low impact production process located in California

MP is cash flow positive today, and this transaction will fully fund its growth strategy, which is expected to deliver

annual estimated Adj. EBITDA of $252 million in 2023 at estimated forward pricing with the opportunity to

significantly expand earnings power as we move downstream

Alignment of incentives between the sponsors and proposed new shareholders - FVAC has agreed to subject its

founder shares to an earn-out vesting mechanism and MP's existing shareholders plan to roll their existing equity

into the combined company as part of the transaction

• The business combination is expected to close in Q4 2020

1. Bouding PVAC'haurof money wondrs urwerked Sponsor Promicke Shop and Seller incentive Shona cume $10.00/shons market value and monedione: se sice 30 for consumptions

MPMATERIALS 2 Desde oto otonces from angeView entire presentation