Inovalon Results Presentation Deck

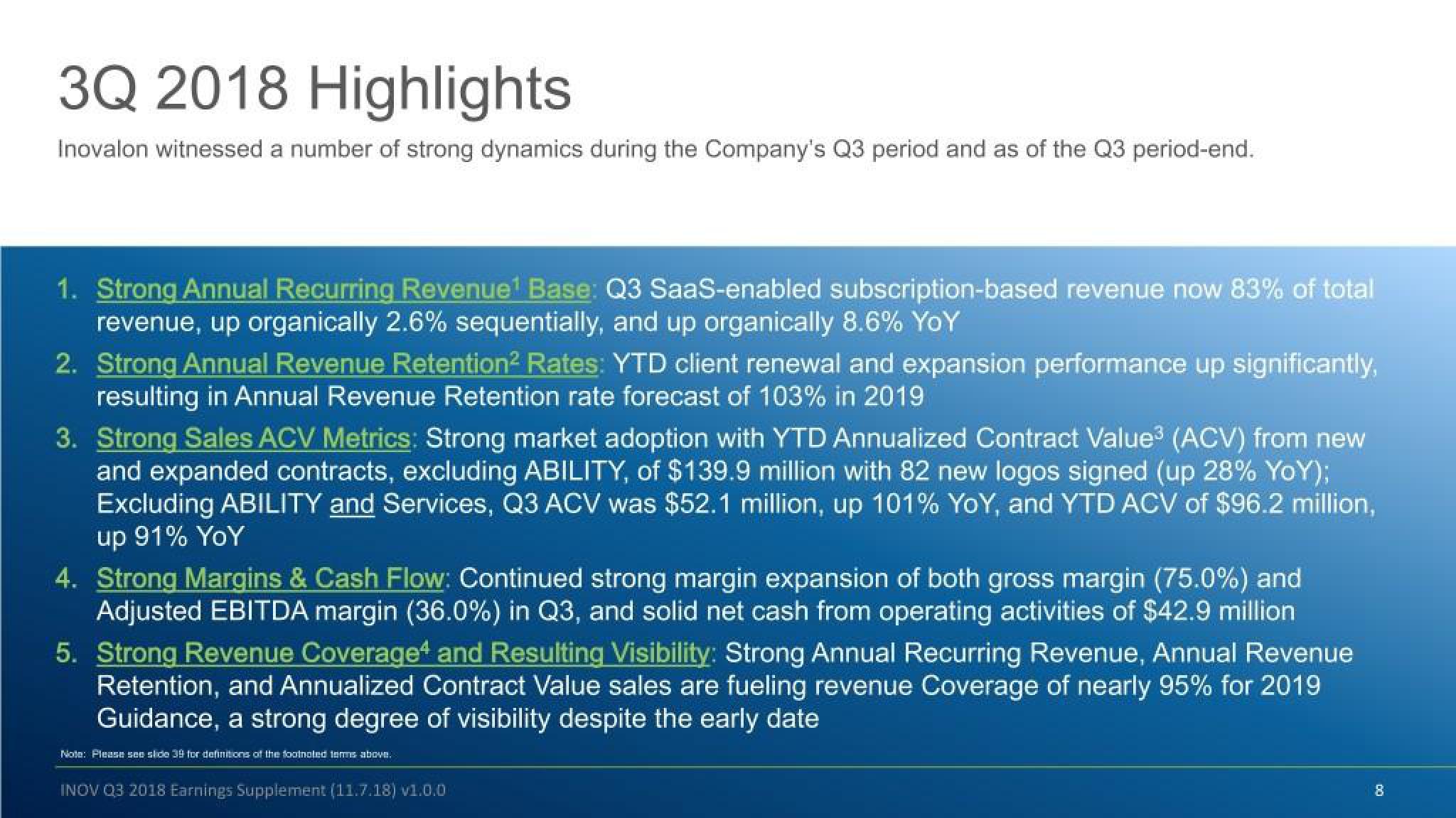

3Q 2018 Highlights

Inovalon witnessed a number of strong dynamics during the Company's Q3 period and as of the Q3 period-end.

1. Strong Annual Recurring Revenue¹ Base: Q3 SaaS-enabled subscription-based revenue now 83% of total

revenue, up organically 2.6% sequentially, and up organically 8.6% YoY

2. Strong Annual Revenue Retention² Rates: YTD client renewal and expansion performance up significantly,

resulting in Annual Revenue Retention rate forecast of 103% in 2019

3. Strong Sales ACV Metrics: Strong market adoption with YTD Annualized Contract Value³ (ACV) from new

and expanded contracts, excluding ABILITY, of $139.9 million with 82 new logos signed (up 28% YoY);

Excluding ABILITY and Services, Q3 ACV was $52.1 million, up 101% YoY, and YTD ACV of $96.2 million,

up 91% YoY

4. Strong Margins & Cash Flow: Continued strong margin expansion of both gross margin (75.0%) and

Adjusted EBITDA margin (36.0%) in Q3, and solid net cash from operating activities of $42.9 million

5. Strong Revenue Coverage4 and Resulting Visibility: Strong Annual Recurring Revenue, Annual Revenue.

Retention, and Annualized Contract Value sales are fueling revenue Coverage of nearly 95% for 2019

Guidance, a strong degree of visibility despite the early date

Note: Please see slide 39 for definitions of the footnoted toms above.

INOV Q3 2018 Earnings Supplement (11.7.18) v1.0.0

8View entire presentation